| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909600 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8708305090 | Doc | 2.5% <u></u>+55.0% | CN | US | 2025-05-12 |

| 8714943060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8714943080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8708998105 | Doc | 57.5% | CN | US | 2025-05-12 |

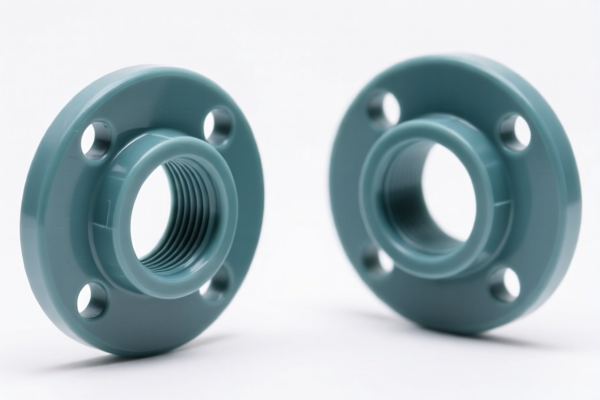

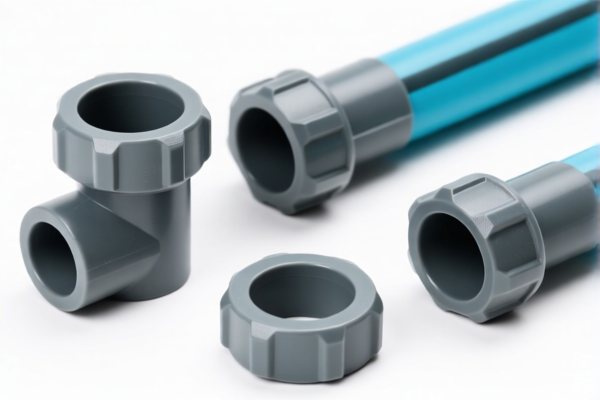

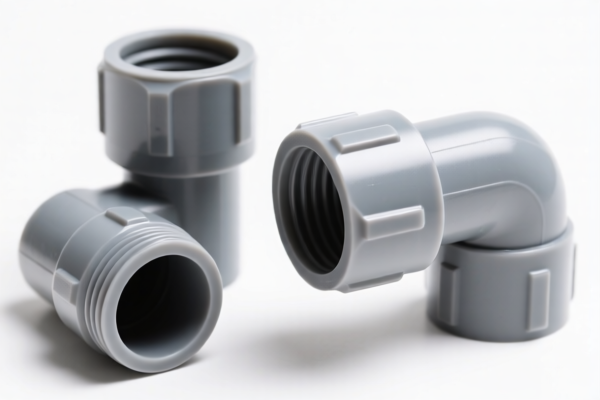

Product Name: Plastic Brake Line Fittings

Classification HS Code Analysis and Tax Overview:

✅ HS CODE: 3926909600

Description: Applicable to plastic products such as brake line fittings and brake line fitting sleeves.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for general plastic brake line fittings. Ensure the product is not classified under a more specific category.

✅ HS CODE: 8708305090

Description: Applicable to brake hose fittings and other vehicle brake components.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 2.5% + 55.0% = 57.5%

- Note: This code is for brake parts used in vehicles. Confirm the product is not classified under a more specific code like 8708305010 or 8708305090.

✅ HS CODE: 8714943060

Description: Applicable to brake connection tubes and other vehicle brake parts.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for general brake parts. Ensure the product is not classified under a more specific category.

✅ HS CODE: 8714943080

Description: Applicable to brake parts such as bicycle brake fittings.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for bicycle brake parts. Confirm the product is not classified under a more specific code.

✅ HS CODE: 8708998105

Description: Applicable to automotive plastic brake hose connectors with fittings.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 2.5% + 55.0% = 57.5%

- Note: This code is for more specialized automotive brake hose connectors. Ensure the product is not classified under a more specific code.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of plastic or other materials, as this can affect classification.

- Check Required Certifications: Some products may require certifications such as ISO, CE, or RoHS, depending on the destination market.

- Confirm Product Use: Ensure the product is intended for automotive or bicycle use, as this can influence the correct HS code.

- Review Tariff Changes: Be aware that the April 11, 2025 tariff increase will apply to all the above codes, increasing the total tax rate by 5%.

- Consult Customs Authority: For high-value or complex products, it is recommended to consult local customs or a customs broker for accurate classification.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Plastic Brake Line Fittings

Classification HS Code Analysis and Tax Overview:

✅ HS CODE: 3926909600

Description: Applicable to plastic products such as brake line fittings and brake line fitting sleeves.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for general plastic brake line fittings. Ensure the product is not classified under a more specific category.

✅ HS CODE: 8708305090

Description: Applicable to brake hose fittings and other vehicle brake components.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 2.5% + 55.0% = 57.5%

- Note: This code is for brake parts used in vehicles. Confirm the product is not classified under a more specific code like 8708305010 or 8708305090.

✅ HS CODE: 8714943060

Description: Applicable to brake connection tubes and other vehicle brake parts.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for general brake parts. Ensure the product is not classified under a more specific category.

✅ HS CODE: 8714943080

Description: Applicable to brake parts such as bicycle brake fittings.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This code is for bicycle brake parts. Confirm the product is not classified under a more specific code.

✅ HS CODE: 8708998105

Description: Applicable to automotive plastic brake hose connectors with fittings.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 2.5% + 55.0% = 57.5%

- Note: This code is for more specialized automotive brake hose connectors. Ensure the product is not classified under a more specific code.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of plastic or other materials, as this can affect classification.

- Check Required Certifications: Some products may require certifications such as ISO, CE, or RoHS, depending on the destination market.

- Confirm Product Use: Ensure the product is intended for automotive or bicycle use, as this can influence the correct HS code.

- Review Tariff Changes: Be aware that the April 11, 2025 tariff increase will apply to all the above codes, increasing the total tax rate by 5%.

- Consult Customs Authority: For high-value or complex products, it is recommended to consult local customs or a customs broker for accurate classification.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.