| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923900012 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923210085 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923210085 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

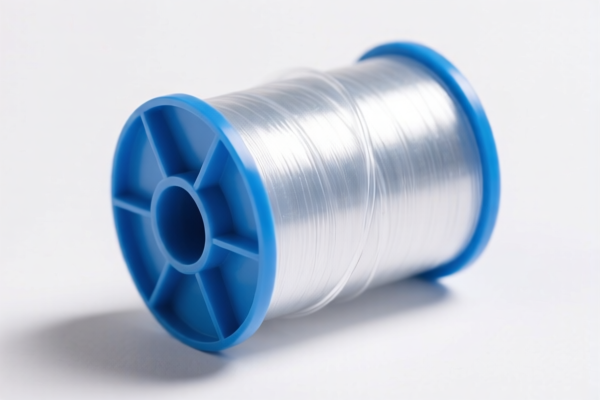

Here is the structured and professional breakdown of the customs classification and tariff details for your Customized Plastic Spools (or similar plastic products):

📦 Product Classification Overview

All listed products fall under Chapter 39 of the Harmonized System (HS), which covers Plastics and articles thereof. Specifically, they are classified under Subheading 3923, which includes Plastic containers, whether or not fitted with other articles, of plastics.

📌 HS Code Details

1. HS Code: 3923900012

- Product Description: Plastic buckets (customized)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy—ensure compliance with updated regulations after April 11, 2025.

2. HS Code: 3923300090

- Product Description: Plastic bottles (customized, including color)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above—April 11, 2025 is a critical date for tariff changes.

3. HS Code: 3923210085

- Product Description: Plastic bags (customizable size or design)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to plastic bags, which may be subject to anti-dumping duties if imported from certain countries (e.g., China).

⚠️ Important Notes and Recommendations

-

April 11, 2025, Tariff Adjustment:

A 30.0% additional tariff will be applied to all these products after April 11, 2025. Ensure your customs documentation and pricing reflect this change. -

Anti-Dumping Duties:

If your plastic spools are made of iron or aluminum, be aware that anti-dumping duties may apply. Confirm the material composition and country of origin to avoid unexpected costs. -

Customization Impact:

Customization (e.g., size, color, design) may affect classification. Ensure your product description aligns with the HS code used. If in doubt, consult a customs broker or classification expert. -

Certifications Required:

Depending on the end-use (e.g., food contact, industrial use), certifications such as FDA compliance, REACH, or RoHS may be required. Verify these before export.

✅ Proactive Actions to Take

-

Verify Material and Unit Price:

Confirm the material type (e.g., polyethylene, polypropylene) and unit price to ensure correct classification and tax calculation. -

Check Required Certifications:

Ensure your product meets all import/export certifications for the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes, especially after April 11, 2025, and consider pre-shipment audits or customs compliance checks.

Let me know if you need help with customs documentation, classification confirmation, or tariff calculation tools. Here is the structured and professional breakdown of the customs classification and tariff details for your Customized Plastic Spools (or similar plastic products):

📦 Product Classification Overview

All listed products fall under Chapter 39 of the Harmonized System (HS), which covers Plastics and articles thereof. Specifically, they are classified under Subheading 3923, which includes Plastic containers, whether or not fitted with other articles, of plastics.

📌 HS Code Details

1. HS Code: 3923900012

- Product Description: Plastic buckets (customized)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy—ensure compliance with updated regulations after April 11, 2025.

2. HS Code: 3923300090

- Product Description: Plastic bottles (customized, including color)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above—April 11, 2025 is a critical date for tariff changes.

3. HS Code: 3923210085

- Product Description: Plastic bags (customizable size or design)

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to plastic bags, which may be subject to anti-dumping duties if imported from certain countries (e.g., China).

⚠️ Important Notes and Recommendations

-

April 11, 2025, Tariff Adjustment:

A 30.0% additional tariff will be applied to all these products after April 11, 2025. Ensure your customs documentation and pricing reflect this change. -

Anti-Dumping Duties:

If your plastic spools are made of iron or aluminum, be aware that anti-dumping duties may apply. Confirm the material composition and country of origin to avoid unexpected costs. -

Customization Impact:

Customization (e.g., size, color, design) may affect classification. Ensure your product description aligns with the HS code used. If in doubt, consult a customs broker or classification expert. -

Certifications Required:

Depending on the end-use (e.g., food contact, industrial use), certifications such as FDA compliance, REACH, or RoHS may be required. Verify these before export.

✅ Proactive Actions to Take

-

Verify Material and Unit Price:

Confirm the material type (e.g., polyethylene, polypropylene) and unit price to ensure correct classification and tax calculation. -

Check Required Certifications:

Ensure your product meets all import/export certifications for the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes, especially after April 11, 2025, and consider pre-shipment audits or customs compliance checks.

Let me know if you need help with customs documentation, classification confirmation, or tariff calculation tools.

Customer Reviews

No reviews yet.