| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7306305026 | Doc | 30.0% | CN | US | 2025-05-12 |

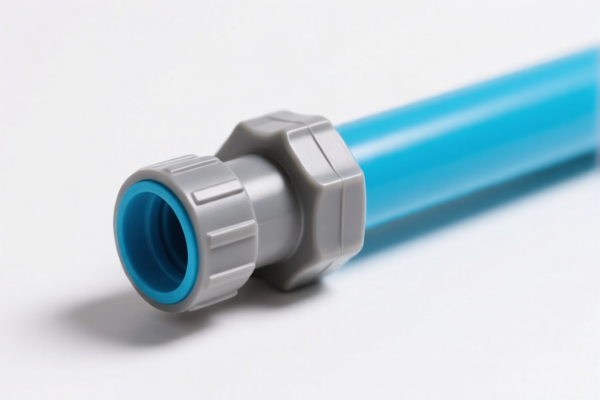

Product Classification: Plastic Gas Pipe

HS CODE: 3917320050, 3917390050, 3917210000, 3917310000, 7306305026

🔍 Classification Overview

Plastic gas pipes are typically classified under HS Chapter 3917, which covers "Plastics and articles thereof: Other articles of plastics, not elsewhere specified or included." Specific codes depend on the type of plastic and the product's intended use.

📌 HS CODE Breakdown and Tax Rates

1. 3917320050

- Description: Plastic gas pipe (specific type)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is specifically for plastic gas pipes and may require additional documentation or certification.

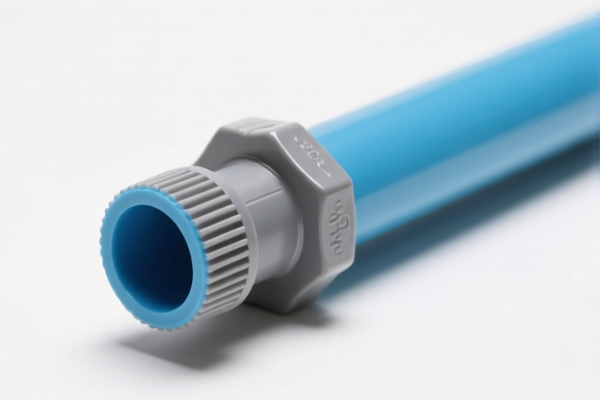

2. 3917390050

- Description: General plastic pipe (not specifically for gas)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for general-purpose plastic pipes, not specifically for gas. Ensure the product is not misclassified.

3. 3917210000

- Description: Plastic pipe (other types)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code may apply to other types of plastic pipes, but not specifically for gas.

4. 3917310000

- Description: Pneumatic plastic pipe

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for pneumatic (air) plastic pipes, not for gas. Be cautious of misclassification.

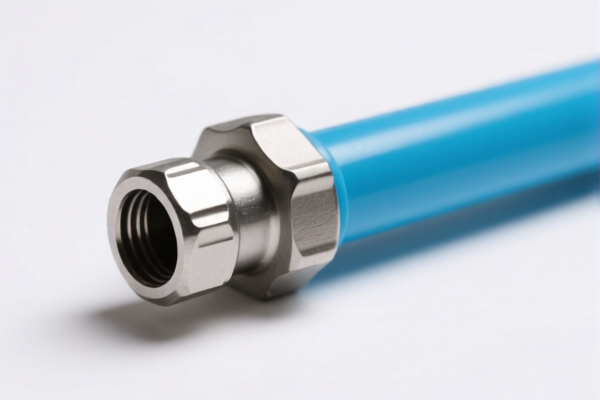

5. 7306305026

- Description: Metal gas pipe (e.g., steel)

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is a metal gas pipe, not plastic. If the product is plastic, this code is not applicable.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total tax burden.

-

Anti-dumping duties:

-

Not applicable for plastic products, but if the product is metal (e.g., code 7306305026), check for any anti-dumping duties on iron or aluminum.

-

Certifications and Documentation:

- Verify the material composition (e.g., PVC, PE, etc.) and intended use (gas, water, pneumatic) to ensure correct classification.

- Confirm if certifications (e.g., ISO, CE, or local safety standards) are required for customs clearance.

✅ Proactive Advice

- Verify the product's material and intended use to ensure the correct HS code is applied.

- Check the unit price to determine if the product falls under any preferential tariff rates.

- Review the April 11, 2025 policy and plan accordingly for increased tariffs.

- Consult a customs broker or classification expert if the product is complex or if you're unsure of the classification.

Let me know if you need help with a specific product description or documentation.

Product Classification: Plastic Gas Pipe

HS CODE: 3917320050, 3917390050, 3917210000, 3917310000, 7306305026

🔍 Classification Overview

Plastic gas pipes are typically classified under HS Chapter 3917, which covers "Plastics and articles thereof: Other articles of plastics, not elsewhere specified or included." Specific codes depend on the type of plastic and the product's intended use.

📌 HS CODE Breakdown and Tax Rates

1. 3917320050

- Description: Plastic gas pipe (specific type)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is specifically for plastic gas pipes and may require additional documentation or certification.

2. 3917390050

- Description: General plastic pipe (not specifically for gas)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for general-purpose plastic pipes, not specifically for gas. Ensure the product is not misclassified.

3. 3917210000

- Description: Plastic pipe (other types)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code may apply to other types of plastic pipes, but not specifically for gas.

4. 3917310000

- Description: Pneumatic plastic pipe

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for pneumatic (air) plastic pipes, not for gas. Be cautious of misclassification.

5. 7306305026

- Description: Metal gas pipe (e.g., steel)

- Total Tax Rate: 30.0%

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is a metal gas pipe, not plastic. If the product is plastic, this code is not applicable.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total tax burden.

-

Anti-dumping duties:

-

Not applicable for plastic products, but if the product is metal (e.g., code 7306305026), check for any anti-dumping duties on iron or aluminum.

-

Certifications and Documentation:

- Verify the material composition (e.g., PVC, PE, etc.) and intended use (gas, water, pneumatic) to ensure correct classification.

- Confirm if certifications (e.g., ISO, CE, or local safety standards) are required for customs clearance.

✅ Proactive Advice

- Verify the product's material and intended use to ensure the correct HS code is applied.

- Check the unit price to determine if the product falls under any preferential tariff rates.

- Review the April 11, 2025 policy and plan accordingly for increased tariffs.

- Consult a customs broker or classification expert if the product is complex or if you're unsure of the classification.

Let me know if you need help with a specific product description or documentation.

Customer Reviews

No reviews yet.