| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 4820500000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926905000 | Doc | 41.3% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 4820500000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance information for the Photo Organizer Album based on the provided HS codes and tax details:

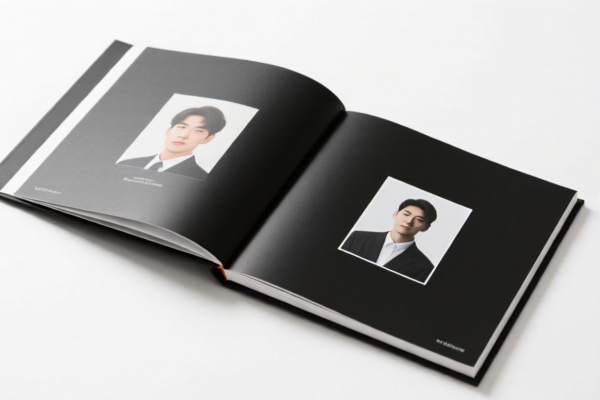

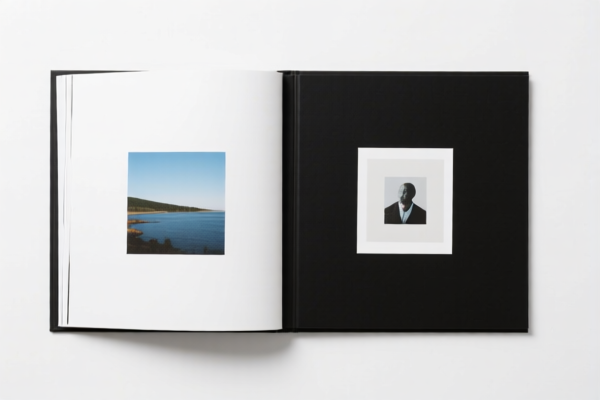

✅ HS CODE: 3926904800

Product Description: Plastic photo albums or other plastic products (excluding those in Chapters 3901 to 3914)

Total Tax Rate: 33.4%

Tax Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to plastic-based photo organizers. - The 30% additional tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

✅ HS CODE: 4820500000

Product Description: Sample books or albums made of paper or paperboard

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to paper or paperboard-based photo albums. - The 25% additional tariff is already in effect. - An additional 30% tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

✅ HS CODE: 3926905000

Product Description: Frames or mounts for photographic negatives or prints

Total Tax Rate: 41.3%

Tax Breakdown:

- Base Tariff: 3.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to photo frames or mounts used for negatives or prints. - The 7.5% additional tariff is already in effect. - An additional 30% tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

📌 Proactive Advice for Importers:

- Verify the material composition of the product (plastic, paper, or paperboard) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., CE, RoHS, or other product-specific standards) for compliance with local regulations.

- Monitor the April 11, 2025, deadline for the additional 30% tariff, and plan accordingly for cost adjustments.

- If the product contains iron or aluminum components, check for any applicable anti-dumping duties (not applicable in this case).

Let me know if you need help with HS code verification or customs documentation. Here is the structured analysis and customs compliance information for the Photo Organizer Album based on the provided HS codes and tax details:

✅ HS CODE: 3926904800

Product Description: Plastic photo albums or other plastic products (excluding those in Chapters 3901 to 3914)

Total Tax Rate: 33.4%

Tax Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to plastic-based photo organizers. - The 30% additional tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

✅ HS CODE: 4820500000

Product Description: Sample books or albums made of paper or paperboard

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to paper or paperboard-based photo albums. - The 25% additional tariff is already in effect. - An additional 30% tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

✅ HS CODE: 3926905000

Product Description: Frames or mounts for photographic negatives or prints

Total Tax Rate: 41.3%

Tax Breakdown:

- Base Tariff: 3.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

Key Notes: - This code applies to photo frames or mounts used for negatives or prints. - The 7.5% additional tariff is already in effect. - An additional 30% tariff will be applied after April 11, 2025. - No anti-dumping duties are applicable for this product category.

📌 Proactive Advice for Importers:

- Verify the material composition of the product (plastic, paper, or paperboard) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., CE, RoHS, or other product-specific standards) for compliance with local regulations.

- Monitor the April 11, 2025, deadline for the additional 30% tariff, and plan accordingly for cost adjustments.

- If the product contains iron or aluminum components, check for any applicable anti-dumping duties (not applicable in this case).

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.