| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 9403708015 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3923300010 | Doc | 58.0% | CN | US | 2025-05-12 |

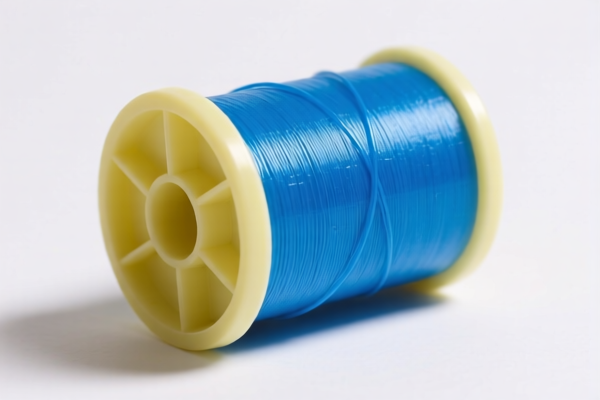

Here is the structured classification and tariff information for Plastic Spools (Household) based on the provided HS codes and tax details:

📦 Product Classification: Plastic Spools (Household)

🔍 HS CODE: 3924905650

Description: Plastic-made tableware, kitchen utensils, and other household items

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

- Notes:

- This code is suitable if the spools are classified as general household items (e.g., storage containers, small tools, etc.).

- Ensure the product is not classified under a more specific category (e.g., 3923300010 for bottles or 9403708015 for furniture).

🔍 HS CODE: 9403708015

Description: Plastic-made furniture

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies if the spools are part of a larger furniture product (e.g., spools used in a plastic chair or table).

- Not ideal for standalone spools unless they are part of a furniture assembly.

🔍 HS CODE: 3921904090

Description: Other plastic sheets, films, foils, and strips (flexible category)

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for raw or semi-finished plastic materials.

- Not suitable for finished spools unless they are being imported as raw material for further processing.

🔍 HS CODE: 3917390050

Description: Plastic pipes, tubes, and hoses and their fittings

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Notes:

- This code is for plastic tubes and fittings.

- If the spools are used as part of a plumbing system or industrial application, this may be a better fit.

- Not ideal for household spools unless they are used for specific technical purposes.

🔍 HS CODE: 3923300010

Description: Plastic bottles

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes:

- This code is for plastic bottles.

- Not suitable for spools unless they are bottle-shaped or used as containers.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition of the spools (e.g., polyethylene, polypropylene) and their intended use (e.g., storage, industrial, or decorative) to ensure correct classification.

- Check Required Certifications: Some plastic products may require environmental or safety certifications (e.g., REACH, RoHS) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan your import schedule accordingly.

- Consider Anti-Dumping Duties: If the spools are made of iron or aluminum (unlikely for plastic), additional anti-dumping duties may apply. However, for plastic products, this is generally not applicable.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for Plastic Spools (Household) based on the provided HS codes and tax details:

📦 Product Classification: Plastic Spools (Household)

🔍 HS CODE: 3924905650

Description: Plastic-made tableware, kitchen utensils, and other household items

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

- Notes:

- This code is suitable if the spools are classified as general household items (e.g., storage containers, small tools, etc.).

- Ensure the product is not classified under a more specific category (e.g., 3923300010 for bottles or 9403708015 for furniture).

🔍 HS CODE: 9403708015

Description: Plastic-made furniture

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies if the spools are part of a larger furniture product (e.g., spools used in a plastic chair or table).

- Not ideal for standalone spools unless they are part of a furniture assembly.

🔍 HS CODE: 3921904090

Description: Other plastic sheets, films, foils, and strips (flexible category)

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code is for raw or semi-finished plastic materials.

- Not suitable for finished spools unless they are being imported as raw material for further processing.

🔍 HS CODE: 3917390050

Description: Plastic pipes, tubes, and hoses and their fittings

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Notes:

- This code is for plastic tubes and fittings.

- If the spools are used as part of a plumbing system or industrial application, this may be a better fit.

- Not ideal for household spools unless they are used for specific technical purposes.

🔍 HS CODE: 3923300010

Description: Plastic bottles

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes:

- This code is for plastic bottles.

- Not suitable for spools unless they are bottle-shaped or used as containers.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition of the spools (e.g., polyethylene, polypropylene) and their intended use (e.g., storage, industrial, or decorative) to ensure correct classification.

- Check Required Certifications: Some plastic products may require environmental or safety certifications (e.g., REACH, RoHS) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan your import schedule accordingly.

- Consider Anti-Dumping Duties: If the spools are made of iron or aluminum (unlikely for plastic), additional anti-dumping duties may apply. However, for plastic products, this is generally not applicable.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.