| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 9033009000 | Doc | 59.4% | CN | US | 2025-05-12 |

| 9209991000 | Doc | 43.2% | CN | US | 2025-05-12 |

| 3926305000 | Doc | 42.8% | CN | US | 2025-05-12 |

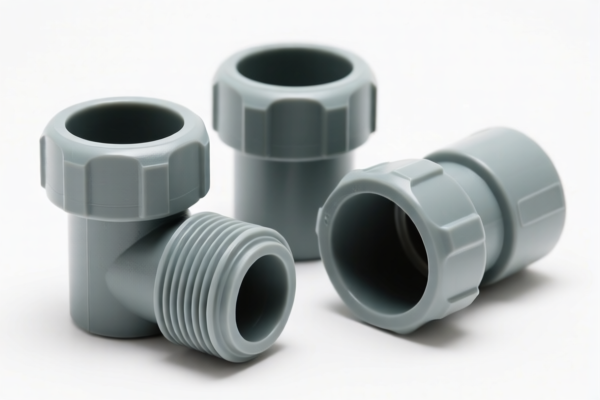

Here is the structured analysis and customs compliance guidance for the "Plastic Rural Fittings" product based on the provided HS codes and tax details:

✅ HS CODE: 3917400095

Product Description: Plastic pipes, fittings, and other similar items

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most likely HS code for plastic rural fittings.

- The special tariff after April 11, 2025, significantly increases the total tax burden.

- Proactive Advice: Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Also, check if any certifications (e.g., CE, RoHS) are required for import.

✅ HS CODE: 3926903500

Product Description: Other plastic products

Total Tax Rate: 44.0%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for general plastic products and may not be the most accurate for fittings.

- The special tariff after April 11, 2025, still applies and increases the total tax.

- Proactive Advice: If the product is clearly a fitting, use 3917400095 instead of this broader category.

✅ HS CODE: 9033009000

Product Description: Parts and accessories of machines, instruments, etc.

Total Tax Rate: 59.4%

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for machine parts, which is not relevant for plastic rural fittings.

- Proactive Advice: Avoid using this code unless the fittings are part of a machine or instrument.

✅ HS CODE: 9209991000

Product Description: Parts and accessories of musical instruments

Total Tax Rate: 43.2%

Breakdown:

- Base Tariff: 5.7%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for musical instrument parts, which is not applicable to plastic rural fittings.

- Proactive Advice: Ensure the product is not related to musical instruments before using this code.

✅ HS CODE: 3926305000

Product Description: Other fittings for furniture, vehicles, etc.

Total Tax Rate: 42.8%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for furniture or vehicle fittings, which may be a close match if the fittings are used in agricultural or rural equipment.

- Proactive Advice: Confirm the end-use of the fittings (e.g., for irrigation, farming, etc.) to determine the most accurate classification.

📌 Summary of Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase of 30.0% in the total tax rate.

- This is a time-sensitive policy, so import planning should be done before this date.

🛑 Critical Actions to Take:

- Verify the exact product description and material to ensure correct HS code.

- Check the end-use of the fittings (e.g., agricultural, irrigation, etc.).

- Confirm the unit price and certifications required for import (e.g., customs declarations, product standards).

- Plan import timelines to avoid the April 11, 2025 tax increase if possible.

Let me know if you need help with customs declaration forms or certification requirements. Here is the structured analysis and customs compliance guidance for the "Plastic Rural Fittings" product based on the provided HS codes and tax details:

✅ HS CODE: 3917400095

Product Description: Plastic pipes, fittings, and other similar items

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most likely HS code for plastic rural fittings.

- The special tariff after April 11, 2025, significantly increases the total tax burden.

- Proactive Advice: Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Also, check if any certifications (e.g., CE, RoHS) are required for import.

✅ HS CODE: 3926903500

Product Description: Other plastic products

Total Tax Rate: 44.0%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for general plastic products and may not be the most accurate for fittings.

- The special tariff after April 11, 2025, still applies and increases the total tax.

- Proactive Advice: If the product is clearly a fitting, use 3917400095 instead of this broader category.

✅ HS CODE: 9033009000

Product Description: Parts and accessories of machines, instruments, etc.

Total Tax Rate: 59.4%

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for machine parts, which is not relevant for plastic rural fittings.

- Proactive Advice: Avoid using this code unless the fittings are part of a machine or instrument.

✅ HS CODE: 9209991000

Product Description: Parts and accessories of musical instruments

Total Tax Rate: 43.2%

Breakdown:

- Base Tariff: 5.7%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for musical instrument parts, which is not applicable to plastic rural fittings.

- Proactive Advice: Ensure the product is not related to musical instruments before using this code.

✅ HS CODE: 3926305000

Product Description: Other fittings for furniture, vehicles, etc.

Total Tax Rate: 42.8%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for furniture or vehicle fittings, which may be a close match if the fittings are used in agricultural or rural equipment.

- Proactive Advice: Confirm the end-use of the fittings (e.g., for irrigation, farming, etc.) to determine the most accurate classification.

📌 Summary of Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase of 30.0% in the total tax rate.

- This is a time-sensitive policy, so import planning should be done before this date.

🛑 Critical Actions to Take:

- Verify the exact product description and material to ensure correct HS code.

- Check the end-use of the fittings (e.g., agricultural, irrigation, etc.).

- Confirm the unit price and certifications required for import (e.g., customs declarations, product standards).

- Plan import timelines to avoid the April 11, 2025 tax increase if possible.

Let me know if you need help with customs declaration forms or certification requirements.

Customer Reviews

No reviews yet.