| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300010 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

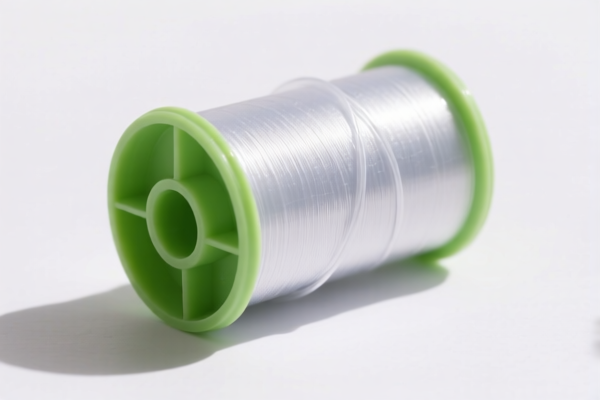

Product Name: Plastic Spools (Recyclable)

Classification: Packaging or Transport Goods Made of Plastic

✅ HS CODE Classification and Tax Details

Below are the relevant HS codes and their associated tax rates for plastic spools (recyclable), based on your input:

📦 HS CODE: 3923900012

Description: Plastic-made transport or packaging goods, other plastic drums or pails, with a capacity of less than 11.36 liters

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

📦 HS CODE: 3923300010

Description: Plastic bottles

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

📦 HS CODE: 3923300090

Description: Plastic-made transport or packaging goods, other categories

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- Anti-dumping duties: Not applicable for plastic products unless specified by the importing country (e.g., China may impose anti-dumping duties on certain plastic goods from specific countries).

- Recyclable Material: If the product is labeled as "recyclable," ensure that the customs declaration includes this detail, as it may affect classification or eligibility for certain trade agreements or environmental incentives.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Confirm whether the spools are made of polyethylene, polypropylene, or other specific plastics, as this can influence the correct HS code.

- Check Unit Price and Quantity: Tariff rates may vary based on the unit price and quantity of goods, especially under preferential trade agreements.

- Certifications Required: Ensure compliance with any environmental or recyclability certifications if the product is marketed as eco-friendly.

- Consult Local Customs Authority: For the most up-to-date HS code and tariff information, always cross-check with the customs authority in your country of import.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation.

Product Name: Plastic Spools (Recyclable)

Classification: Packaging or Transport Goods Made of Plastic

✅ HS CODE Classification and Tax Details

Below are the relevant HS codes and their associated tax rates for plastic spools (recyclable), based on your input:

📦 HS CODE: 3923900012

Description: Plastic-made transport or packaging goods, other plastic drums or pails, with a capacity of less than 11.36 liters

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

📦 HS CODE: 3923300010

Description: Plastic bottles

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

📦 HS CODE: 3923300090

Description: Plastic-made transport or packaging goods, other categories

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- Anti-dumping duties: Not applicable for plastic products unless specified by the importing country (e.g., China may impose anti-dumping duties on certain plastic goods from specific countries).

- Recyclable Material: If the product is labeled as "recyclable," ensure that the customs declaration includes this detail, as it may affect classification or eligibility for certain trade agreements or environmental incentives.

🛠️ Proactive Advice for Importers

- Verify Material Composition: Confirm whether the spools are made of polyethylene, polypropylene, or other specific plastics, as this can influence the correct HS code.

- Check Unit Price and Quantity: Tariff rates may vary based on the unit price and quantity of goods, especially under preferential trade agreements.

- Certifications Required: Ensure compliance with any environmental or recyclability certifications if the product is marketed as eco-friendly.

- Consult Local Customs Authority: For the most up-to-date HS code and tariff information, always cross-check with the customs authority in your country of import.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.