Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 9620005000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 7324290000 | Doc | 87.5% | CN | US | 2025-05-12 |

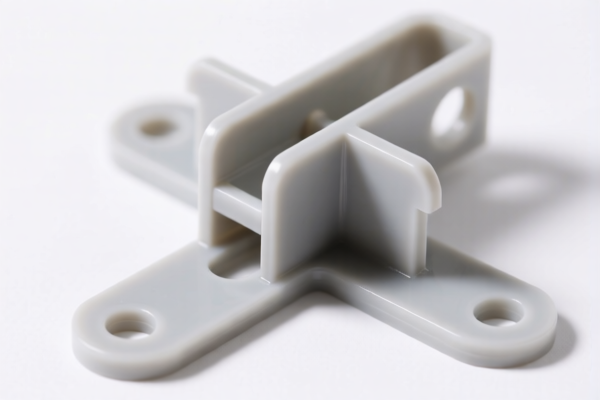

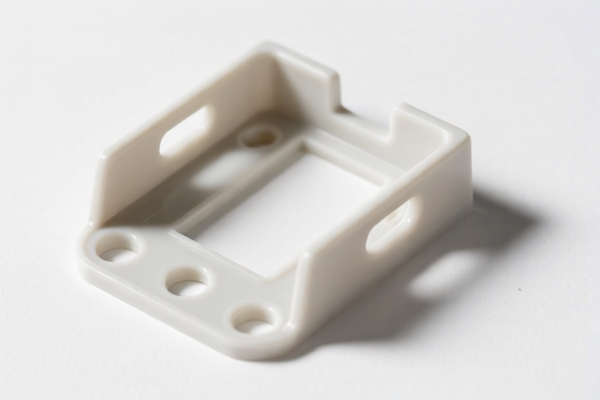

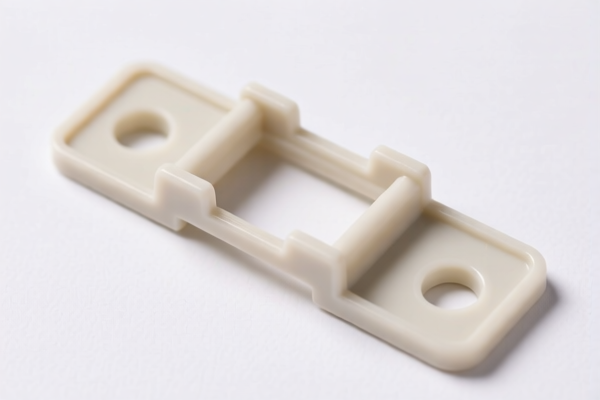

Product Name: Plastic Bathtub Bracket

Classification Analysis and Tax Information:

- HS CODE: 3922100000

- Description: Plastic bathtubs and related accessories; a bracket can be considered an accessory of a bathtub.

- Total Tax Rate: 43.8%

- Tax Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most appropriate classification for a plastic bathtub bracket as it is considered an accessory of a bathtub.

- HS CODE: 3926909989

- Description: Other plastic products.

- Total Tax Rate: 42.8%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may apply if the bracket is not clearly classified under 3922100000.

- HS CODE: 9405920000

- Description: Parts of lighting fixtures and lighting devices, made of plastic.

- Total Tax Rate: 58.7%

- Tax Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Not applicable for a bathtub bracket unless it is a part of a lighting device.

- HS CODE: 9620005000

- Description: Other.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all category and should be used only if the product does not fit into more specific classifications.

- HS CODE: 7324290000

- Description: Sanitary ware and parts thereof, of iron or steel; other types of bathtubs.

- Total Tax Rate: 87.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50%

- Note: This is for metal products, not plastic. Not applicable for a plastic bathtub bracket.

✅ Recommendations:

- Confirm the Material: Ensure the bracket is made of plastic and not metal (e.g., steel, aluminum, copper), as this will affect the classification and tax rate.

- Check the Unit Price: If the bracket is sold separately from the bathtub, it may be classified under 3922100000.

- Verify Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) for import.

- Monitor Tariff Changes: The special tariff after April 11, 2025 will significantly increase the total tax rate by 30.0% for all listed HS codes. Plan accordingly for import costs.

-

Consult a Customs Broker: For complex or high-value shipments, it is advisable to consult a customs broker or a customs compliance expert to ensure accurate classification and avoid delays or penalties. Product Name: Plastic Bathtub Bracket

Classification Analysis and Tax Information: -

HS CODE: 3922100000

- Description: Plastic bathtubs and related accessories; a bracket can be considered an accessory of a bathtub.

- Total Tax Rate: 43.8%

- Tax Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most appropriate classification for a plastic bathtub bracket as it is considered an accessory of a bathtub.

- HS CODE: 3926909989

- Description: Other plastic products.

- Total Tax Rate: 42.8%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may apply if the bracket is not clearly classified under 3922100000.

- HS CODE: 9405920000

- Description: Parts of lighting fixtures and lighting devices, made of plastic.

- Total Tax Rate: 58.7%

- Tax Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Not applicable for a bathtub bracket unless it is a part of a lighting device.

- HS CODE: 9620005000

- Description: Other.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all category and should be used only if the product does not fit into more specific classifications.

- HS CODE: 7324290000

- Description: Sanitary ware and parts thereof, of iron or steel; other types of bathtubs.

- Total Tax Rate: 87.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50%

- Note: This is for metal products, not plastic. Not applicable for a plastic bathtub bracket.

✅ Recommendations:

- Confirm the Material: Ensure the bracket is made of plastic and not metal (e.g., steel, aluminum, copper), as this will affect the classification and tax rate.

- Check the Unit Price: If the bracket is sold separately from the bathtub, it may be classified under 3922100000.

- Verify Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) for import.

- Monitor Tariff Changes: The special tariff after April 11, 2025 will significantly increase the total tax rate by 30.0% for all listed HS codes. Plan accordingly for import costs.

- Consult a Customs Broker: For complex or high-value shipments, it is advisable to consult a customs broker or a customs compliance expert to ensure accurate classification and avoid delays or penalties.

Customer Reviews

No reviews yet.