| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

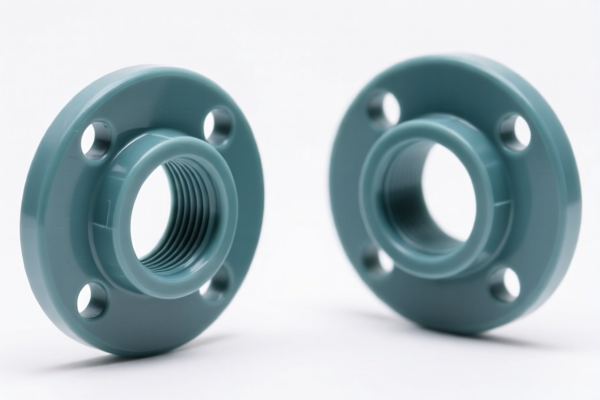

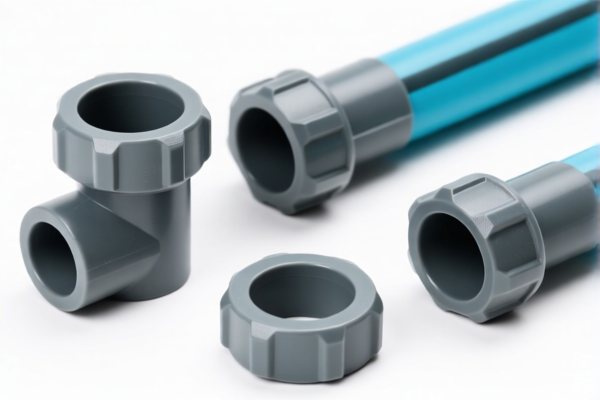

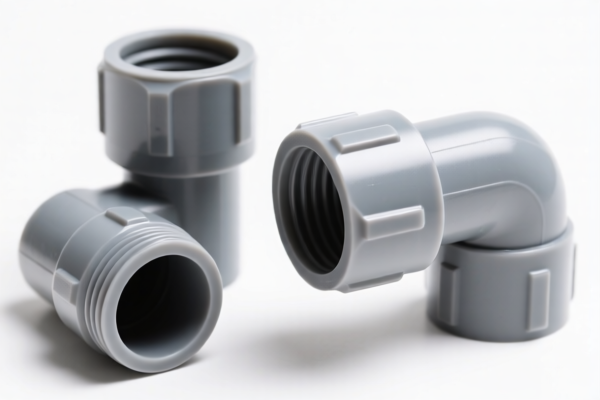

Product Classification: Plastic Flange Fittings

HS CODEs and Tax Information Overview:

- HS CODE 3917400095

- Description: Plastic flange fittings classified under HS CODE 3917400095.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to plastic flange fittings with specific characteristics.

-

HS CODE 3917400050

- Description: Plastic flange fittings classified under HS CODE 3917400050, which includes various types of plastic fittings, including flange fittings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is similar to 3917400095 but may differ in specific product attributes.

-

HS CODE 3917330000

- Description: Plastic flange fittings classified under HS CODE 3917330000, which includes plastic fittings and flanges that are not reinforced or combined with other materials.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff, but still subject to the 30% special tariff after April 11, 2025.

-

HS CODE 3917290050

- Description: Plastic flange fittings classified under HS CODE 3917290050.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to specific types of plastic flange fittings with unique features.

-

HS CODE 3917390050

- Description: Plastic flange fittings classified under HS CODE 3917390050, which matches the 8–10 digit description provided.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be used for specific types of plastic flange fittings.

Key Tax Rate Changes (April 11, 2025):

- All codes listed above are subject to an additional 30% tariff after April 11, 2025.

- No anti-dumping duties are currently applicable for this product category.

Proactive Advice:

- Verify Material and Unit Price: Ensure the product is purely made of plastic and not reinforced or combined with other materials (e.g., metal), as this may affect the HS CODE classification.

- Check Required Certifications: Confirm if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country.

- Review HS CODE Classification: Double-check the exact HS CODE based on the product's material, structure, and intended use to avoid misclassification and potential penalties.

-

Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, as this could significantly impact the total import cost. Product Classification: Plastic Flange Fittings

HS CODEs and Tax Information Overview: -

HS CODE 3917400095

- Description: Plastic flange fittings classified under HS CODE 3917400095.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to plastic flange fittings with specific characteristics.

-

HS CODE 3917400050

- Description: Plastic flange fittings classified under HS CODE 3917400050, which includes various types of plastic fittings, including flange fittings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is similar to 3917400095 but may differ in specific product attributes.

-

HS CODE 3917330000

- Description: Plastic flange fittings classified under HS CODE 3917330000, which includes plastic fittings and flanges that are not reinforced or combined with other materials.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff, but still subject to the 30% special tariff after April 11, 2025.

-

HS CODE 3917290050

- Description: Plastic flange fittings classified under HS CODE 3917290050.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to specific types of plastic flange fittings with unique features.

-

HS CODE 3917390050

- Description: Plastic flange fittings classified under HS CODE 3917390050, which matches the 8–10 digit description provided.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be used for specific types of plastic flange fittings.

Key Tax Rate Changes (April 11, 2025):

- All codes listed above are subject to an additional 30% tariff after April 11, 2025.

- No anti-dumping duties are currently applicable for this product category.

Proactive Advice:

- Verify Material and Unit Price: Ensure the product is purely made of plastic and not reinforced or combined with other materials (e.g., metal), as this may affect the HS CODE classification.

- Check Required Certifications: Confirm if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country.

- Review HS CODE Classification: Double-check the exact HS CODE based on the product's material, structure, and intended use to avoid misclassification and potential penalties.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, as this could significantly impact the total import cost.

Customer Reviews

No reviews yet.