| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8547200000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3923400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9001100050 | Doc | 61.7% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 9403704020 | Doc | 55.0% | CN | US | 2025-05-12 |

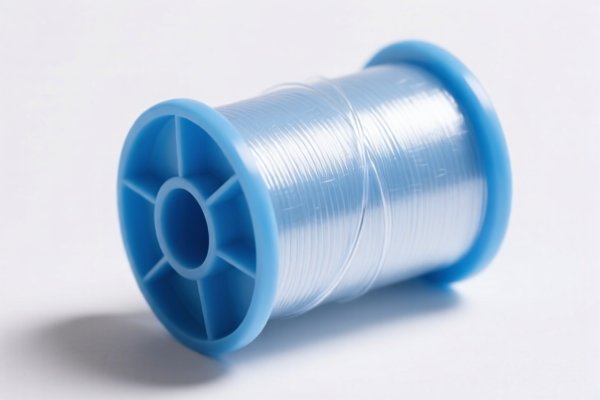

Product Name: Plastic Cable Spools

Classification Analysis:

Based on the product description and the provided HS codes, the most appropriate classification for plastic cable spools is:

✅ HS CODE: 3923400050

Description: Plastic-made other types of spools, bobbins, reels, and other similar supports

Total Tax Rate: 60.3%

📌 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

📌 Key Considerations:

- Material Verification: Confirm that the cable spools are indeed made of plastic and not a composite or mixed material, as this can affect classification.

- Unit Price and Certification: Check if any specific certifications (e.g., RoHS, REACH) are required for import, especially if the product is intended for industrial or electrical use.

- Classification Accuracy: Ensure that the product is not misclassified under a different HS code (e.g., 8547200000 for insulation parts or 3926909987 for cable conduits), which could lead to incorrect tariffs or customs delays.

📌 Proactive Advice:

- Verify Product Description: Ensure the product is clearly defined as a spool and not a reel, tube, or conduit, as this can change the applicable HS code.

- Consult Customs Broker: For high-value or frequently imported goods, consider engaging a customs broker to ensure compliance with all regulations and avoid penalties.

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025, when the special tariff of 30.0% will apply.

Let me know if you need help with customs documentation or further classification clarification.

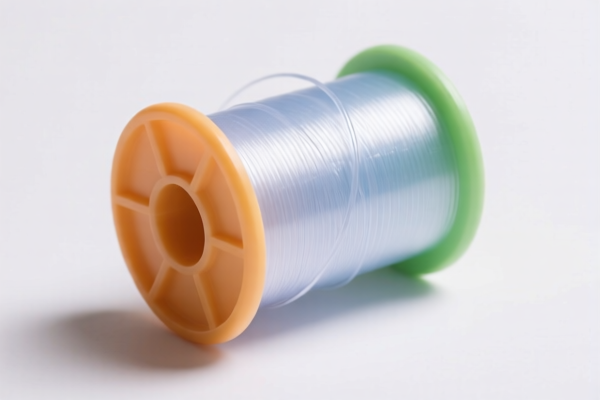

Product Name: Plastic Cable Spools

Classification Analysis:

Based on the product description and the provided HS codes, the most appropriate classification for plastic cable spools is:

✅ HS CODE: 3923400050

Description: Plastic-made other types of spools, bobbins, reels, and other similar supports

Total Tax Rate: 60.3%

📌 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

📌 Key Considerations:

- Material Verification: Confirm that the cable spools are indeed made of plastic and not a composite or mixed material, as this can affect classification.

- Unit Price and Certification: Check if any specific certifications (e.g., RoHS, REACH) are required for import, especially if the product is intended for industrial or electrical use.

- Classification Accuracy: Ensure that the product is not misclassified under a different HS code (e.g., 8547200000 for insulation parts or 3926909987 for cable conduits), which could lead to incorrect tariffs or customs delays.

📌 Proactive Advice:

- Verify Product Description: Ensure the product is clearly defined as a spool and not a reel, tube, or conduit, as this can change the applicable HS code.

- Consult Customs Broker: For high-value or frequently imported goods, consider engaging a customs broker to ensure compliance with all regulations and avoid penalties.

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025, when the special tariff of 30.0% will apply.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.