Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

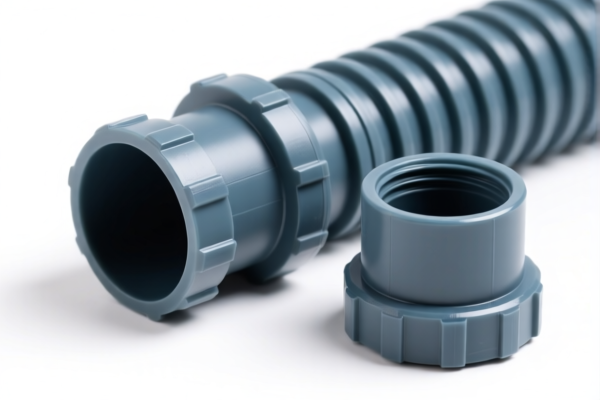

Product Name: Plastic Drainage Fittings

Classification: HS Code 3917400050 or 3917400095

🔍 HS Code Classification Overview

- HS Code 3917400050

- Description: Non-pressure drainage, waste, and vent (DWV) plastic fittings.

-

Applicable for: Fittings used in non-pressure drainage systems (e.g., plumbing in residential or commercial buildings).

-

HS Code 3917400095

- Description: Other plastic fittings (not specifically for non-pressure drainage systems).

- Applicable for: General-purpose plastic fittings that may be used in various applications, not limited to drainage systems.

📊 Tariff Rates (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3% (for both HS codes)

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on imports after April 11, 2025.

- This is a critical date for importers to consider when planning shipments.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for plastic drainage fittings (not subject to current anti-dumping duties on iron or aluminum).

- However, always verify if the product is on any anti-dumping duty list for the specific country of import.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is made of plastic and not mixed with other materials (e.g., metal), as this may affect classification.

- Check Unit Price: Tariff rates may vary based on the value of the product (e.g., under or over the threshold for preferential treatment).

- Certifications Required: Confirm if any technical or safety certifications (e.g., CE, ISO) are required for import into the destination country.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline between HS codes.

✅ Summary of Key Points

- HS Code Options: 3917400050 (specific to non-pressure drainage) or 3917400095 (other plastic fittings).

- Total Tariff: 60.3% (includes base, general, and special tariffs).

- Special Tariff Alert: 30.0% added after April 11, 2025.

- No Anti-Dumping Duties currently applicable.

- Action Required: Confirm product details and consult customs experts for compliance.

Product Name: Plastic Drainage Fittings

Classification: HS Code 3917400050 or 3917400095

🔍 HS Code Classification Overview

- HS Code 3917400050

- Description: Non-pressure drainage, waste, and vent (DWV) plastic fittings.

-

Applicable for: Fittings used in non-pressure drainage systems (e.g., plumbing in residential or commercial buildings).

-

HS Code 3917400095

- Description: Other plastic fittings (not specifically for non-pressure drainage systems).

- Applicable for: General-purpose plastic fittings that may be used in various applications, not limited to drainage systems.

📊 Tariff Rates (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3% (for both HS codes)

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on imports after April 11, 2025.

- This is a critical date for importers to consider when planning shipments.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for plastic drainage fittings (not subject to current anti-dumping duties on iron or aluminum).

- However, always verify if the product is on any anti-dumping duty list for the specific country of import.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is made of plastic and not mixed with other materials (e.g., metal), as this may affect classification.

- Check Unit Price: Tariff rates may vary based on the value of the product (e.g., under or over the threshold for preferential treatment).

- Certifications Required: Confirm if any technical or safety certifications (e.g., CE, ISO) are required for import into the destination country.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline between HS codes.

✅ Summary of Key Points

- HS Code Options: 3917400050 (specific to non-pressure drainage) or 3917400095 (other plastic fittings).

- Total Tariff: 60.3% (includes base, general, and special tariffs).

- Special Tariff Alert: 30.0% added after April 11, 2025.

- No Anti-Dumping Duties currently applicable.

- Action Required: Confirm product details and consult customs experts for compliance.

Customer Reviews

No reviews yet.