Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200010 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

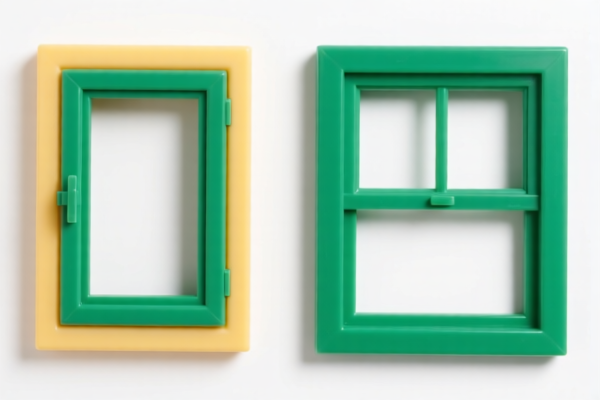

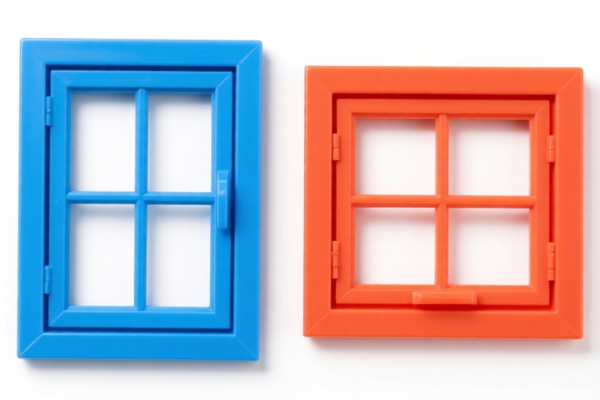

Product Classification: Plastic Builder's Ware Doors

HS CODE: 3925200091 (or 3925200010, depending on specific product details)

🔍 Classification Summary:

- HS CODE 3925200091 or 3925200010 applies to plastic building components, specifically doors and door frames, not otherwise specified or included.

- These codes are for plastic doors and door frames used in construction.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-dumping duties are currently listed for this product category (iron and aluminum anti-dumping duties do not apply here).

- No specific anti-dumping or countervailing duties are mentioned for this HS code.

📌 Proactive Advice for Importers:

- Verify the exact product description – Ensure the product is classified under 3925200091 or 3925200010 and not under a different HS code (e.g., 3920995000 for composite plastic sheets).

- Check the material composition – If the door is made of composite materials (e.g., plastic + wood or metal), it may fall under a different classification.

- Confirm unit price and quantity – This will affect the total duty calculation.

- Review required certifications – Some countries may require product conformity certificates or safety standards for imported building materials.

- Monitor policy updates – The April 11, 2025 tariff is a key date to watch for potential cost increases.

📌 Alternative HS Code (if applicable):

- HS CODE 3920995000 applies to composite plastic sheets (e.g., layered or combined with other materials), which may be used in door manufacturing but are not the same as finished doors or door frames.

Let me know if you need help determining the correct HS code based on your product specifications.

Product Classification: Plastic Builder's Ware Doors

HS CODE: 3925200091 (or 3925200010, depending on specific product details)

🔍 Classification Summary:

- HS CODE 3925200091 or 3925200010 applies to plastic building components, specifically doors and door frames, not otherwise specified or included.

- These codes are for plastic doors and door frames used in construction.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-dumping duties are currently listed for this product category (iron and aluminum anti-dumping duties do not apply here).

- No specific anti-dumping or countervailing duties are mentioned for this HS code.

📌 Proactive Advice for Importers:

- Verify the exact product description – Ensure the product is classified under 3925200091 or 3925200010 and not under a different HS code (e.g., 3920995000 for composite plastic sheets).

- Check the material composition – If the door is made of composite materials (e.g., plastic + wood or metal), it may fall under a different classification.

- Confirm unit price and quantity – This will affect the total duty calculation.

- Review required certifications – Some countries may require product conformity certificates or safety standards for imported building materials.

- Monitor policy updates – The April 11, 2025 tariff is a key date to watch for potential cost increases.

📌 Alternative HS Code (if applicable):

- HS CODE 3920995000 applies to composite plastic sheets (e.g., layered or combined with other materials), which may be used in door manufacturing but are not the same as finished doors or door frames.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

No reviews yet.