| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

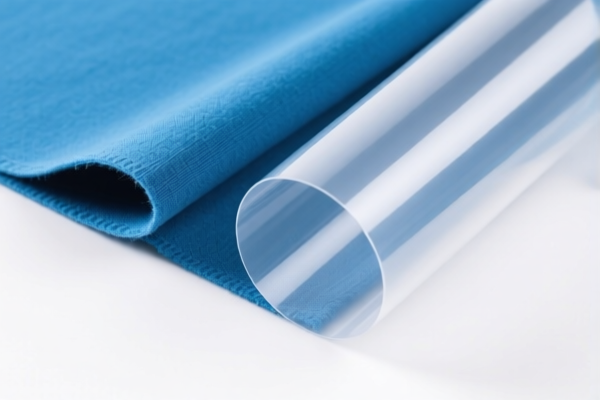

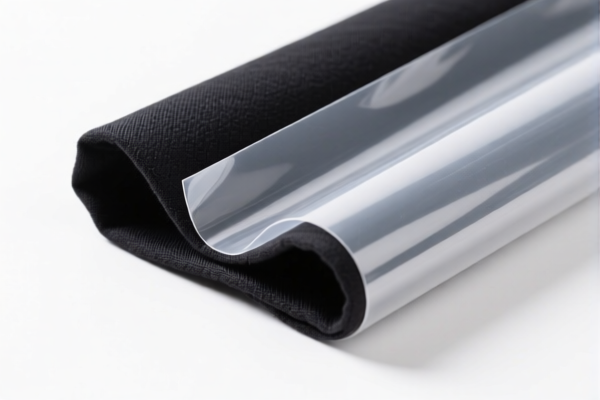

Here is the structured analysis and classification for the Plastic Composite Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921904090

Description: Other plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is suitable for general plastic films that are not reinforced or combined with other materials.

- Proactive Advice: Confirm if the product is a basic plastic film without any composite or layered structure.

✅ HS CODE: 3921905050

Description: Plastic sheets, plates, films, etc.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is similar to 3921904090 but may apply to specific types of plastic films.

- Proactive Advice: Verify the exact composition and structure of the film to ensure correct classification.

✅ HS CODE: 3920992000

Description: Laminated, supported, or otherwise combined with other materials plastic sheets, plates, films, etc.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to composite or layered plastic films (e.g., plastic + paper, plastic + metal).

- Proactive Advice: Confirm if the product is a composite material and check for required certifications (e.g., material composition, safety standards).

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for flexible plastic films reinforced with paper.

- Proactive Advice: Ensure the product is reinforced with paper and not with other materials (e.g., metal, fabric).

✅ HS CODE: 3901400000

Description: Primary forms of polymer of ethylene

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to raw polymer materials (e.g., polyethylene in its primary form).

- Proactive Advice: This is not suitable for finished composite films. Use only if the product is a raw polymer.

📌 Key Policy Alert:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (unless the product is imported from specific countries with known anti-dumping duties).

🛠️ Proactive Recommendations:

- Verify the product composition (e.g., is it a composite, reinforced, or layered material?).

- Check the unit price and compare with similar products to ensure correct classification.

- Confirm required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Consult a customs broker or local customs authority for final confirmation, especially if the product is close to multiple HS codes.

Let me know if you need help determining which HS code best fits your specific product. Here is the structured analysis and classification for the Plastic Composite Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921904090

Description: Other plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is suitable for general plastic films that are not reinforced or combined with other materials.

- Proactive Advice: Confirm if the product is a basic plastic film without any composite or layered structure.

✅ HS CODE: 3921905050

Description: Plastic sheets, plates, films, etc.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is similar to 3921904090 but may apply to specific types of plastic films.

- Proactive Advice: Verify the exact composition and structure of the film to ensure correct classification.

✅ HS CODE: 3920992000

Description: Laminated, supported, or otherwise combined with other materials plastic sheets, plates, films, etc.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to composite or layered plastic films (e.g., plastic + paper, plastic + metal).

- Proactive Advice: Confirm if the product is a composite material and check for required certifications (e.g., material composition, safety standards).

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for flexible plastic films reinforced with paper.

- Proactive Advice: Ensure the product is reinforced with paper and not with other materials (e.g., metal, fabric).

✅ HS CODE: 3901400000

Description: Primary forms of polymer of ethylene

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code applies to raw polymer materials (e.g., polyethylene in its primary form).

- Proactive Advice: This is not suitable for finished composite films. Use only if the product is a raw polymer.

📌 Key Policy Alert:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (unless the product is imported from specific countries with known anti-dumping duties).

🛠️ Proactive Recommendations:

- Verify the product composition (e.g., is it a composite, reinforced, or layered material?).

- Check the unit price and compare with similar products to ensure correct classification.

- Confirm required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Consult a customs broker or local customs authority for final confirmation, especially if the product is close to multiple HS codes.

Let me know if you need help determining which HS code best fits your specific product.

Customer Reviews

No reviews yet.