| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200010 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

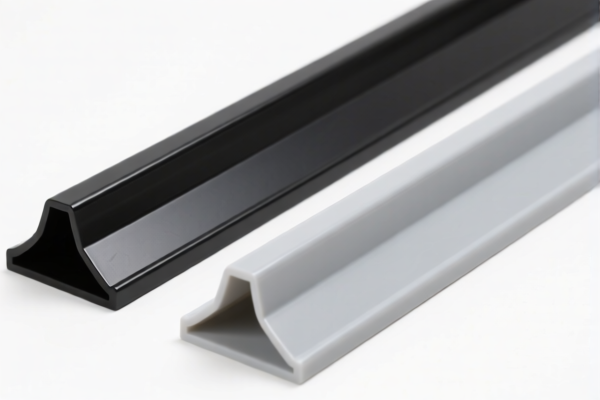

- HS CODE: 3925200010

- Product Name: Plastic Door Thresholds

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code is specifically for plastic door thresholds. Ensure the product description matches this classification.

-

HS CODE: 3925200091

- Product Name: Plastic Thresholds (General)

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general plastic thresholds, not limited to doors. Confirm the product's specific use (e.g., door, window, or general).

-

HS CODE: 3925200020

- Product Name: Plastic Window Thresholds

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code is for plastic window thresholds. Ensure the product is not misclassified as a door threshold.

-

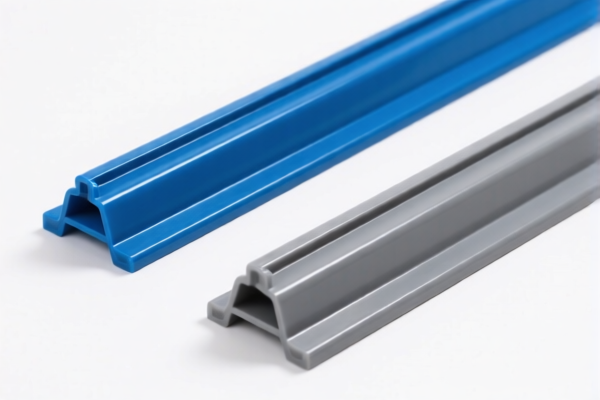

HS CODE: 3925900000

- Product Name: Plastic Threshold Strips

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to plastic threshold strips. The higher tax rate is due to the additional 25% tariff. Verify if this is the correct classification for your product.

-

HS CODE: 3921905050

- Product Name: Plastic Threshold Strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code also applies to plastic threshold strips but has a lower base tariff. Confirm the product's material and structure to determine the correct code.

Proactive Advice:

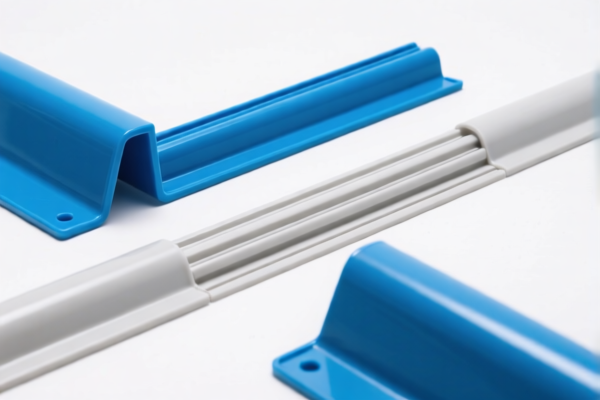

- Verify Material and Unit Price: Ensure the product is made entirely of plastic and not a composite material, which may fall under a different HS code.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) for customs clearance.

- Monitor Tariff Changes: The 30% additional tariff after April 11, 2025, applies to all listed codes. Plan accordingly for increased costs.

- Consult a Customs Broker: For complex classifications or large shipments, seek professional assistance to avoid delays or penalties.

- HS CODE: 3925200010

- Product Name: Plastic Door Thresholds

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code is specifically for plastic door thresholds. Ensure the product description matches this classification.

-

HS CODE: 3925200091

- Product Name: Plastic Thresholds (General)

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general plastic thresholds, not limited to doors. Confirm the product's specific use (e.g., door, window, or general).

-

HS CODE: 3925200020

- Product Name: Plastic Window Thresholds

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code is for plastic window thresholds. Ensure the product is not misclassified as a door threshold.

-

HS CODE: 3925900000

- Product Name: Plastic Threshold Strips

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to plastic threshold strips. The higher tax rate is due to the additional 25% tariff. Verify if this is the correct classification for your product.

-

HS CODE: 3921905050

- Product Name: Plastic Threshold Strips

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code also applies to plastic threshold strips but has a lower base tariff. Confirm the product's material and structure to determine the correct code.

Proactive Advice:

- Verify Material and Unit Price: Ensure the product is made entirely of plastic and not a composite material, which may fall under a different HS code.

- Check Required Certifications: Some products may require specific certifications (e.g., safety, environmental compliance) for customs clearance.

- Monitor Tariff Changes: The 30% additional tariff after April 11, 2025, applies to all listed codes. Plan accordingly for increased costs.

- Consult a Customs Broker: For complex classifications or large shipments, seek professional assistance to avoid delays or penalties.

Customer Reviews

No reviews yet.