| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922900000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3926902100 | Doc | 41.7% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3926305000 | Doc | 42.8% | CN | US | 2025-05-12 |

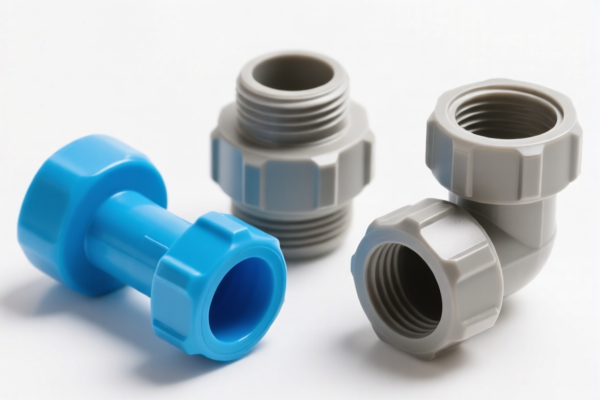

Product Classification: Plastic Laundry Room Fittings

Customs Compliance Analysis and Tax Overview

Below is the detailed breakdown of the HS codes and associated tariffs for plastic laundry room fittings, based on the provided data:

✅ HS CODE: 3922900000

Description: Plastic bathroom fittings, including plastic sanitary ware accessories.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Key Notes:

- This code is suitable for general plastic bathroom accessories, including laundry room fittings.

- Proactive Advice: Confirm the product is not classified under a more specific code (e.g., 3926902100 for specific types of plastic nozzles).

✅ HS CODE: 3926902100

Description: Plastic nozzles or flushing device parts.

- Base Tariff Rate: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.7%

- Key Notes:

- This code is more specific for parts of flushing devices.

- Proactive Advice: Ensure the product is a nozzle or flushing part and not a general fitting.

✅ HS CODE: 3917400095

Description: Plastic pipes, fittings, and other tubing.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for general plastic pipes and fittings.

- Proactive Advice: Confirm if the product is a pipe or fitting, not a decorative or bathroom-specific item.

✅ HS CODE: 3926903500

Description: Other plastic beads, tubular beads, and sequins, not strung or mounted.

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

- Key Notes:

- This code is for decorative or non-functional plastic items.

- Proactive Advice: Not suitable for functional laundry room fittings.

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicles, or similar uses.

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Key Notes:

- This code is for general-purpose parts, not specific to bathrooms or laundry rooms.

- Proactive Advice: Not ideal for specialized laundry room fittings.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed codes will have an additional 30.0% tariff applied after this date.

- Anti-dumping duties: Not applicable for plastic products (not iron or aluminum).

- Certifications: Ensure compliance with any required certifications (e.g., safety, material declarations).

- Material and Unit Price: Verify the exact material composition and unit price to avoid misclassification.

- Classification Accuracy: Double-check the product description and function to ensure the most accurate HS code is used.

If you provide more details about the specific product (e.g., type of fitting, material, function), I can help you further narrow down the most accurate HS code and tax rate.

Product Classification: Plastic Laundry Room Fittings

Customs Compliance Analysis and Tax Overview

Below is the detailed breakdown of the HS codes and associated tariffs for plastic laundry room fittings, based on the provided data:

✅ HS CODE: 3922900000

Description: Plastic bathroom fittings, including plastic sanitary ware accessories.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Key Notes:

- This code is suitable for general plastic bathroom accessories, including laundry room fittings.

- Proactive Advice: Confirm the product is not classified under a more specific code (e.g., 3926902100 for specific types of plastic nozzles).

✅ HS CODE: 3926902100

Description: Plastic nozzles or flushing device parts.

- Base Tariff Rate: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 41.7%

- Key Notes:

- This code is more specific for parts of flushing devices.

- Proactive Advice: Ensure the product is a nozzle or flushing part and not a general fitting.

✅ HS CODE: 3917400095

Description: Plastic pipes, fittings, and other tubing.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for general plastic pipes and fittings.

- Proactive Advice: Confirm if the product is a pipe or fitting, not a decorative or bathroom-specific item.

✅ HS CODE: 3926903500

Description: Other plastic beads, tubular beads, and sequins, not strung or mounted.

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

- Key Notes:

- This code is for decorative or non-functional plastic items.

- Proactive Advice: Not suitable for functional laundry room fittings.

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicles, or similar uses.

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Key Notes:

- This code is for general-purpose parts, not specific to bathrooms or laundry rooms.

- Proactive Advice: Not ideal for specialized laundry room fittings.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed codes will have an additional 30.0% tariff applied after this date.

- Anti-dumping duties: Not applicable for plastic products (not iron or aluminum).

- Certifications: Ensure compliance with any required certifications (e.g., safety, material declarations).

- Material and Unit Price: Verify the exact material composition and unit price to avoid misclassification.

- Classification Accuracy: Double-check the product description and function to ensure the most accurate HS code is used.

If you provide more details about the specific product (e.g., type of fitting, material, function), I can help you further narrow down the most accurate HS code and tax rate.

Customer Reviews

No reviews yet.