| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3824829000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3907300000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

Product Name: Phenolic Resins

Classification: HS Code Classification and Tariff Information

Below is the detailed breakdown of the HS codes and associated tariffs for phenolic resins, based on the provided data:

✅ HS Code: 3824829000

Description: Phenolic resins intended for use as binders in casting molds or cores.

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

✅ HS Code: 3907300000

Description: Phenolic epoxy resins, classified under HS 3907.

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.1%

✅ HS Code: 3909400000

Description: Phenolic resin particles, powders, or structural materials, classified under HS 3909.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS Code: 3920940000

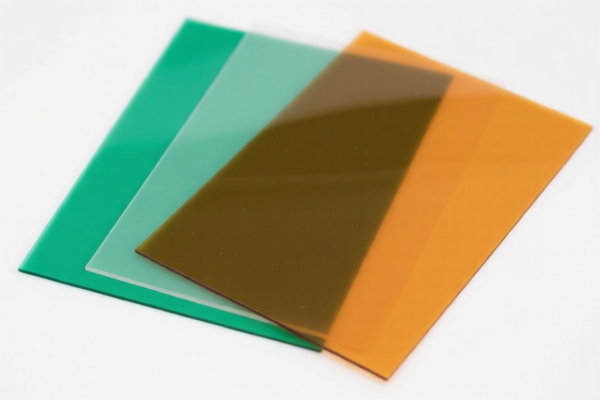

Description: Phenolic resin films, classified under HS 3920940000.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all four HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification Requirements: Confirm the exact chemical composition and intended use of the phenolic resins, as this may affect classification and required documentation (e.g., technical specifications, safety data sheets, or import permits).

📌 Proactive Advice:

- Verify the exact product form and usage: Different forms (e.g., powder, film, binder) may fall under different HS codes.

- Check the country of origin: Tariff rates may vary depending on trade agreements or bilateral policies.

- Consult customs brokers or classification experts: For complex or high-value shipments, professional verification is recommended to avoid misclassification penalties.

Let me know if you need help with classification based on specific product details or documentation.

Product Name: Phenolic Resins

Classification: HS Code Classification and Tariff Information

Below is the detailed breakdown of the HS codes and associated tariffs for phenolic resins, based on the provided data:

✅ HS Code: 3824829000

Description: Phenolic resins intended for use as binders in casting molds or cores.

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

✅ HS Code: 3907300000

Description: Phenolic epoxy resins, classified under HS 3907.

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.1%

✅ HS Code: 3909400000

Description: Phenolic resin particles, powders, or structural materials, classified under HS 3909.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS Code: 3920940000

Description: Phenolic resin films, classified under HS 3920940000.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all four HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification Requirements: Confirm the exact chemical composition and intended use of the phenolic resins, as this may affect classification and required documentation (e.g., technical specifications, safety data sheets, or import permits).

📌 Proactive Advice:

- Verify the exact product form and usage: Different forms (e.g., powder, film, binder) may fall under different HS codes.

- Check the country of origin: Tariff rates may vary depending on trade agreements or bilateral policies.

- Consult customs brokers or classification experts: For complex or high-value shipments, professional verification is recommended to avoid misclassification penalties.

Let me know if you need help with classification based on specific product details or documentation.

Customer Reviews

No reviews yet.