| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3922900000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

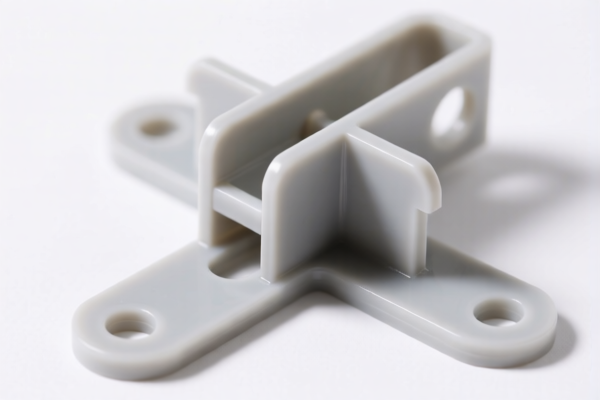

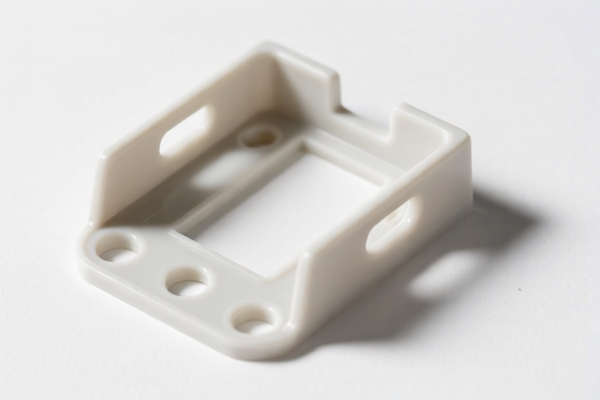

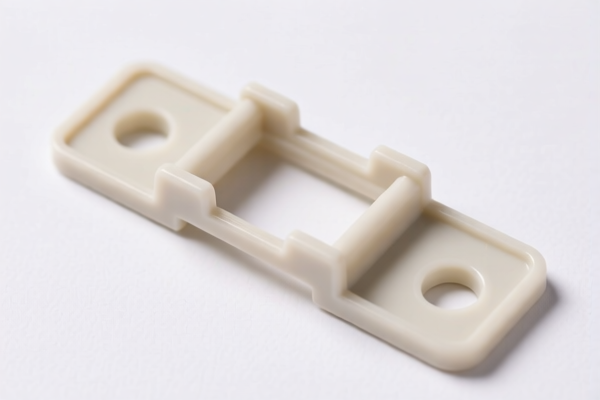

Product Name: Plastic Shower Bracket

Classification Analysis and Customs Tariff Overview:

- HS CODE: 3922100000

- Description: Plastic bathtub brackets, plastic bathtubs (with brackets), and other related plastic bathtub accessories.

- Total Tax Rate: 43.8%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable if the product is specifically for bathtubs or related accessories.

-

HS CODE: 3922900000

- Description: Plastic showerheads, plastic shower trays, plastic shower tanks, and other plastic bathroom equipment.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to general plastic bathroom equipment, not specifically for bathtubs.

-

HS CODE: 3924905650

- Description: Plastic bathroom washstands, and other plastic-made household items.

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general household plastic items, including washstands.

-

HS CODE: 9405920000

- Description: Plastic brackets, parts of lighting fixtures and lighting devices.

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for parts of lighting devices, not for general bathroom use.

-

HS CODE: 3926909989

- Description: Plastic brackets and other plastic products.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for other plastic products not covered by more specific codes.

Key Notes and Recommendations:

-

Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025, for all the above HS codes. This is a critical date to be aware of for cost planning and compliance.

-

Material and Certification Check: Confirm the material composition of the product (e.g., whether it's made of polyethylene, PVC, etc.) and whether any certifications (e.g., CE, RoHS) are required for import.

-

Unit Price and Classification: Ensure the product description and unit price align with the selected HS code. Misclassification can lead to delays and penalties.

-

Anti-Dumping Duty: If the product is made of iron or aluminum, check if anti-dumping duties apply. However, for plastic products, this is generally not applicable.

-

Proactive Action: If the product is used in a bathroom setting, consider HS CODE 3922100000 or 3922900000 for more accurate classification. Otherwise, 3926909989 is a general fallback. Product Name: Plastic Shower Bracket

Classification Analysis and Customs Tariff Overview: -

HS CODE: 3922100000

- Description: Plastic bathtub brackets, plastic bathtubs (with brackets), and other related plastic bathtub accessories.

- Total Tax Rate: 43.8%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable if the product is specifically for bathtubs or related accessories.

-

HS CODE: 3922900000

- Description: Plastic showerheads, plastic shower trays, plastic shower tanks, and other plastic bathroom equipment.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to general plastic bathroom equipment, not specifically for bathtubs.

-

HS CODE: 3924905650

- Description: Plastic bathroom washstands, and other plastic-made household items.

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general household plastic items, including washstands.

-

HS CODE: 9405920000

- Description: Plastic brackets, parts of lighting fixtures and lighting devices.

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for parts of lighting devices, not for general bathroom use.

-

HS CODE: 3926909989

- Description: Plastic brackets and other plastic products.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for other plastic products not covered by more specific codes.

Key Notes and Recommendations:

-

Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025, for all the above HS codes. This is a critical date to be aware of for cost planning and compliance.

-

Material and Certification Check: Confirm the material composition of the product (e.g., whether it's made of polyethylene, PVC, etc.) and whether any certifications (e.g., CE, RoHS) are required for import.

-

Unit Price and Classification: Ensure the product description and unit price align with the selected HS code. Misclassification can lead to delays and penalties.

-

Anti-Dumping Duty: If the product is made of iron or aluminum, check if anti-dumping duties apply. However, for plastic products, this is generally not applicable.

-

Proactive Action: If the product is used in a bathroom setting, consider HS CODE 3922100000 or 3922900000 for more accurate classification. Otherwise, 3926909989 is a general fallback.

Customer Reviews

No reviews yet.