| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

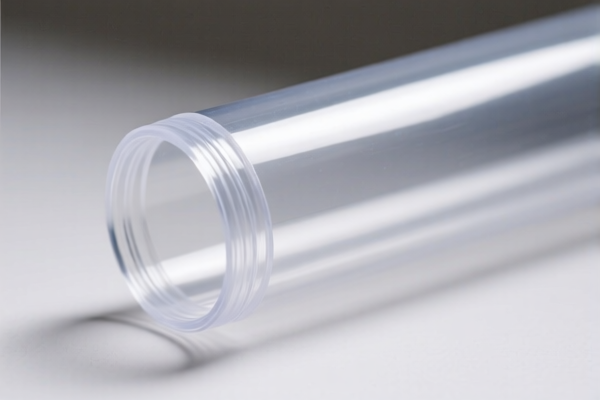

Here is the structured classification and tariff information for Plastic Round Tube based on the provided HS codes and tax details:

✅ HS CODE: 3903190000

Product Description: Polystyrene round tube, primary form of styrene polymer

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code applies to primary forms of polystyrene, not finished products.

✅ HS CODE: 3917390050

Product Description: Plastic pipe, part of non-pressure drainage, waste, and ventilation (DWV) piping systems

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for non-pressure systems, such as drainage and ventilation.

✅ HS CODE: 3917400050

Product Description: Plastic pipe, including pipes, fittings, and connectors

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code covers a broad range of plastic pipes and fittings, including general-purpose products.

✅ HS CODE: 3917320050

Product Description: Plastic pipe, meeting classification criteria

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for specific types of plastic pipes, often used in industrial or construction applications.

✅ HS CODE: 3917210000

Product Description: Plastic pipe, made from polyethylene (hard type)

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for hard polyethylene pipes, typically used in rigid applications.

📌 Proactive Advice for Users:

- Verify Material: Confirm the exact polymer type (e.g., polyethylene, polystyrene) and application (e.g., pressure vs. non-pressure) to ensure correct HS code.

- Check Unit Price: High tax rates may affect cost competitiveness; consider certifications or preferential trade agreements if applicable.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. If your shipment is scheduled after this date, adjust pricing or seek duty relief.

- Documentation: Ensure proper product descriptions, material specifications, and certifications (e.g., ISO, CE) are included in customs documentation.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Plastic Round Tube based on the provided HS codes and tax details:

✅ HS CODE: 3903190000

Product Description: Polystyrene round tube, primary form of styrene polymer

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code applies to primary forms of polystyrene, not finished products.

✅ HS CODE: 3917390050

Product Description: Plastic pipe, part of non-pressure drainage, waste, and ventilation (DWV) piping systems

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for non-pressure systems, such as drainage and ventilation.

✅ HS CODE: 3917400050

Product Description: Plastic pipe, including pipes, fittings, and connectors

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code covers a broad range of plastic pipes and fittings, including general-purpose products.

✅ HS CODE: 3917320050

Product Description: Plastic pipe, meeting classification criteria

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for specific types of plastic pipes, often used in industrial or construction applications.

✅ HS CODE: 3917210000

Product Description: Plastic pipe, made from polyethylene (hard type)

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for hard polyethylene pipes, typically used in rigid applications.

📌 Proactive Advice for Users:

- Verify Material: Confirm the exact polymer type (e.g., polyethylene, polystyrene) and application (e.g., pressure vs. non-pressure) to ensure correct HS code.

- Check Unit Price: High tax rates may affect cost competitiveness; consider certifications or preferential trade agreements if applicable.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. If your shipment is scheduled after this date, adjust pricing or seek duty relief.

- Documentation: Ensure proper product descriptions, material specifications, and certifications (e.g., ISO, CE) are included in customs documentation.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.