| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariff information for Plastic Corrosion Resistant Hose:

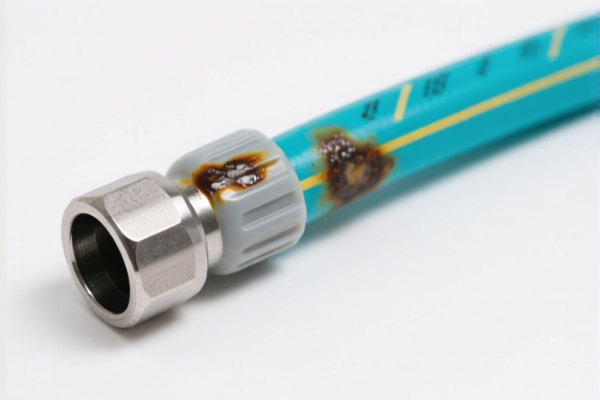

📦 Product Classification Overview: Plastic Corrosion Resistant Hose

Below are the HS codes and their corresponding tariff details:

🔢 HS Code: 3917310000

Description: Plastic tubes, suitable for corrosion-resistant plastic tubes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917320050

Description: Plastic tubes or fittings, not reinforced or combined with other materials, without fittings, suitable for corrosion-resistant plastic tubes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917320010

Description: Plastic tubes or fittings made of polyvinyl chloride (PVC), suitable for corrosion-resistant soft PVC hoses.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917400050

Description: Plastic fittings, suitable for corrosion-resistant plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS Code: 3917400095

Description: Other plastic tubes, fittings, and hose fittings, suitable for corrosion-resistant plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for these plastic products.

- Material and Certification: Verify the material composition (e.g., PVC, other plastics) and unit price to ensure correct classification. Also, check if certifications (e.g., ISO, CE, etc.) are required for import compliance.

✅ Proactive Advice:

- Confirm the exact product description and material to ensure the correct HS code is used.

- Be aware of the April 11, 2025 deadline for the special tariff.

- If importing in bulk, consider customs broker assistance to ensure compliance and avoid delays.

Let me know if you need help with HS code selection or customs documentation. Here is the structured and professional breakdown of the HS codes and associated tariff information for Plastic Corrosion Resistant Hose:

📦 Product Classification Overview: Plastic Corrosion Resistant Hose

Below are the HS codes and their corresponding tariff details:

🔢 HS Code: 3917310000

Description: Plastic tubes, suitable for corrosion-resistant plastic tubes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917320050

Description: Plastic tubes or fittings, not reinforced or combined with other materials, without fittings, suitable for corrosion-resistant plastic tubes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917320010

Description: Plastic tubes or fittings made of polyvinyl chloride (PVC), suitable for corrosion-resistant soft PVC hoses.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

🔢 HS Code: 3917400050

Description: Plastic fittings, suitable for corrosion-resistant plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS Code: 3917400095

Description: Other plastic tubes, fittings, and hose fittings, suitable for corrosion-resistant plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for these plastic products.

- Material and Certification: Verify the material composition (e.g., PVC, other plastics) and unit price to ensure correct classification. Also, check if certifications (e.g., ISO, CE, etc.) are required for import compliance.

✅ Proactive Advice:

- Confirm the exact product description and material to ensure the correct HS code is used.

- Be aware of the April 11, 2025 deadline for the special tariff.

- If importing in bulk, consider customs broker assistance to ensure compliance and avoid delays.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.