| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

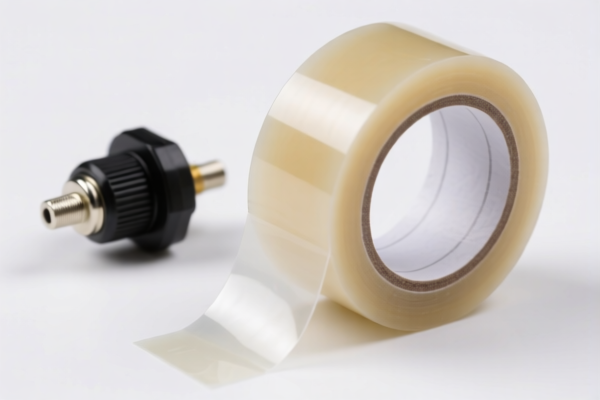

Product Name: Plastic Self Adhesive Tape for Automotive Sensors

Classification: Other Self-Adhesive Plastic Products (HS Code: 3919.90.50.60, 3919.90.50.40, 3919.90.50.30, 3919.10.20.55)

🔍 HS Code Classification Overview

- HS Code: 3919.90.50.60, 3919.90.50.40, 3919.90.50.30, 3919.10.20.55

- All of these codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3919 (Other self-adhesive plastic sheets, films, etc.).

- These are classified as "Other self-adhesive plastic products", which includes adhesive tapes used in automotive applications such as sensors.

📊 Tariff Breakdown (Total Tax: 60.8%)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: The 30.0% additional tariff applies after April 11, 2025, and is likely part of a trade policy or anti-dumping measure.

⚠️ Important Policy Notes

- April 11 Special Tariff:

-

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may affect your import costs significantly if the product is imported after this date.

-

Anti-Dumping Duties:

- While not explicitly stated, products under Chapter 39 may be subject to anti-dumping duties if they are imported from countries under such measures. You should verify if your product is on any anti-dumping duty list.

📌 Proactive Advice for Importers

- Verify Material and Unit Price:

-

Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification and avoid misclassification penalties.

-

Check Required Certifications:

-

Ensure compliance with automotive industry standards (e.g., ISO, AEC-Q200) and any customs documentation (e.g., commercial invoice, packing list, certificate of origin).

-

Monitor Tariff Changes:

-

Keep track of tariff updates, especially the April 11, 2025 deadline, to adjust your import strategy accordingly.

-

Consult a Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure smooth clearance and avoid delays.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3919.90.50.60 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.40 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.30 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.10.20.55 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

If you need further assistance with customs documentation, tariff calculation, or classification confirmation, feel free to ask.

Product Name: Plastic Self Adhesive Tape for Automotive Sensors

Classification: Other Self-Adhesive Plastic Products (HS Code: 3919.90.50.60, 3919.90.50.40, 3919.90.50.30, 3919.10.20.55)

🔍 HS Code Classification Overview

- HS Code: 3919.90.50.60, 3919.90.50.40, 3919.90.50.30, 3919.10.20.55

- All of these codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3919 (Other self-adhesive plastic sheets, films, etc.).

- These are classified as "Other self-adhesive plastic products", which includes adhesive tapes used in automotive applications such as sensors.

📊 Tariff Breakdown (Total Tax: 60.8%)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: The 30.0% additional tariff applies after April 11, 2025, and is likely part of a trade policy or anti-dumping measure.

⚠️ Important Policy Notes

- April 11 Special Tariff:

-

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may affect your import costs significantly if the product is imported after this date.

-

Anti-Dumping Duties:

- While not explicitly stated, products under Chapter 39 may be subject to anti-dumping duties if they are imported from countries under such measures. You should verify if your product is on any anti-dumping duty list.

📌 Proactive Advice for Importers

- Verify Material and Unit Price:

-

Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification and avoid misclassification penalties.

-

Check Required Certifications:

-

Ensure compliance with automotive industry standards (e.g., ISO, AEC-Q200) and any customs documentation (e.g., commercial invoice, packing list, certificate of origin).

-

Monitor Tariff Changes:

-

Keep track of tariff updates, especially the April 11, 2025 deadline, to adjust your import strategy accordingly.

-

Consult a Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure smooth clearance and avoid delays.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3919.90.50.60 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.40 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.30 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.10.20.55 | Other self-adhesive plastic products | 5.8% | 25.0% | 30.0% | 60.8% |

If you need further assistance with customs documentation, tariff calculation, or classification confirmation, feel free to ask.

Customer Reviews

No reviews yet.