| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

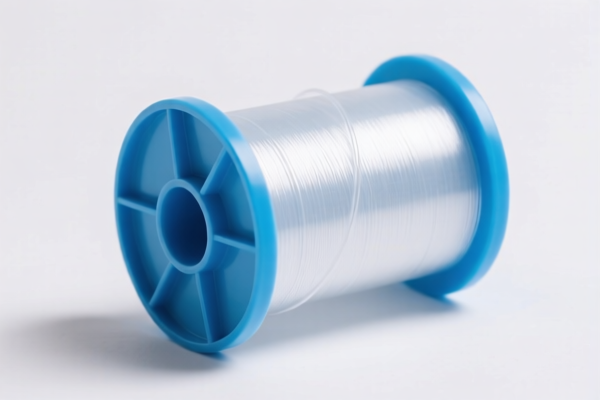

Product Name: Plastic Spools (High Strength)

Classification: Based on the provided HS codes, the product may fall under one of the following classifications:

✅ HS CODE: 3923900012

Description: Plastic-made transport or packaging items; plastic bottle stoppers, caps, and similar closures: Other plastic drums and pails, with or without covers or similar closures, with a capacity of less than 11.36 liters (3 gallons)

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes:

- This code is for plastic drums and pails used for transport or packaging.

- If your plastic spools are used for packaging or transport and are similar in function to drums or pails, this may be the correct classification.

- Important: Confirm the capacity of the spools. If they are less than 11.36 liters, this code applies.

✅ HS CODE: 3926909989

Description: Other articles of plastic or of other materials, classified as "Other", for items not specifically listed in more detailed subcategories

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This is a catch-all code for plastic items not specifically listed elsewhere.

- If your plastic spools are not clearly classified under 3923900012 (e.g., they are not used for packaging or transport), this may be the correct code.

- Important: This code is more general and may result in higher or lower tariffs depending on the specific product description.

📌 Proactive Advice for Users:

- Verify the product's intended use: Is it for packaging, transport, or another purpose? This will help determine the correct HS code.

- Check the capacity: If the spools are used for holding liquids or materials and are less than 11.36 liters, 3923900012 may apply.

- Confirm material and unit price: This can affect the classification and may be required for customs documentation.

- Check for certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Be aware of the April 11, 2025, tariff change: If your product is subject to the 30% additional tariff, this will significantly increase the total cost.

📅 Time-Sensitive Policy Alert:

- Additional tariffs imposed after April 11, 2025: 30.0% applies to both HS codes listed above.

- Anti-dumping duties: Not specified in the data provided, but may apply depending on the origin of the product and current trade policies.

If you have more details about the product (e.g., size, use, material), I can help refine the classification further.

Product Name: Plastic Spools (High Strength)

Classification: Based on the provided HS codes, the product may fall under one of the following classifications:

✅ HS CODE: 3923900012

Description: Plastic-made transport or packaging items; plastic bottle stoppers, caps, and similar closures: Other plastic drums and pails, with or without covers or similar closures, with a capacity of less than 11.36 liters (3 gallons)

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes:

- This code is for plastic drums and pails used for transport or packaging.

- If your plastic spools are used for packaging or transport and are similar in function to drums or pails, this may be the correct classification.

- Important: Confirm the capacity of the spools. If they are less than 11.36 liters, this code applies.

✅ HS CODE: 3926909989

Description: Other articles of plastic or of other materials, classified as "Other", for items not specifically listed in more detailed subcategories

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This is a catch-all code for plastic items not specifically listed elsewhere.

- If your plastic spools are not clearly classified under 3923900012 (e.g., they are not used for packaging or transport), this may be the correct code.

- Important: This code is more general and may result in higher or lower tariffs depending on the specific product description.

📌 Proactive Advice for Users:

- Verify the product's intended use: Is it for packaging, transport, or another purpose? This will help determine the correct HS code.

- Check the capacity: If the spools are used for holding liquids or materials and are less than 11.36 liters, 3923900012 may apply.

- Confirm material and unit price: This can affect the classification and may be required for customs documentation.

- Check for certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Be aware of the April 11, 2025, tariff change: If your product is subject to the 30% additional tariff, this will significantly increase the total cost.

📅 Time-Sensitive Policy Alert:

- Additional tariffs imposed after April 11, 2025: 30.0% applies to both HS codes listed above.

- Anti-dumping duties: Not specified in the data provided, but may apply depending on the origin of the product and current trade policies.

If you have more details about the product (e.g., size, use, material), I can help refine the classification further.

Customer Reviews

No reviews yet.