| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

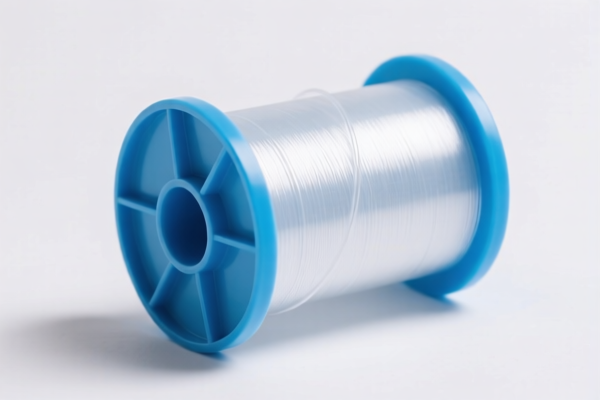

Product Name: Plastic Spools (High Temperature Resistant)

Classification HS Code: Based on the provided data, the most likely HS codes are:

- 3923300090 – For plastic bottles with a capacity over 50 ml used for transportation or packaging, including high-temperature resistant plastic bottles.

- 3923900012 – For plastic buckets and water containers with a capacity less than 11.36 liters, including high-temperature resistant plastic buckets.

🔍 HS Code Classification Summary

- HS Code 3923300090

- Description: Plastic bottles with a capacity over 50 ml used for transportation or packaging, including high-temperature resistant plastic bottles.

- Total Tax Rate: 58.0%

-

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

-

HS Code 3923900012

- Description: Plastic buckets and water containers with a capacity less than 11.36 liters, including high-temperature resistant plastic buckets.

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on these products after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning and import scheduling. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to verify if any anti-dumping measures apply based on the country of origin and product specifics. -

Material and Certification Requirements:

- Confirm the material composition of the plastic spools (e.g., polypropylene, polycarbonate, etc.) to ensure correct classification.

- Check if certifications (e.g., food-grade, heat resistance, safety standards) are required for import or end-use.

✅ Proactive Advice for Importers

- Verify the exact product description and specifications (e.g., capacity, material, intended use) to ensure correct HS code assignment.

- Review the unit price and total value of the goods, as this may affect the application of additional tariffs or duty exemptions.

- Consult with customs brokers or trade compliance experts to ensure full compliance with local and international regulations.

- Monitor updates on tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with a specific product detail or customs documentation.

Product Name: Plastic Spools (High Temperature Resistant)

Classification HS Code: Based on the provided data, the most likely HS codes are:

- 3923300090 – For plastic bottles with a capacity over 50 ml used for transportation or packaging, including high-temperature resistant plastic bottles.

- 3923900012 – For plastic buckets and water containers with a capacity less than 11.36 liters, including high-temperature resistant plastic buckets.

🔍 HS Code Classification Summary

- HS Code 3923300090

- Description: Plastic bottles with a capacity over 50 ml used for transportation or packaging, including high-temperature resistant plastic bottles.

- Total Tax Rate: 58.0%

-

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

-

HS Code 3923900012

- Description: Plastic buckets and water containers with a capacity less than 11.36 liters, including high-temperature resistant plastic buckets.

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on these products after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning and import scheduling. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to verify if any anti-dumping measures apply based on the country of origin and product specifics. -

Material and Certification Requirements:

- Confirm the material composition of the plastic spools (e.g., polypropylene, polycarbonate, etc.) to ensure correct classification.

- Check if certifications (e.g., food-grade, heat resistance, safety standards) are required for import or end-use.

✅ Proactive Advice for Importers

- Verify the exact product description and specifications (e.g., capacity, material, intended use) to ensure correct HS code assignment.

- Review the unit price and total value of the goods, as this may affect the application of additional tariffs or duty exemptions.

- Consult with customs brokers or trade compliance experts to ensure full compliance with local and international regulations.

- Monitor updates on tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with a specific product detail or customs documentation.

Customer Reviews

No reviews yet.