| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8485901000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 8541497080 | Doc | 70.0% | CN | US | 2025-05-12 |

| 8536507000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9001100050 | Doc | 61.7% | CN | US | 2025-05-12 |

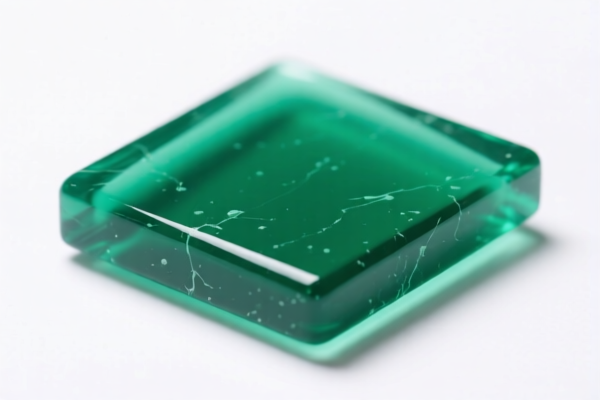

Product Name: Photosensitive Polystyrene Resin

Classification HS Code Analysis and Tax Overview:

- HS CODE: 3903110000

- Description: Polystyrene foam resin or resin for polystyrene foam

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polystyrene foam resin, which may be relevant if your product is used in foam manufacturing.

-

HS CODE: 8485901000

- Description: Plastic parts for 3D printing using photosensitive resin

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to components used in 3D printing with photosensitive resin, not the resin itself.

-

HS CODE: 8541497080

- Description: Photosensitive transistor

- Total Tax Rate: 70.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 50.0%

- Special Tariff after April 11, 2025: 20.0%

-

Note: This is for electronic components, not the resin itself.

-

HS CODE: 8536507000

- Description: Photosensitive electronic switch

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for electronic switches, not the resin.

-

HS CODE: 9001100050

- Description: Polystyrene optical fiber

- Total Tax Rate: 61.7%

- Breakdown:

- Base Tariff: 6.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for optical fiber made of polystyrene, not the resin used in 3D printing.

✅ Proactive Advice:

- Verify the exact product description and technical specifications to ensure the correct HS code is applied.

- Check the unit price and material composition to determine if any additional duties (e.g., anti-dumping) apply.

- Confirm if any certifications (e.g., REACH, RoHS) are required for import into the destination country.

-

Be aware of the April 11, 2025, tariff adjustment and plan accordingly for cost estimation and compliance. Product Name: Photosensitive Polystyrene Resin

Classification HS Code Analysis and Tax Overview: -

HS CODE: 3903110000

- Description: Polystyrene foam resin or resin for polystyrene foam

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polystyrene foam resin, which may be relevant if your product is used in foam manufacturing.

-

HS CODE: 8485901000

- Description: Plastic parts for 3D printing using photosensitive resin

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to components used in 3D printing with photosensitive resin, not the resin itself.

-

HS CODE: 8541497080

- Description: Photosensitive transistor

- Total Tax Rate: 70.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 50.0%

- Special Tariff after April 11, 2025: 20.0%

-

Note: This is for electronic components, not the resin itself.

-

HS CODE: 8536507000

- Description: Photosensitive electronic switch

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for electronic switches, not the resin.

-

HS CODE: 9001100050

- Description: Polystyrene optical fiber

- Total Tax Rate: 61.7%

- Breakdown:

- Base Tariff: 6.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for optical fiber made of polystyrene, not the resin used in 3D printing.

✅ Proactive Advice:

- Verify the exact product description and technical specifications to ensure the correct HS code is applied.

- Check the unit price and material composition to determine if any additional duties (e.g., anti-dumping) apply.

- Confirm if any certifications (e.g., REACH, RoHS) are required for import into the destination country.

- Be aware of the April 11, 2025, tariff adjustment and plan accordingly for cost estimation and compliance.

Customer Reviews

No reviews yet.