| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

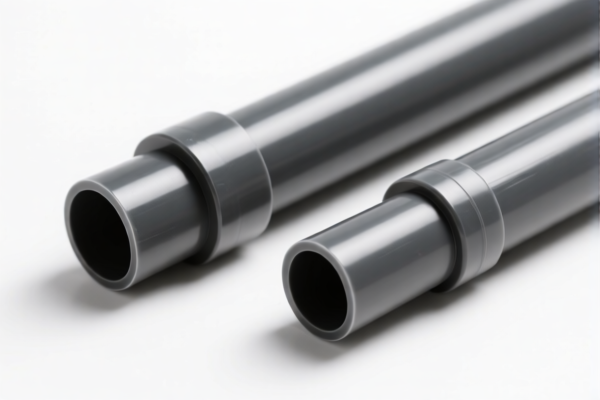

Here is the structured analysis of the HS codes and tariff rates for Plastic Industrial Tubes, based on the provided data:

📦 Product Classification Overview: Plastic Industrial Tubes

Below are the relevant HS codes and their associated tariff details:

🔢 HS Code: 3917320050

Description: Other plastic tubes and pipe fittings, not reinforced or combined with other materials, without fittings

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917220000

Description: Polypropylene plastic industrial tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917310000

Description: Industrial conveying plastic tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917400050

Description: Plastic tubes, fittings, and soft tubes and fittings, non-pressure grade (DWV), other

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3926909987

Description: Industrial plastic conduits

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower total tax rate due to lower base and additional tariffs.

🔢 HS Code: 3917400095

Description: Plastic tubes, fittings, and soft tubes and fittings: other fittings

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917210000

Description: Polyethylene plastic industrial tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: Applies to all listed HS codes. Ensure your import timeline is aligned with this date to avoid unexpected costs.

- Material Verification: Confirm the exact material (e.g., polyethylene, polypropylene) and whether the product is reinforced or combined with other materials, as this can affect classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for customs clearance.

- Unit Price: Verify the unit price and quantity for accurate duty calculation, as customs may use different valuation methods.

- Anti-Dumping Duties: While not mentioned in the data, be aware that anti-dumping duties may apply depending on the country of origin and product type.

✅ Proactive Action Steps:

- Confirm the exact product description and material composition to ensure correct HS code classification.

- Review import documentation and certifications required for compliance.

- Consider consulting a customs broker or legal expert for complex or high-value shipments.

Let me know if you need help with HS code selection or duty calculation for a specific product. Here is the structured analysis of the HS codes and tariff rates for Plastic Industrial Tubes, based on the provided data:

📦 Product Classification Overview: Plastic Industrial Tubes

Below are the relevant HS codes and their associated tariff details:

🔢 HS Code: 3917320050

Description: Other plastic tubes and pipe fittings, not reinforced or combined with other materials, without fittings

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917220000

Description: Polypropylene plastic industrial tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917310000

Description: Industrial conveying plastic tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917400050

Description: Plastic tubes, fittings, and soft tubes and fittings, non-pressure grade (DWV), other

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3926909987

Description: Industrial plastic conduits

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower total tax rate due to lower base and additional tariffs.

🔢 HS Code: 3917400095

Description: Plastic tubes, fittings, and soft tubes and fittings: other fittings

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

🔢 HS Code: 3917210000

Description: Polyethylene plastic industrial tubes

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: No anti-dumping duties mentioned for this category.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: Applies to all listed HS codes. Ensure your import timeline is aligned with this date to avoid unexpected costs.

- Material Verification: Confirm the exact material (e.g., polyethylene, polypropylene) and whether the product is reinforced or combined with other materials, as this can affect classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for customs clearance.

- Unit Price: Verify the unit price and quantity for accurate duty calculation, as customs may use different valuation methods.

- Anti-Dumping Duties: While not mentioned in the data, be aware that anti-dumping duties may apply depending on the country of origin and product type.

✅ Proactive Action Steps:

- Confirm the exact product description and material composition to ensure correct HS code classification.

- Review import documentation and certifications required for compliance.

- Consider consulting a customs broker or legal expert for complex or high-value shipments.

Let me know if you need help with HS code selection or duty calculation for a specific product.

Customer Reviews

No reviews yet.