Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924103000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3924104000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3924103000 | Doc | 42.8% | CN | US | 2025-05-12 |

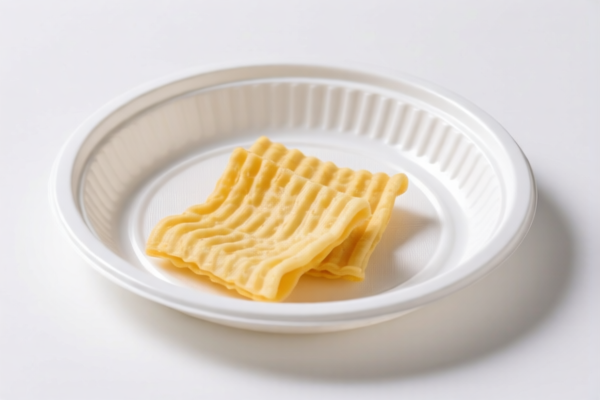

Product Name: Plastic Snack Plates

Classification: Plastic Tableware (Plastic Snack Plates)

HS CODE: 3924103000

🔍 HS Code and Classification Details:

- HS CODE: 3924103000

- Description: Plastic tableware, kitchen utensils, other household goods, and sanitary or toilet articles (including plastic trays)

- Total Tax Rate: 42.8%

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a significant increase and will greatly affect the total cost of importation.

📌 Proactive Advice for Importers:

- Verify Material: Ensure the product is 100% plastic and not mixed with other materials (e.g., metal or wood), as this could affect classification.

- Check Unit Price: The total tax rate is 42.8%, so the unit price will be significantly impacted. Consider this in your pricing strategy.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are needed for import.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the additional tariff will increase the cost by 30.0% after that date.

📌 Alternative HS Codes (for Reference):

- 3921904090: Flexible plastic sheets, films, etc. (not suitable for tableware)

- 3923900080: Plastic products for transport or packaging (not suitable for tableware)

- 3924104000: Plastic tableware, kitchen utensils (other category) – lower tax rate (33.4%) if applicable

Note: If your product is clearly a tableware item (e.g., plates, bowls), 3924103000 is the correct and most accurate classification.

✅ Summary:

- HS CODE: 3924103000

- Total Tax Rate: 42.8% (5.3% base + 7.5% additional)

- After April 11, 2025: 30.0% additional tariff (total 62.8%)

- Action Required: Confirm product composition, check for certifications, and plan for increased costs after April 11, 2025.

Product Name: Plastic Snack Plates

Classification: Plastic Tableware (Plastic Snack Plates)

HS CODE: 3924103000

🔍 HS Code and Classification Details:

- HS CODE: 3924103000

- Description: Plastic tableware, kitchen utensils, other household goods, and sanitary or toilet articles (including plastic trays)

- Total Tax Rate: 42.8%

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a significant increase and will greatly affect the total cost of importation.

📌 Proactive Advice for Importers:

- Verify Material: Ensure the product is 100% plastic and not mixed with other materials (e.g., metal or wood), as this could affect classification.

- Check Unit Price: The total tax rate is 42.8%, so the unit price will be significantly impacted. Consider this in your pricing strategy.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are needed for import.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the additional tariff will increase the cost by 30.0% after that date.

📌 Alternative HS Codes (for Reference):

- 3921904090: Flexible plastic sheets, films, etc. (not suitable for tableware)

- 3923900080: Plastic products for transport or packaging (not suitable for tableware)

- 3924104000: Plastic tableware, kitchen utensils (other category) – lower tax rate (33.4%) if applicable

Note: If your product is clearly a tableware item (e.g., plates, bowls), 3924103000 is the correct and most accurate classification.

✅ Summary:

- HS CODE: 3924103000

- Total Tax Rate: 42.8% (5.3% base + 7.5% additional)

- After April 11, 2025: 30.0% additional tariff (total 62.8%)

- Action Required: Confirm product composition, check for certifications, and plan for increased costs after April 11, 2025.

Customer Reviews

No reviews yet.