| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

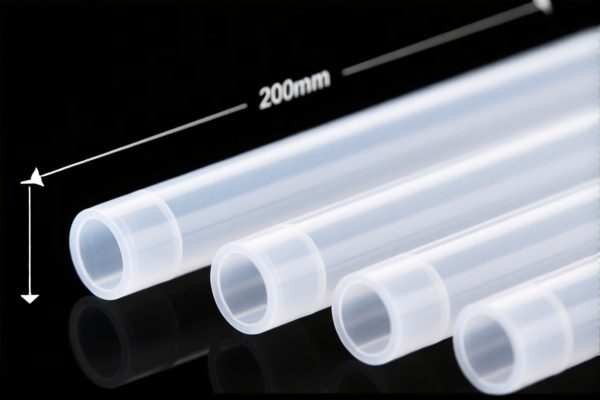

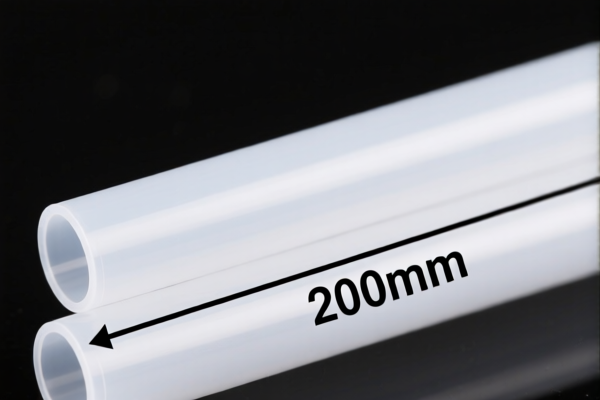

Product Classification: Plastic Fittings Less than 200mm

Based on the provided HS codes and tax details, here is a structured breakdown of the customs compliance and tariff information for plastic fittings less than 200mm:

🔍 HS Code 3917290050

Description:

Rigid plastic pipes and fittings (e.g., couplings, elbows, flanges), other than those of plastics, with fittings less than 200mm in length.

Tariff Breakdown: - Base Tariff Rate: 3.1% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 58.1%

🔍 HS Code 3917400095

Description:

Plastic pipe fittings (general category).

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered when planning import schedules. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category in the provided data. -

Material and Certification Requirements:

Ensure the product is made of plastic (not metal or composite) and that the length of the fittings is less than 200mm. Verify the material composition and unit price for accurate classification and tax calculation.

Check if certifications (e.g., RoHS, REACH, or other local import requirements) are needed for customs clearance.

✅ Proactive Advice:

-

Confirm Product Specifications:

Double-check the material type, length, and function of the fittings to ensure correct HS code classification. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as they may significantly impact the total import cost. -

Consult Customs Broker:

For complex or high-value shipments, consider consulting a customs broker or compliance expert to avoid misclassification and penalties.

Let me know if you need help with certification requirements or customs documentation for these products. Product Classification: Plastic Fittings Less than 200mm

Based on the provided HS codes and tax details, here is a structured breakdown of the customs compliance and tariff information for plastic fittings less than 200mm:

🔍 HS Code 3917290050

Description:

Rigid plastic pipes and fittings (e.g., couplings, elbows, flanges), other than those of plastics, with fittings less than 200mm in length.

Tariff Breakdown: - Base Tariff Rate: 3.1% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 58.1%

🔍 HS Code 3917400095

Description:

Plastic pipe fittings (general category).

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff (After April 11, 2025): 30.0% - Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered when planning import schedules. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category in the provided data. -

Material and Certification Requirements:

Ensure the product is made of plastic (not metal or composite) and that the length of the fittings is less than 200mm. Verify the material composition and unit price for accurate classification and tax calculation.

Check if certifications (e.g., RoHS, REACH, or other local import requirements) are needed for customs clearance.

✅ Proactive Advice:

-

Confirm Product Specifications:

Double-check the material type, length, and function of the fittings to ensure correct HS code classification. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as they may significantly impact the total import cost. -

Consult Customs Broker:

For complex or high-value shipments, consider consulting a customs broker or compliance expert to avoid misclassification and penalties.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.