| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9033009000 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 8701301090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926305000 | Doc | 42.8% | CN | US | 2025-05-12 |

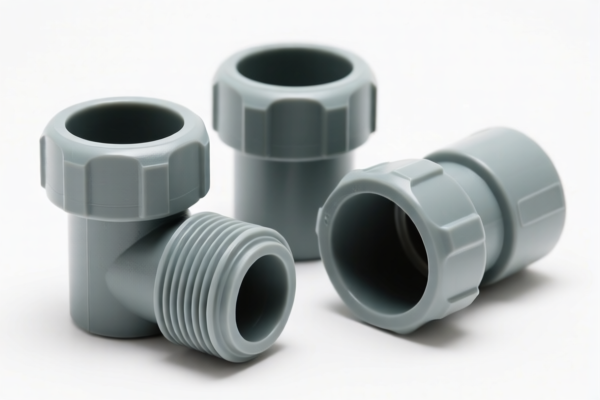

Product Name: Plastic Farm Fittings

Classification HS Codes and Tax Details:

✅ HS CODE: 3917400095

Description: Plastic pipe fittings and plastic hoses and fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This is the most relevant classification for general plastic farm fittings. Ensure the product is not classified under a more specific code.

✅ HS CODE: 9033009000

Description: Parts and accessories of machines, instruments, or devices

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: This may apply if the fittings are considered parts of agricultural machinery or instruments.

✅ HS CODE: 3926903500

Description: Other plastic products

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

- Notes: This is a broader category and may apply if the fittings are not clearly classified under 3917.

✅ HS CODE: 8701301090

Description: Plastic parts of agricultural tractors

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is specific to parts of agricultural tractors. Ensure the product is indeed used in tractors.

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicles, or similar uses

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes: This may apply if the fittings are used in agricultural vehicles or equipment.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of plastic and whether it falls under the most specific HS code (e.g., 3917400095 for general plastic fittings).

- Check Required Certifications: Some products may require specific certifications (e.g., CE, RoHS) for import compliance.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant (30.0%) and will increase the total tax burden. Ensure your import planning accounts for this.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to consult a customs broker or a compliance expert.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Plastic Farm Fittings

Classification HS Codes and Tax Details:

✅ HS CODE: 3917400095

Description: Plastic pipe fittings and plastic hoses and fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This is the most relevant classification for general plastic farm fittings. Ensure the product is not classified under a more specific code.

✅ HS CODE: 9033009000

Description: Parts and accessories of machines, instruments, or devices

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes: This may apply if the fittings are considered parts of agricultural machinery or instruments.

✅ HS CODE: 3926903500

Description: Other plastic products

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

- Notes: This is a broader category and may apply if the fittings are not clearly classified under 3917.

✅ HS CODE: 8701301090

Description: Plastic parts of agricultural tractors

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is specific to parts of agricultural tractors. Ensure the product is indeed used in tractors.

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicles, or similar uses

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes: This may apply if the fittings are used in agricultural vehicles or equipment.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of plastic and whether it falls under the most specific HS code (e.g., 3917400095 for general plastic fittings).

- Check Required Certifications: Some products may require specific certifications (e.g., CE, RoHS) for import compliance.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant (30.0%) and will increase the total tax burden. Ensure your import planning accounts for this.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to consult a customs broker or a compliance expert.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.