| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9403708003 | Doc | 55.0% | CN | US | 2025-05-12 |

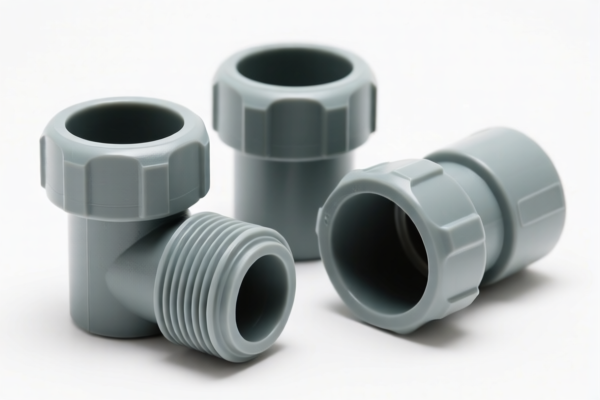

Here is the structured classification and tariff information for Plastic Garden Fittings, based on the provided HS codes and tax details:

📦 Product Classification Overview: Plastic Garden Fittings

🔢 HS CODE: 3924905650

- Product Description: Plastic garden decorations

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code applies to decorative items made of plastic used in garden settings.

🔢 HS CODE: 3926909989

- Product Description: Plastic garden tool kits

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for kits containing multiple plastic garden tools.

🔢 HS CODE: 3926903500

- Product Description: Plastic decorative fittings

- Total Tax Rate: 44.0%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for decorative fittings used in garden or outdoor settings.

🔢 HS CODE: 3917400095

- Product Description: Plastic fittings (general)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This is a general category for plastic fittings, which may include a wide range of products.

🔢 HS CODE: 9403708003

- Product Description: Plastic fence fittings

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for fittings used in plastic fencing systems.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products, but it's advisable to check for any ongoing investigations or duties related to plastic products. -

Material and Certification:

- Verify the material composition of the product (e.g., type of plastic used).

-

Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the actual product description and unit price. Misclassification can lead to delays or penalties.

✅ Proactive Advice:

- Double-check the product description against the HS code to avoid misclassification.

- Consult with a customs broker or local customs authority for the most up-to-date and accurate tariff information.

- Plan ahead for the April 11, 2025, tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or documentation preparation. Here is the structured classification and tariff information for Plastic Garden Fittings, based on the provided HS codes and tax details:

📦 Product Classification Overview: Plastic Garden Fittings

🔢 HS CODE: 3924905650

- Product Description: Plastic garden decorations

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code applies to decorative items made of plastic used in garden settings.

🔢 HS CODE: 3926909989

- Product Description: Plastic garden tool kits

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for kits containing multiple plastic garden tools.

🔢 HS CODE: 3926903500

- Product Description: Plastic decorative fittings

- Total Tax Rate: 44.0%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for decorative fittings used in garden or outdoor settings.

🔢 HS CODE: 3917400095

- Product Description: Plastic fittings (general)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This is a general category for plastic fittings, which may include a wide range of products.

🔢 HS CODE: 9403708003

- Product Description: Plastic fence fittings

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for fittings used in plastic fencing systems.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products, but it's advisable to check for any ongoing investigations or duties related to plastic products. -

Material and Certification:

- Verify the material composition of the product (e.g., type of plastic used).

-

Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the actual product description and unit price. Misclassification can lead to delays or penalties.

✅ Proactive Advice:

- Double-check the product description against the HS code to avoid misclassification.

- Consult with a customs broker or local customs authority for the most up-to-date and accurate tariff information.

- Plan ahead for the April 11, 2025, tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or documentation preparation.

Customer Reviews

No reviews yet.