| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

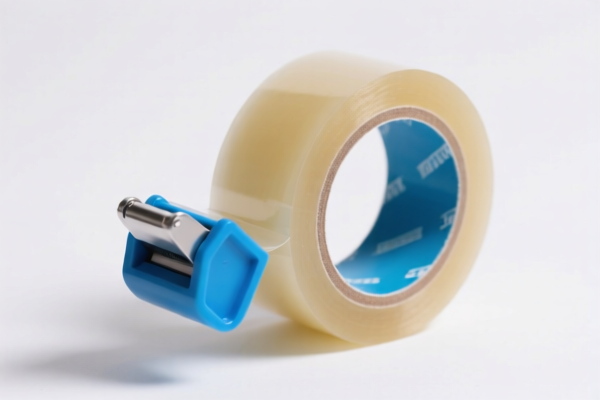

Product Classification: Plastic Self Adhesive Tape Roll with Dispenser

HS CODE: 3919.10.20.55 (and other related codes as listed)

🔍 Classification Summary:

- Product Type: Plastic self-adhesive tape rolls (with or without dispenser).

- Applicable HS Codes:

- 3919.10.20.55

- 3919.10.20.40

- 3919.90.50.60

- 3919.10.20.30

- (Note: Some codes may overlap in description, so material composition and product specifics are critical for accurate classification.)

📊 Tariff Overview (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not applicable for this product category (plastic self-adhesive tape rolls), unless the product is made of iron or aluminum (which is not the case here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is made of plastic and not metal (to avoid anti-dumping duties).

- Check Unit Price and Packaging: Confirm whether the dispenser is included in the product or sold separately, as this may affect classification.

- Certifications Required: Some countries may require product safety certifications (e.g., RoHS, REACH) for adhesive products.

- Consult Customs Authority: If in doubt, seek a pre-classification ruling from the local customs office to avoid delays or penalties.

📚 Example:

If you are importing plastic self-adhesive tape rolls with a dispenser, and the product is not made of metal, the applicable HS code would likely be 3919.10.20.55 with a total tax rate of 60.8%, including the 30.0% special tariff after April 11, 2025.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Plastic Self Adhesive Tape Roll with Dispenser

HS CODE: 3919.10.20.55 (and other related codes as listed)

🔍 Classification Summary:

- Product Type: Plastic self-adhesive tape rolls (with or without dispenser).

- Applicable HS Codes:

- 3919.10.20.55

- 3919.10.20.40

- 3919.90.50.60

- 3919.10.20.30

- (Note: Some codes may overlap in description, so material composition and product specifics are critical for accurate classification.)

📊 Tariff Overview (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not applicable for this product category (plastic self-adhesive tape rolls), unless the product is made of iron or aluminum (which is not the case here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is made of plastic and not metal (to avoid anti-dumping duties).

- Check Unit Price and Packaging: Confirm whether the dispenser is included in the product or sold separately, as this may affect classification.

- Certifications Required: Some countries may require product safety certifications (e.g., RoHS, REACH) for adhesive products.

- Consult Customs Authority: If in doubt, seek a pre-classification ruling from the local customs office to avoid delays or penalties.

📚 Example:

If you are importing plastic self-adhesive tape rolls with a dispenser, and the product is not made of metal, the applicable HS code would likely be 3919.10.20.55 with a total tax rate of 60.8%, including the 30.0% special tariff after April 11, 2025.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.