| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 9403708031 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6302511000 | Doc | 36.1% | CN | US | 2025-05-12 |

| 3926301000 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

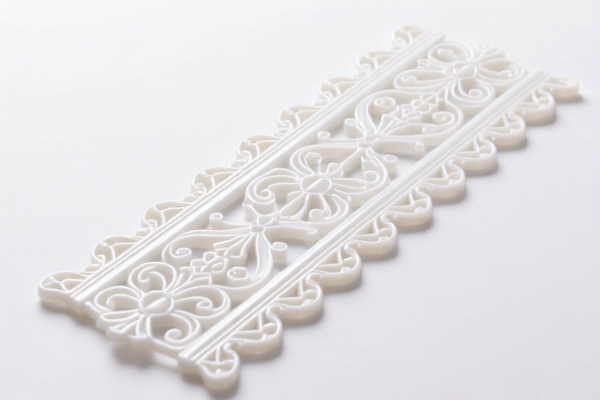

Product Classification: Plastic Decorative Runners

Based on the product description and provided HS codes, Plastic Decorative Runners can be classified under multiple HS codes, depending on their specific use, material, and design. Below is a structured breakdown of the classification options and associated tariff rates:

1. HS CODE: 3924901010

Description:

- Plastic decorative runners made of plastic, used as decorative items such as tablecloths, table runners, napkins, decorative pads, etc.

- Includes items like panels, pleated curtains, table flags, and similar decorative items.

Tariff Details:

- Base Tariff Rate: 3.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 33.3%

Note: This is the most likely classification for general decorative runners made of plastic, not used as furniture or textile products.

2. HS CODE: 9403708031

Description:

- Plastic decorative runners used as furniture components, such as decorative parts of a table or chair.

- This classification applies if the runner is integrated into furniture or used as a furniture accessory.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

Note: This classification is higher in tariff and should be used only if the product is clearly part of a furniture set.

3. HS CODE: 6302511000

Description:

- If the decorative runner is made of textile material (e.g., cotton), and used as a table runner or decorative cloth, it may fall under this code.

Tariff Details:

- Base Tariff Rate: 6.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 36.1%

Note: This classification is only applicable if the product is textile-based, not plastic.

4. HS CODE: 3926301000

Description:

- If the decorative runner is used as a furniture accessory, such as a table leg cover or decorative handle, it may be classified under this code.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 44.0%

Note: This classification is less common for decorative runners unless they are specifically used as furniture parts.

Key Tariff Changes After April 11, 2025

- All classifications will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

Proactive Advice for Importers

- Verify the material (plastic, textile, etc.) and intended use (decorative, furniture part, textile item) to determine the correct HS code.

- Check the unit price and product description to ensure compliance with customs regulations.

- Confirm if any certifications (e.g., safety, environmental) are required for import.

- Plan for increased costs after April 11, 2025, and consider tariff mitigation strategies if applicable.

Summary Table

| HS Code | Description | Base Tariff | Additional Tariff (before 2025.4.2) | Additional Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3924901010 | Plastic decorative runners (general use) | 3.3% | 0.0% | 30.0% | 33.3% |

| 9403708031 | Plastic decorative runners (furniture part) | 0.0% | 25.0% | 30.0% | 55.0% |

| 6302511000 | Textile decorative runners (e.g., cotton) | 6.1% | 0.0% | 30.0% | 36.1% |

| 3926301000 | Plastic decorative runners (furniture part) | 6.5% | 7.5% | 30.0% | 44.0% |

Let me know if you need help determining the most accurate classification for your specific product.

Product Classification: Plastic Decorative Runners

Based on the product description and provided HS codes, Plastic Decorative Runners can be classified under multiple HS codes, depending on their specific use, material, and design. Below is a structured breakdown of the classification options and associated tariff rates:

1. HS CODE: 3924901010

Description:

- Plastic decorative runners made of plastic, used as decorative items such as tablecloths, table runners, napkins, decorative pads, etc.

- Includes items like panels, pleated curtains, table flags, and similar decorative items.

Tariff Details:

- Base Tariff Rate: 3.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 33.3%

Note: This is the most likely classification for general decorative runners made of plastic, not used as furniture or textile products.

2. HS CODE: 9403708031

Description:

- Plastic decorative runners used as furniture components, such as decorative parts of a table or chair.

- This classification applies if the runner is integrated into furniture or used as a furniture accessory.

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

Note: This classification is higher in tariff and should be used only if the product is clearly part of a furniture set.

3. HS CODE: 6302511000

Description:

- If the decorative runner is made of textile material (e.g., cotton), and used as a table runner or decorative cloth, it may fall under this code.

Tariff Details:

- Base Tariff Rate: 6.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 36.1%

Note: This classification is only applicable if the product is textile-based, not plastic.

4. HS CODE: 3926301000

Description:

- If the decorative runner is used as a furniture accessory, such as a table leg cover or decorative handle, it may be classified under this code.

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 44.0%

Note: This classification is less common for decorative runners unless they are specifically used as furniture parts.

Key Tariff Changes After April 11, 2025

- All classifications will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

Proactive Advice for Importers

- Verify the material (plastic, textile, etc.) and intended use (decorative, furniture part, textile item) to determine the correct HS code.

- Check the unit price and product description to ensure compliance with customs regulations.

- Confirm if any certifications (e.g., safety, environmental) are required for import.

- Plan for increased costs after April 11, 2025, and consider tariff mitigation strategies if applicable.

Summary Table

| HS Code | Description | Base Tariff | Additional Tariff (before 2025.4.2) | Additional Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3924901010 | Plastic decorative runners (general use) | 3.3% | 0.0% | 30.0% | 33.3% |

| 9403708031 | Plastic decorative runners (furniture part) | 0.0% | 25.0% | 30.0% | 55.0% |

| 6302511000 | Textile decorative runners (e.g., cotton) | 6.1% | 0.0% | 30.0% | 36.1% |

| 3926301000 | Plastic decorative runners (furniture part) | 6.5% | 7.5% | 30.0% | 44.0% |

Let me know if you need help determining the most accurate classification for your specific product.

Customer Reviews

No reviews yet.