Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

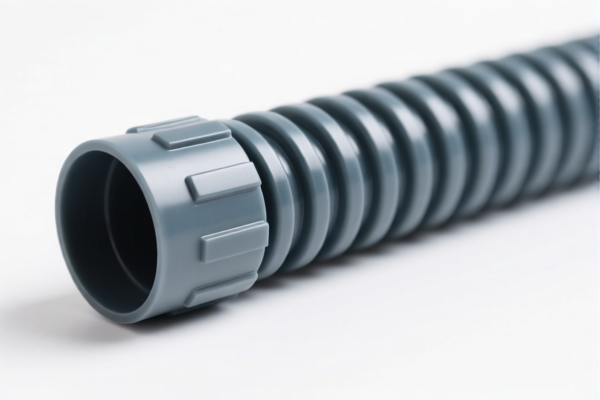

Here is the structured classification and tariff information for the Plastic PP Hose (Polypropylene Hose) based on the provided HS codes and tax details:

✅ Product Classification: Plastic PP Hose

🔍 HS CODE: 3917310000

- Description: Flexible plastic hoses, including plastic flexible tubes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to general flexible plastic hoses, including those made of polypropylene (PP).

- If the hose has a minimum burst pressure of 27.6 MPa, it still falls under this code.

🔍 HS CODE: 3917320050

- Description: Other plastic tubes, pipes, and fittings, not reinforced or combined with other materials, excluding those with fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for general plastic tubes and fittings, but not reinforced or combined with other materials.

- Ensure your product does not include fittings to qualify for this code.

🔍 HS CODE: 3917400050

- Description: Plastic pipe hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic pipe hoses, which may be more rigid or specialized than the flexible hoses in 3917310000.

- Higher base tariff rate compared to 3917310000.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the material composition (e.g., polypropylene, reinforced or not) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., safety, pressure ratings) are required for customs clearance, especially for high-pressure hoses.

- Unit Price: Be aware that tariff rates may vary based on the unit price and country of origin (e.g., China vs. other countries).

- Anti-dumping duties: Not applicable for plastic products, but always verify with the latest customs regulations.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code description.

- Consult a customs broker or HS code expert if the product has special features (e.g., high pressure, reinforced, with fittings).

- Keep records of product specifications, material, and origin for customs compliance.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for the Plastic PP Hose (Polypropylene Hose) based on the provided HS codes and tax details:

✅ Product Classification: Plastic PP Hose

🔍 HS CODE: 3917310000

- Description: Flexible plastic hoses, including plastic flexible tubes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to general flexible plastic hoses, including those made of polypropylene (PP).

- If the hose has a minimum burst pressure of 27.6 MPa, it still falls under this code.

🔍 HS CODE: 3917320050

- Description: Other plastic tubes, pipes, and fittings, not reinforced or combined with other materials, excluding those with fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for general plastic tubes and fittings, but not reinforced or combined with other materials.

- Ensure your product does not include fittings to qualify for this code.

🔍 HS CODE: 3917400050

- Description: Plastic pipe hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic pipe hoses, which may be more rigid or specialized than the flexible hoses in 3917310000.

- Higher base tariff rate compared to 3917310000.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the material composition (e.g., polypropylene, reinforced or not) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., safety, pressure ratings) are required for customs clearance, especially for high-pressure hoses.

- Unit Price: Be aware that tariff rates may vary based on the unit price and country of origin (e.g., China vs. other countries).

- Anti-dumping duties: Not applicable for plastic products, but always verify with the latest customs regulations.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code description.

- Consult a customs broker or HS code expert if the product has special features (e.g., high pressure, reinforced, with fittings).

- Keep records of product specifications, material, and origin for customs compliance.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.