| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200010 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

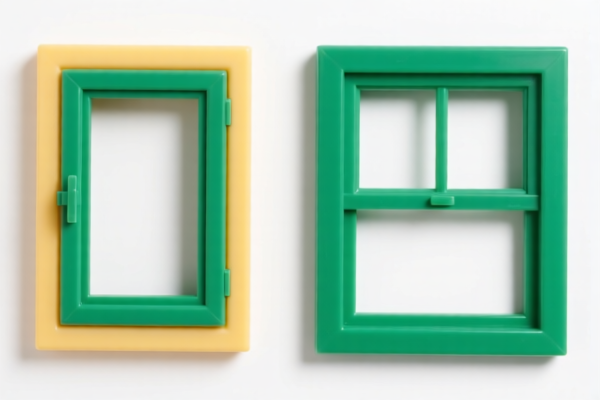

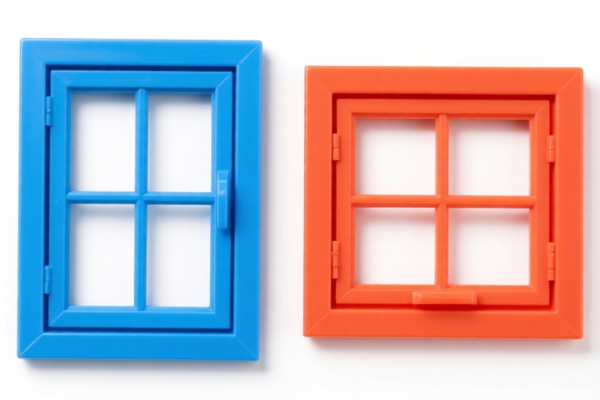

Product Name: Plastic Builder's Ware Windows

Classification: Plastic building components, including doors, windows, and door frames and thresholds

🔍 HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for Plastic Builder's Ware Windows:

- HS CODE: 3925200091

- Description: Plastic building components, including doors, windows, and door frames and thresholds

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3925200020

- Description: Plastic building components, not otherwise specified or included: windows and window frames

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3925200010

- Description: Plastic building components, not otherwise specified or included: doors and door frames

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

- Base Tariff: 5.3% (applies to all listed HS codes)

- Additional Tariff: 7.5% (standard additional duty)

- April 11, 2025 Special Tariff: 30.0% (applies to all listed HS codes)

-

Important: This special tariff is time-sensitive and will be in effect after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

-

Anti-dumping duties: Not applicable for plastic products (unlike iron and aluminum).

- Other duties: No specific anti-dumping or countervailing duties are listed for this product category.

🛠️ Proactive Advice for Importers

- Verify Material: Confirm that the product is made of plastic and not a composite or mixed material, as this could affect classification.

- Check Unit Price: The total tax rate is based on the total value of the product, including packaging and accessories.

- Certifications Required: Ensure compliance with any import certifications or product standards required by the destination country.

- Consult Customs Broker: For accurate classification and to avoid misdeclaration, consider working with a qualified customs broker or compliance expert.

✅ Summary

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3925200091 | Plastic building components (doors, windows, etc.) | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200020 | Plastic building components (windows and frames) | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200010 | Plastic building components (doors and frames) | 5.3% | 7.5% | 30.0% | 42.8% |

If you need further assistance with customs documentation or classification, feel free to ask!

Product Name: Plastic Builder's Ware Windows

Classification: Plastic building components, including doors, windows, and door frames and thresholds

🔍 HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for Plastic Builder's Ware Windows:

- HS CODE: 3925200091

- Description: Plastic building components, including doors, windows, and door frames and thresholds

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3925200020

- Description: Plastic building components, not otherwise specified or included: windows and window frames

- Total Tax Rate: 42.8%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3925200010

- Description: Plastic building components, not otherwise specified or included: doors and door frames

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

- Base Tariff: 5.3% (applies to all listed HS codes)

- Additional Tariff: 7.5% (standard additional duty)

- April 11, 2025 Special Tariff: 30.0% (applies to all listed HS codes)

-

Important: This special tariff is time-sensitive and will be in effect after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

-

Anti-dumping duties: Not applicable for plastic products (unlike iron and aluminum).

- Other duties: No specific anti-dumping or countervailing duties are listed for this product category.

🛠️ Proactive Advice for Importers

- Verify Material: Confirm that the product is made of plastic and not a composite or mixed material, as this could affect classification.

- Check Unit Price: The total tax rate is based on the total value of the product, including packaging and accessories.

- Certifications Required: Ensure compliance with any import certifications or product standards required by the destination country.

- Consult Customs Broker: For accurate classification and to avoid misdeclaration, consider working with a qualified customs broker or compliance expert.

✅ Summary

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3925200091 | Plastic building components (doors, windows, etc.) | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200020 | Plastic building components (windows and frames) | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200010 | Plastic building components (doors and frames) | 5.3% | 7.5% | 30.0% | 42.8% |

If you need further assistance with customs documentation or classification, feel free to ask!

Customer Reviews

Very helpful information, clear and accurate HS code details.