Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3924902000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3926905000 | Doc | 41.3% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3924902000 | Doc | 33.4% | CN | US | 2025-05-12 |

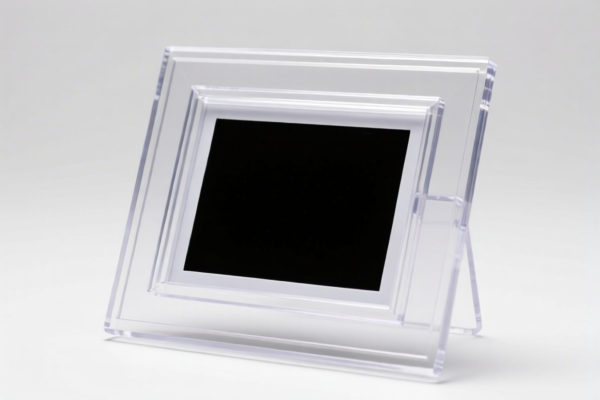

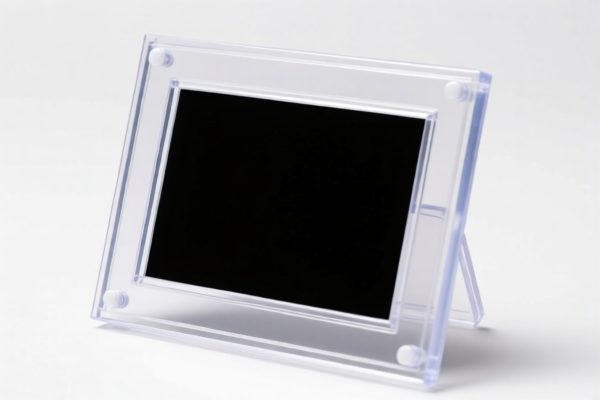

Product Name: Plastic Photo Display Frame

Classification HS Codes and Tax Information:

✅ HS CODE: 3926904800

- Description: Plastic photo display frames fall under Chapter 3926, which includes "Other plastic articles and articles of plastic from Chapters 3901 to 3914." This classification aligns with the description: "Other: Albums."

- Total Tax Rate: 33.4%

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for photo albums or similar items, but may not be the most accurate for a standalone photo display frame.

✅ HS CODE: 3924902000

- Description: Plastic photo display frames are classified under this code, which covers "Plastic tableware, kitchenware, other household or sanitary or toilet articles: Other: Picture frames."

- Total Tax Rate: 33.4%

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a strong candidate for a plastic photo display frame, especially if it is used as a picture frame.

✅ HS CODE: 3926905000

- Description: This code covers "Other plastic articles," including frames.

- Total Tax Rate: 41.3%

- Base Tariff: 3.8%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Higher tax rate due to additional tariffs. Consider if the product is more decorative or complex in design.

✅ HS CODE: 3926400090

- Description: This code includes "Other articles of plastic or of other materials," specifically "Statuettes and other decorative articles: Other." Plastic photo display frames may fall under this category if they are considered decorative.

- Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a less common classification for photo display frames but may apply if the product is considered decorative.

✅ HS CODE: 3924902000 (Duplicate Entry)

- Same as above. This code is repeated in the input and should be treated as a duplicate.

📌 Key Tax Rate Changes (April 11, 2025 Special Tariff):

- All codes listed above are subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and must be considered in cost planning and customs clearance.

🛠️ Proactive Advice for Users:

- Verify the product's material and design: Is it purely functional (e.g., a picture frame) or decorative? This will influence the correct HS code.

- Check unit price and product description: This helps in determining the most accurate classification.

- Confirm required certifications: Some products may require specific documentation or certifications for import.

- Consider the April 11, 2025 tariff impact: This will significantly increase the total cost, so it should be factored into pricing and compliance strategies.

If you have more details about the product (e.g., size, material, design, or intended use), I can help you further narrow down the most accurate HS code.

Product Name: Plastic Photo Display Frame

Classification HS Codes and Tax Information:

✅ HS CODE: 3926904800

- Description: Plastic photo display frames fall under Chapter 3926, which includes "Other plastic articles and articles of plastic from Chapters 3901 to 3914." This classification aligns with the description: "Other: Albums."

- Total Tax Rate: 33.4%

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for photo albums or similar items, but may not be the most accurate for a standalone photo display frame.

✅ HS CODE: 3924902000

- Description: Plastic photo display frames are classified under this code, which covers "Plastic tableware, kitchenware, other household or sanitary or toilet articles: Other: Picture frames."

- Total Tax Rate: 33.4%

- Base Tariff: 3.4%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a strong candidate for a plastic photo display frame, especially if it is used as a picture frame.

✅ HS CODE: 3926905000

- Description: This code covers "Other plastic articles," including frames.

- Total Tax Rate: 41.3%

- Base Tariff: 3.8%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Higher tax rate due to additional tariffs. Consider if the product is more decorative or complex in design.

✅ HS CODE: 3926400090

- Description: This code includes "Other articles of plastic or of other materials," specifically "Statuettes and other decorative articles: Other." Plastic photo display frames may fall under this category if they are considered decorative.

- Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a less common classification for photo display frames but may apply if the product is considered decorative.

✅ HS CODE: 3924902000 (Duplicate Entry)

- Same as above. This code is repeated in the input and should be treated as a duplicate.

📌 Key Tax Rate Changes (April 11, 2025 Special Tariff):

- All codes listed above are subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and must be considered in cost planning and customs clearance.

🛠️ Proactive Advice for Users:

- Verify the product's material and design: Is it purely functional (e.g., a picture frame) or decorative? This will influence the correct HS code.

- Check unit price and product description: This helps in determining the most accurate classification.

- Confirm required certifications: Some products may require specific documentation or certifications for import.

- Consider the April 11, 2025 tariff impact: This will significantly increase the total cost, so it should be factored into pricing and compliance strategies.

If you have more details about the product (e.g., size, material, design, or intended use), I can help you further narrow down the most accurate HS code.

Customer Reviews

No reviews yet.