Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924103000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3924102000 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3924103000 | Doc | 42.8% | CN | US | 2025-05-12 |

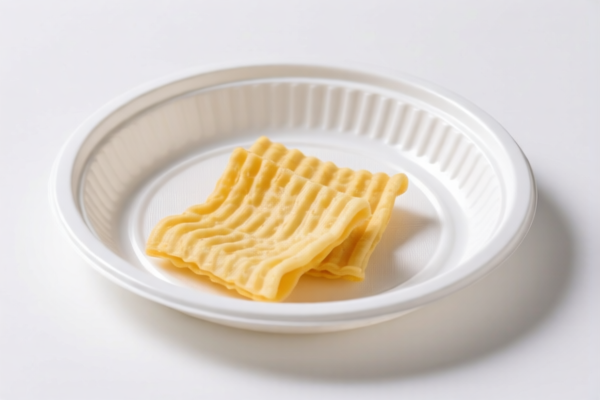

Product Name: Plastic Snack Plate

Classification: Plastic Tableware

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for "Plastic Snack Plate" based on your input:

🔢 1. HS CODE: 3924103000

- Description: Plastic tableware and kitchen utensils, including trays. Plastic snack plates fall under this category.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most accurate and commonly used classification for plastic snack plates.

🔢 2. HS CODE: 3924102000

- Description: Matches the 8–10 digit explanation of the HS code, and this code exists.

- Total Tax Rate: 44.0%

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base tariff than 3924103000. Ensure the product description aligns with this code.

🔢 3. HS CODE: 3926909989

- Description: Other articles of plastics and articles of other materials of headings 3901 to 3914. This is a broader category that may include plastic snack plates.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all category. Use only if the product does not clearly fit under 3924.

🔢 4. HS CODE: 3921904090

- Description: Covers other plastic sheets, plates, films, foils, and strips. Plastic snack plates may be classified here if they are considered as sheets or plates.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but this classification is less common for snack plates. Verify if the product is considered a "sheet" or "plate" in this context.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not applicable for plastic products unless specifically mentioned (not indicated here).

- Material and Certification: Verify the material composition (e.g., polypropylene, polystyrene) and unit price to ensure correct classification. Some certifications (e.g., food-grade, FDA compliance) may be required for export.

- Classification Accuracy: Ensure the product is not misclassified under a broader or incorrect HS code (e.g., 3926909989) which may lead to higher tariffs or customs delays.

✅ Recommended Action

- Confirm the most accurate HS code (preferably 3924103000) based on product description and material.

- Check the April 11, 2025 tariff in your export plan.

- Verify certifications and material specifications to avoid customs issues.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Plastic Snack Plate

Classification: Plastic Tableware

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for "Plastic Snack Plate" based on your input:

🔢 1. HS CODE: 3924103000

- Description: Plastic tableware and kitchen utensils, including trays. Plastic snack plates fall under this category.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most accurate and commonly used classification for plastic snack plates.

🔢 2. HS CODE: 3924102000

- Description: Matches the 8–10 digit explanation of the HS code, and this code exists.

- Total Tax Rate: 44.0%

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base tariff than 3924103000. Ensure the product description aligns with this code.

🔢 3. HS CODE: 3926909989

- Description: Other articles of plastics and articles of other materials of headings 3901 to 3914. This is a broader category that may include plastic snack plates.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all category. Use only if the product does not clearly fit under 3924.

🔢 4. HS CODE: 3921904090

- Description: Covers other plastic sheets, plates, films, foils, and strips. Plastic snack plates may be classified here if they are considered as sheets or plates.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but this classification is less common for snack plates. Verify if the product is considered a "sheet" or "plate" in this context.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not applicable for plastic products unless specifically mentioned (not indicated here).

- Material and Certification: Verify the material composition (e.g., polypropylene, polystyrene) and unit price to ensure correct classification. Some certifications (e.g., food-grade, FDA compliance) may be required for export.

- Classification Accuracy: Ensure the product is not misclassified under a broader or incorrect HS code (e.g., 3926909989) which may lead to higher tariffs or customs delays.

✅ Recommended Action

- Confirm the most accurate HS code (preferably 3924103000) based on product description and material.

- Check the April 11, 2025 tariff in your export plan.

- Verify certifications and material specifications to avoid customs issues.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.