| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102030 | Doc | 60.8% | CN | US | 2025-05-12 |

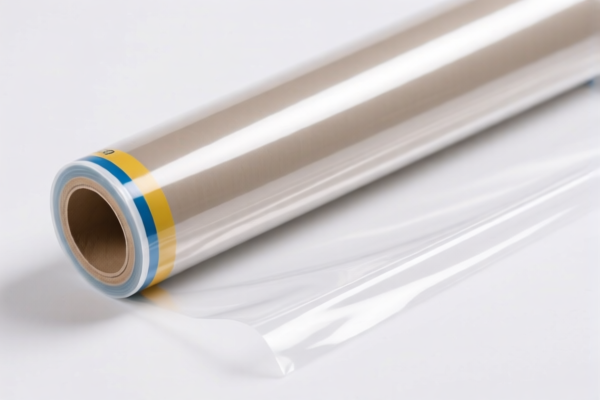

Product Classification: Plastic Self-Adhesive Protective Film (Width ≤ 20cm)

HS CODE:

- 3919102040 – Plastic self-adhesive tape (width ≤ 20cm)

- 3919102055 – Self-adhesive plastic sheeting (width ≤ 20cm)

- 3919102030 – Plastic self-adhesive tape (width ≤ 5cm)

🔍 Key Tax Rate Information

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Classification Notes

- 3919102040 and 3919102055 are both classified under Chapter 39, which covers plastics and articles thereof.

- 3919102030 is a more specific classification for narrower tapes (≤ 5cm).

- The width of the product is a critical factor in determining the correct HS code. Ensure the product description clearly specifies the width.

📦 Customs Compliance Tips

- Verify Material: Confirm the exact composition of the plastic (e.g., PVC, PE, etc.) to ensure correct classification.

- Unit Price: Check the unit price to determine if the product falls under any preferential tariff schemes (e.g., RCEP, China-Australia FTA).

- Certifications: Some products may require import licenses or technical documentation (e.g., safety, environmental compliance).

- Documentation: Ensure all product specifications, including width, material, and intended use, are clearly stated in the commercial invoice and packing list.

📅 Time-Sensitive Policy Reminder

- April 11, 2025: A 30.0% additional tariff will be applied to this product category.

- If your shipment is scheduled after this date, consider adjusting the product classification or seeking alternative import routes to reduce costs.

✅ Proactive Advice

- Double-check the product width to ensure the correct HS code is used.

- Consult a customs broker or import compliance expert if the product is part of a larger kit or bundled with other items.

- Keep records of product specifications and supplier documentation for audit purposes.

Let me know if you need help with tariff calculation, certification requirements, or customs documentation for this product.

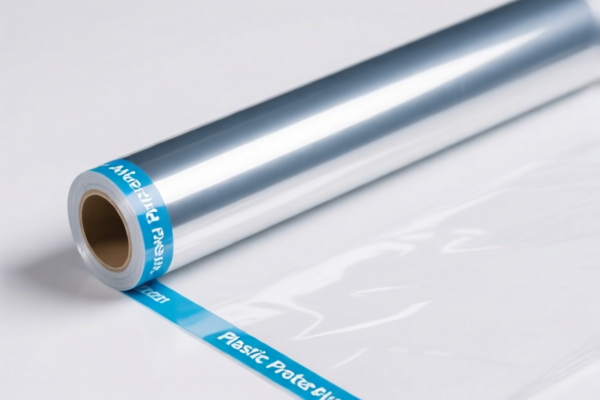

Product Classification: Plastic Self-Adhesive Protective Film (Width ≤ 20cm)

HS CODE:

- 3919102040 – Plastic self-adhesive tape (width ≤ 20cm)

- 3919102055 – Self-adhesive plastic sheeting (width ≤ 20cm)

- 3919102030 – Plastic self-adhesive tape (width ≤ 5cm)

🔍 Key Tax Rate Information

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Classification Notes

- 3919102040 and 3919102055 are both classified under Chapter 39, which covers plastics and articles thereof.

- 3919102030 is a more specific classification for narrower tapes (≤ 5cm).

- The width of the product is a critical factor in determining the correct HS code. Ensure the product description clearly specifies the width.

📦 Customs Compliance Tips

- Verify Material: Confirm the exact composition of the plastic (e.g., PVC, PE, etc.) to ensure correct classification.

- Unit Price: Check the unit price to determine if the product falls under any preferential tariff schemes (e.g., RCEP, China-Australia FTA).

- Certifications: Some products may require import licenses or technical documentation (e.g., safety, environmental compliance).

- Documentation: Ensure all product specifications, including width, material, and intended use, are clearly stated in the commercial invoice and packing list.

📅 Time-Sensitive Policy Reminder

- April 11, 2025: A 30.0% additional tariff will be applied to this product category.

- If your shipment is scheduled after this date, consider adjusting the product classification or seeking alternative import routes to reduce costs.

✅ Proactive Advice

- Double-check the product width to ensure the correct HS code is used.

- Consult a customs broker or import compliance expert if the product is part of a larger kit or bundled with other items.

- Keep records of product specifications and supplier documentation for audit purposes.

Let me know if you need help with tariff calculation, certification requirements, or customs documentation for this product.

Customer Reviews

No reviews yet.