Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923500000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3923500000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3923500000 | Doc | 60.3% | CN | US | 2025-05-12 |

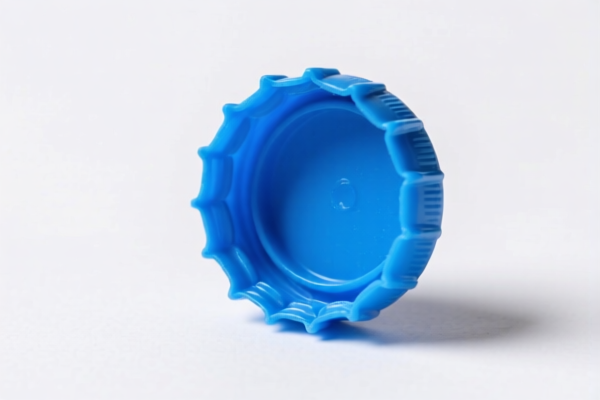

Product Classification: Plastic Bottle Caps

HS CODE: 3923500000

🔍 Classification Summary

- Description: Plastic bottle caps, closures, and stoppers used for sealing bottles or containers.

- HS Code: 3923500000

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff: Not applicable for this HS code.

- Anti-dumping duties on iron and aluminum: Not applicable for plastic products.

- Other applicable duties: None specified for this classification.

📌 Proactive Advice for Importers

- Verify Material: Confirm that the product is indeed made of plastic and not a composite or mixed material.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Ensure compliance with any local import regulations or certifications (e.g., REACH, RoHS, etc.) if applicable.

- Document Accurately: Maintain clear documentation of product use (e.g., for packaging or industrial purposes) to avoid misclassification.

📚 Alternative HS Codes (for Reference)

- 3923900080: Plastic closures and stoppers for transport or packaging (slightly different scope).

- 3926909910: Other plastic products, including lab equipment (not applicable for standard bottle caps).

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: Plastic Bottle Caps

HS CODE: 3923500000

🔍 Classification Summary

- Description: Plastic bottle caps, closures, and stoppers used for sealing bottles or containers.

- HS Code: 3923500000

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff: Not applicable for this HS code.

- Anti-dumping duties on iron and aluminum: Not applicable for plastic products.

- Other applicable duties: None specified for this classification.

📌 Proactive Advice for Importers

- Verify Material: Confirm that the product is indeed made of plastic and not a composite or mixed material.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Ensure compliance with any local import regulations or certifications (e.g., REACH, RoHS, etc.) if applicable.

- Document Accurately: Maintain clear documentation of product use (e.g., for packaging or industrial purposes) to avoid misclassification.

📚 Alternative HS Codes (for Reference)

- 3923900080: Plastic closures and stoppers for transport or packaging (slightly different scope).

- 3926909910: Other plastic products, including lab equipment (not applicable for standard bottle caps).

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.