| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

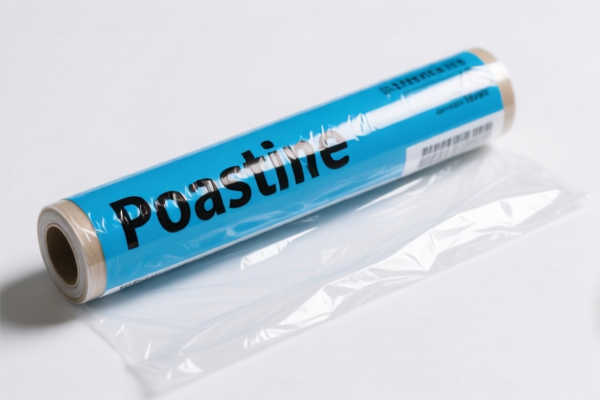

Here is the structured analysis and classification for the Plastic Protective Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921904090

Description: Plastic-made other sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is suitable for plastic films used as protective films, especially if they are not reinforced with paper or other materials. - Tariff increase alert: A significant 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3921904010

Description: Plastic-made other sheets, plates, films, foils, and strips, reinforced with paper

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code applies to paper-reinforced plastic films, which may be used in industrial or packaging applications. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920991000

Description: Plastic sheets, plates, films, usually flexible, thickness may exceed 0.152 mm, not wound

Total Tax Rate: 61.0%

Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for flexible plastic films that are not wound, possibly used in protective films or industrial applications. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3918905000

Description: Plastic wall coverings

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for plastic wall coverings, which may be used in construction or interior design. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3925900000

Description: Plastic building hardware products, not otherwise specified or included

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for miscellaneous plastic building hardware, which may not be directly applicable to a protective film. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

📌 Proactive Advice:

- Verify the material composition of the protective film (e.g., is it reinforced with paper? Is it flexible?).

- Check the unit price to determine if it falls under a different classification.

- Confirm the intended use (e.g., industrial, construction, packaging) to ensure correct HS code.

- Review required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured analysis and classification for the Plastic Protective Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921904090

Description: Plastic-made other sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is suitable for plastic films used as protective films, especially if they are not reinforced with paper or other materials. - Tariff increase alert: A significant 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3921904010

Description: Plastic-made other sheets, plates, films, foils, and strips, reinforced with paper

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code applies to paper-reinforced plastic films, which may be used in industrial or packaging applications. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920991000

Description: Plastic sheets, plates, films, usually flexible, thickness may exceed 0.152 mm, not wound

Total Tax Rate: 61.0%

Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for flexible plastic films that are not wound, possibly used in protective films or industrial applications. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3918905000

Description: Plastic wall coverings

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for plastic wall coverings, which may be used in construction or interior design. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3925900000

Description: Plastic building hardware products, not otherwise specified or included

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes: - This code is for miscellaneous plastic building hardware, which may not be directly applicable to a protective film. - Tariff increase alert: A 30% additional tariff will apply after April 11, 2025.

📌 Proactive Advice:

- Verify the material composition of the protective film (e.g., is it reinforced with paper? Is it flexible?).

- Check the unit price to determine if it falls under a different classification.

- Confirm the intended use (e.g., industrial, construction, packaging) to ensure correct HS code.

- Review required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.