Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925305000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925301000 | Doc | 40.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

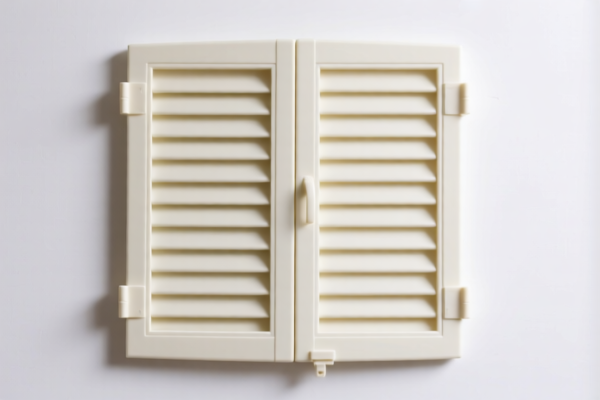

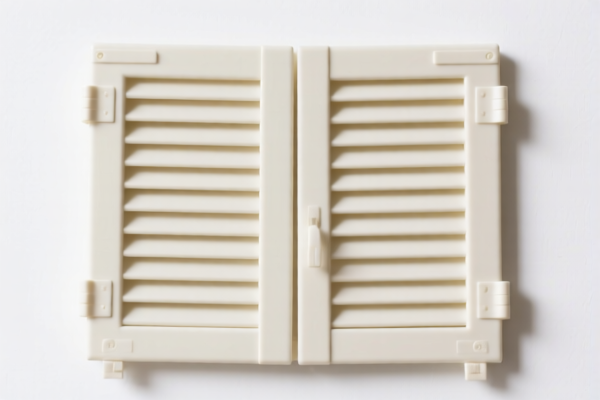

- Product Classification: Plastic Shutters

- HS CODEs:

- 3925301000

- 3925200091

- 3925200020

- 3925305000 (for both "Plastic Shutters" and "Plastic Shutter Blades")

🔍 Tariff Overview:

- Base Tariff Rate: Varies between 3.3% and 5.3%, depending on the specific HS code.

- Additional Tariff: 7.5% applied universally across all listed HS codes.

- Special Tariff after April 11, 2025: 30.0% added on top of the base and additional tariffs.

- Total Tax Rate: Ranges from 40.8% to 42.8%, depending on the base rate.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before this date to avoid the 30% additional charge.

- Material and Unit Price: Verify the exact material composition and unit price of the product, as this may affect classification and tax calculation.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

📌 Proactive Advice:

- Confirm HS Code: Ensure the correct HS code is used based on the product's specific design and material (e.g., whether it's a complete shutter or just blades).

- Review Documentation: Prepare all necessary documentation, including product specifications, invoices, and any required compliance certificates.

- Consult Customs Broker: For complex cases, consider consulting a customs broker or compliance expert to avoid misclassification and unnecessary delays.

Let me know if you need help determining the most appropriate HS code for your specific product.

- Product Classification: Plastic Shutters

- HS CODEs:

- 3925301000

- 3925200091

- 3925200020

- 3925305000 (for both "Plastic Shutters" and "Plastic Shutter Blades")

🔍 Tariff Overview:

- Base Tariff Rate: Varies between 3.3% and 5.3%, depending on the specific HS code.

- Additional Tariff: 7.5% applied universally across all listed HS codes.

- Special Tariff after April 11, 2025: 30.0% added on top of the base and additional tariffs.

- Total Tax Rate: Ranges from 40.8% to 42.8%, depending on the base rate.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before this date to avoid the 30% additional charge.

- Material and Unit Price: Verify the exact material composition and unit price of the product, as this may affect classification and tax calculation.

- Certifications: Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

📌 Proactive Advice:

- Confirm HS Code: Ensure the correct HS code is used based on the product's specific design and material (e.g., whether it's a complete shutter or just blades).

- Review Documentation: Prepare all necessary documentation, including product specifications, invoices, and any required compliance certificates.

- Consult Customs Broker: For complex cases, consider consulting a customs broker or compliance expert to avoid misclassification and unnecessary delays.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.