| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3926909940 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 6506910060 | Doc | 55.0% | CN | US | 2025-05-12 |

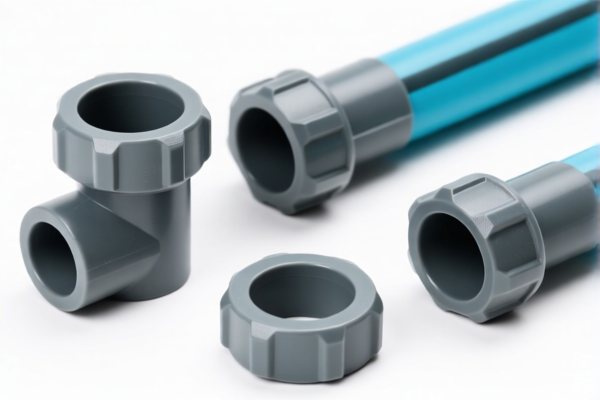

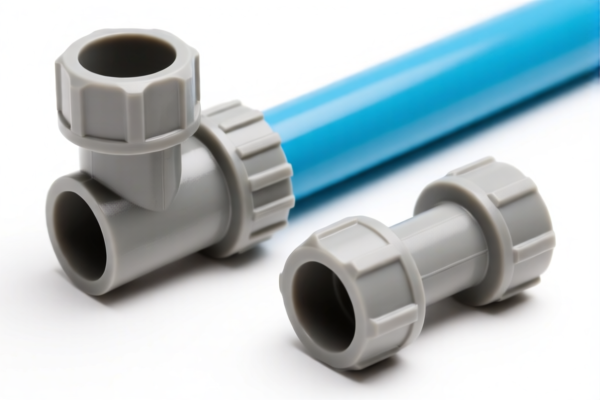

Here is the structured analysis and classification for Plastic Cap Fittings based on the provided HS codes and tariff details:

✅ HS CODE: 3917400095

Product Description: Plastic pipe fittings and plastic flexible hoses and fittings

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most likely HS code for plastic cap fittings used in piping systems.

- The special tariff applies after April 11, 2025, so be mindful of the timing for customs clearance.

- Proactive Advice: Confirm the material composition and specific use (e.g., for water, gas, or chemical systems) to ensure correct classification.

✅ HS CODE: 3926903500

Product Description: Other plastic products

Total Tax Rate: 44.0%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is more general and may apply to plastic cap fittings if they are not clearly classified under 3917.

- Proactive Advice: If the product is not clearly defined as a pipe fitting, this may be a fallback code. Verify with customs or a classification expert.

✅ HS CODE: 3926909940

Product Description: Plastic or other materials made manhole covers, frames, drainage gates, etc.

Total Tax Rate: 42.8%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for manhole covers and related items, which are not related to plastic cap fittings.

- Proactive Advice: Avoid using this code unless the product is clearly a manhole cover or similar item.

✅ HS CODE: 3923900080

Product Description: Plastic goods for cargo or packaging

Total Tax Rate: 58.0%

Tariff Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for packaging or transport goods, not for cap fittings.

- Proactive Advice: Only use this code if the product is used for packaging or transport purposes.

✅ HS CODE: 6506910060

Product Description: Headwear made of rubber or plastic

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for headwear, not for plastic cap fittings.

- Proactive Advice: Not applicable for your product. Avoid using this code.

📌 Recommendation Summary:

- Best Fit HS Code: 3917400095 (Plastic pipe fittings)

- Tariff Alert: A 30.0% additional tariff will apply after April 11, 2025.

- Action Required:

- Confirm the material (e.g., polyethylene, PVC) and intended use (e.g., water, gas, chemical systems).

- Ensure certifications (e.g., ISO, CE) are in place if exporting to regulated markets.

- Check with customs or a classification expert to confirm the most accurate code for your specific product.

Let me know if you need help with certification requirements or customs documentation. Here is the structured analysis and classification for Plastic Cap Fittings based on the provided HS codes and tariff details:

✅ HS CODE: 3917400095

Product Description: Plastic pipe fittings and plastic flexible hoses and fittings

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most likely HS code for plastic cap fittings used in piping systems.

- The special tariff applies after April 11, 2025, so be mindful of the timing for customs clearance.

- Proactive Advice: Confirm the material composition and specific use (e.g., for water, gas, or chemical systems) to ensure correct classification.

✅ HS CODE: 3926903500

Product Description: Other plastic products

Total Tax Rate: 44.0%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is more general and may apply to plastic cap fittings if they are not clearly classified under 3917.

- Proactive Advice: If the product is not clearly defined as a pipe fitting, this may be a fallback code. Verify with customs or a classification expert.

✅ HS CODE: 3926909940

Product Description: Plastic or other materials made manhole covers, frames, drainage gates, etc.

Total Tax Rate: 42.8%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for manhole covers and related items, which are not related to plastic cap fittings.

- Proactive Advice: Avoid using this code unless the product is clearly a manhole cover or similar item.

✅ HS CODE: 3923900080

Product Description: Plastic goods for cargo or packaging

Total Tax Rate: 58.0%

Tariff Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for packaging or transport goods, not for cap fittings.

- Proactive Advice: Only use this code if the product is used for packaging or transport purposes.

✅ HS CODE: 6506910060

Product Description: Headwear made of rubber or plastic

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for headwear, not for plastic cap fittings.

- Proactive Advice: Not applicable for your product. Avoid using this code.

📌 Recommendation Summary:

- Best Fit HS Code: 3917400095 (Plastic pipe fittings)

- Tariff Alert: A 30.0% additional tariff will apply after April 11, 2025.

- Action Required:

- Confirm the material (e.g., polyethylene, PVC) and intended use (e.g., water, gas, chemical systems).

- Ensure certifications (e.g., ISO, CE) are in place if exporting to regulated markets.

- Check with customs or a classification expert to confirm the most accurate code for your specific product.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.