Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923300010 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

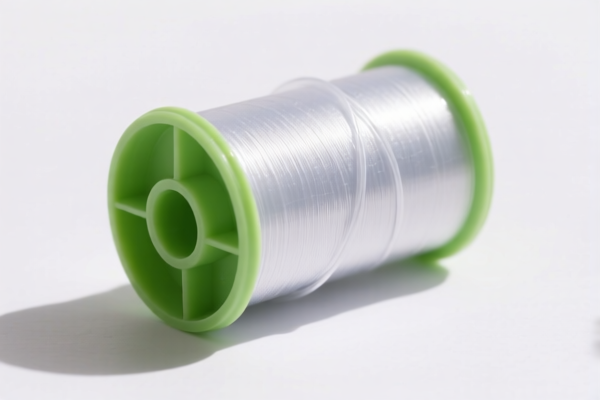

Product Name: Plastic Spools (Colored)

Classification Analysis:

Based on the provided HS codes and descriptions, the product "Plastic Spools (Colored)" may fall under the following classifications:

🔍 1. HS Code: 3923300010 - Plastic Bottles

- Description: This code is for plastic bottles, which are typically used for packaging liquids.

- Applicability: If the plastic spools are similar in structure to bottles (e.g., cylindrical, with a neck or opening), this classification may be applicable.

- Tariff Details:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

🔍 2. HS Code: 3926400090 - Plastic Decorations

- Description: This code is for decorative plastic items, such as figurines, ornaments, or other non-functional plastic items.

- Applicability: If the plastic spools are primarily used for decorative purposes (e.g., as part of a gift set or for display), this classification may be more appropriate.

- Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 35.3%

📌 Key Considerations for Classification:

- Material: Confirm whether the spools are made of polyethylene, polypropylene, or another type of plastic, as this can affect classification.

- Function: Determine if the spools are for functional use (e.g., for winding thread, cable, etc.) or decorative use.

- Color: Colored plastic may be relevant for customs inspection, especially if the color is a key feature of the product.

- Unit Price: If the product is imported at a high value, it may be subject to anti-dumping duties or additional tariffs based on the importing country's regulations.

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to both classifications after this date. This is a critical date for importers to consider when planning shipments.

🛠️ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and value of the product to ensure correct classification.

- Check Required Certifications: Some plastic products may require compliance certificates (e.g., REACH, RoHS) depending on the destination country.

- Consult a Customs Broker: For complex classifications, it is advisable to seek professional customs advice to avoid delays or penalties.

If you can provide more details about the function, material, and intended use of the plastic spools, I can help narrow down the most accurate HS code.

Product Name: Plastic Spools (Colored)

Classification Analysis:

Based on the provided HS codes and descriptions, the product "Plastic Spools (Colored)" may fall under the following classifications:

🔍 1. HS Code: 3923300010 - Plastic Bottles

- Description: This code is for plastic bottles, which are typically used for packaging liquids.

- Applicability: If the plastic spools are similar in structure to bottles (e.g., cylindrical, with a neck or opening), this classification may be applicable.

- Tariff Details:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

🔍 2. HS Code: 3926400090 - Plastic Decorations

- Description: This code is for decorative plastic items, such as figurines, ornaments, or other non-functional plastic items.

- Applicability: If the plastic spools are primarily used for decorative purposes (e.g., as part of a gift set or for display), this classification may be more appropriate.

- Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 35.3%

📌 Key Considerations for Classification:

- Material: Confirm whether the spools are made of polyethylene, polypropylene, or another type of plastic, as this can affect classification.

- Function: Determine if the spools are for functional use (e.g., for winding thread, cable, etc.) or decorative use.

- Color: Colored plastic may be relevant for customs inspection, especially if the color is a key feature of the product.

- Unit Price: If the product is imported at a high value, it may be subject to anti-dumping duties or additional tariffs based on the importing country's regulations.

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to both classifications after this date. This is a critical date for importers to consider when planning shipments.

🛠️ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and value of the product to ensure correct classification.

- Check Required Certifications: Some plastic products may require compliance certificates (e.g., REACH, RoHS) depending on the destination country.

- Consult a Customs Broker: For complex classifications, it is advisable to seek professional customs advice to avoid delays or penalties.

If you can provide more details about the function, material, and intended use of the plastic spools, I can help narrow down the most accurate HS code.

Customer Reviews

No reviews yet.