| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3824829000 | Doc | 58.7% | CN | US | 2025-05-12 |

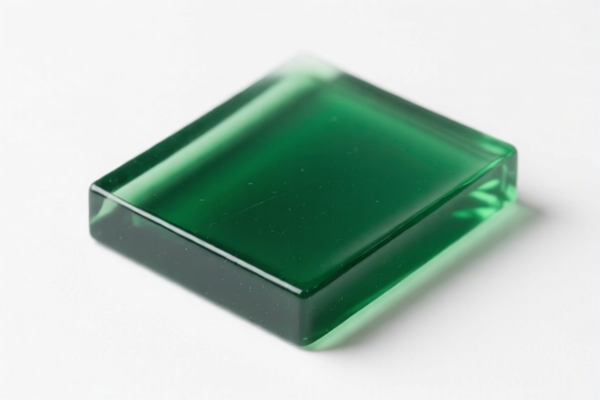

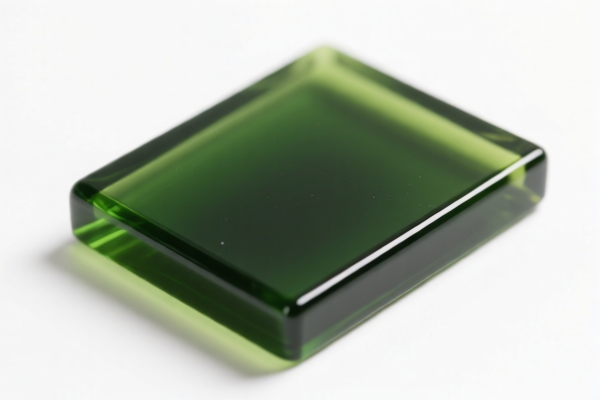

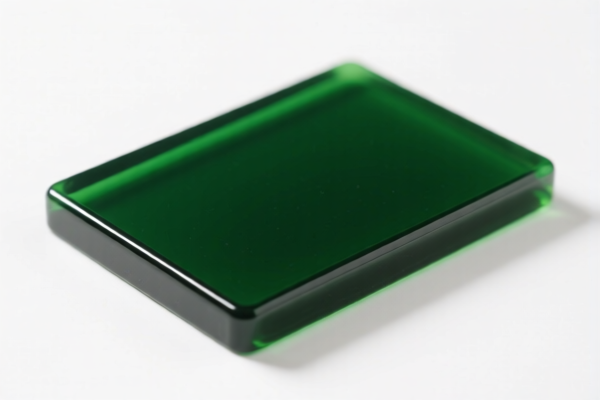

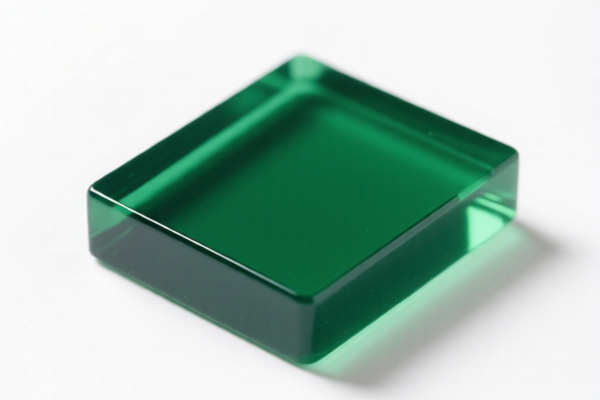

Product Name: Phenolic Resin for Molding Compounds

Classification HS Code: 3909.40.00.00 (Primary classification for phenolic resins in their primary form)

🔍 HS Code Classification Summary:

- HS Code: 3909.40.00.00

- Description: This code applies to phenolic resins in their primary form, including those used in molding compounds.

- Other relevant codes:

- 3909.39.00.00 (Other amino resins, including some types of phenolic resins)

- 3824.82.90.00 (Phenolic resins used as binders for casting molds or cores)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 61.5% (for 3909.40.00.00 and 3909.39.00.00)

- Alternative Code (3824.82.90.00):

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 58.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on April 11, 2025, and this applies to both 3909.40.00.00 and 3909.39.00.00. -

This is a time-sensitive policy and must be considered in your customs planning.

-

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin and product specifications.

📌 Proactive Advice for Importers:

-

Verify the exact product form:

Ensure whether the phenolic resin is in primary form (3909.40.00.00) or used as a mold binder (3824.82.90.00), as this will affect the HS code and tariff rate. -

Check the unit price and material composition:

The classification may change based on technical specifications or intended use (e.g., for molding vs. casting). -

Confirm required certifications:

Some countries may require technical documentation, safety data sheets (SDS), or customs declarations for chemical products like phenolic resins. -

Monitor policy updates:

Keep an eye on tariff changes after April 11, 2025, as this could significantly impact your import costs.

✅ Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3909.40.00.00 | Phenolic resins, primary form | 6.5% | 25.0% | 30.0% | 61.5% |

| 3909.39.00.00 | Other amino resins | 6.5% | 25.0% | 30.0% | 61.5% |

| 3824.82.90.00 | Phenolic resins as mold binders | 3.7% | 25.0% | 30.0% | 58.7% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's technical specifications and intended use.

Product Name: Phenolic Resin for Molding Compounds

Classification HS Code: 3909.40.00.00 (Primary classification for phenolic resins in their primary form)

🔍 HS Code Classification Summary:

- HS Code: 3909.40.00.00

- Description: This code applies to phenolic resins in their primary form, including those used in molding compounds.

- Other relevant codes:

- 3909.39.00.00 (Other amino resins, including some types of phenolic resins)

- 3824.82.90.00 (Phenolic resins used as binders for casting molds or cores)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 61.5% (for 3909.40.00.00 and 3909.39.00.00)

- Alternative Code (3824.82.90.00):

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 58.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on April 11, 2025, and this applies to both 3909.40.00.00 and 3909.39.00.00. -

This is a time-sensitive policy and must be considered in your customs planning.

-

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin and product specifications.

📌 Proactive Advice for Importers:

-

Verify the exact product form:

Ensure whether the phenolic resin is in primary form (3909.40.00.00) or used as a mold binder (3824.82.90.00), as this will affect the HS code and tariff rate. -

Check the unit price and material composition:

The classification may change based on technical specifications or intended use (e.g., for molding vs. casting). -

Confirm required certifications:

Some countries may require technical documentation, safety data sheets (SDS), or customs declarations for chemical products like phenolic resins. -

Monitor policy updates:

Keep an eye on tariff changes after April 11, 2025, as this could significantly impact your import costs.

✅ Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 3909.40.00.00 | Phenolic resins, primary form | 6.5% | 25.0% | 30.0% | 61.5% |

| 3909.39.00.00 | Other amino resins | 6.5% | 25.0% | 30.0% | 61.5% |

| 3824.82.90.00 | Phenolic resins as mold binders | 3.7% | 25.0% | 30.0% | 58.7% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's technical specifications and intended use.

Customer Reviews

No reviews yet.