Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 8708305030 | Doc | 2.5% <u></u>+55.0% | CN | US | 2025-05-12 |

| 8714943060 | Doc | 55.0% | CN | US | 2025-05-12 |

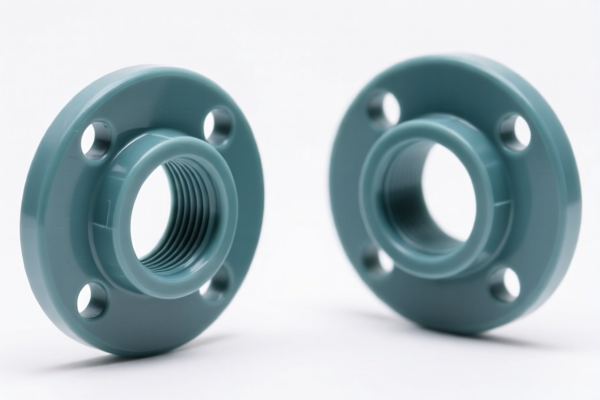

Here is the structured classification and tariff information for Plastic Brake System Fittings, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Plastic Brake System Fittings

✅ HS CODE: 3917390050

- Description: Plastic pipe system fittings

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs apply.

✅ HS CODE: 3917400010

- Description: Automotive brake pipe fittings

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a high-tariff category, especially after April 11, 2025.

✅ HS CODE: 3917400095

- Description: Plastic fittings (general)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917400010, this category is subject to high tariffs post-April 11, 2025.

✅ HS CODE: 8708305030

- Description: Brake system components (for vehicles)

- Total Tax Rate: 2.5% + 55.0%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code includes a special additional tariff of 55.0% (possibly for specific components or origin-based duties).

✅ HS CODE: 8714943060

- Description: Bicycle brake system components

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but subject to high additional tariffs.

⚠️ Important Alerts:

- April 11, 2025 Tariff Increase: All listed HS codes will face an additional 30.0% tariff after this date. This is a critical date for customs planning and cost estimation.

- Anti-dumping duties: Not applicable for these HS codes.

- Material and Certification: Verify the material composition (e.g., type of plastic) and unit price to ensure correct classification. Some fittings may require technical certifications or origin documentation for compliance.

🛠️ Proactive Advice:

- Confirm the exact product description and match it with the most accurate HS code.

- Review the origin of the goods to determine if any preferential tariffs apply.

- Check for any product-specific certifications (e.g., ISO, CE, or industry-specific standards).

- Plan for increased costs post-April 11, 2025, especially for automotive and general plastic fittings.

Let me know if you need help with HS code selection or customs documentation. Here is the structured classification and tariff information for Plastic Brake System Fittings, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Plastic Brake System Fittings

✅ HS CODE: 3917390050

- Description: Plastic pipe system fittings

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties or special tariffs apply.

✅ HS CODE: 3917400010

- Description: Automotive brake pipe fittings

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a high-tariff category, especially after April 11, 2025.

✅ HS CODE: 3917400095

- Description: Plastic fittings (general)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917400010, this category is subject to high tariffs post-April 11, 2025.

✅ HS CODE: 8708305030

- Description: Brake system components (for vehicles)

- Total Tax Rate: 2.5% + 55.0%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code includes a special additional tariff of 55.0% (possibly for specific components or origin-based duties).

✅ HS CODE: 8714943060

- Description: Bicycle brake system components

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but subject to high additional tariffs.

⚠️ Important Alerts:

- April 11, 2025 Tariff Increase: All listed HS codes will face an additional 30.0% tariff after this date. This is a critical date for customs planning and cost estimation.

- Anti-dumping duties: Not applicable for these HS codes.

- Material and Certification: Verify the material composition (e.g., type of plastic) and unit price to ensure correct classification. Some fittings may require technical certifications or origin documentation for compliance.

🛠️ Proactive Advice:

- Confirm the exact product description and match it with the most accurate HS code.

- Review the origin of the goods to determine if any preferential tariffs apply.

- Check for any product-specific certifications (e.g., ISO, CE, or industry-specific standards).

- Plan for increased costs post-April 11, 2025, especially for automotive and general plastic fittings.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.