| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923210085 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 9615192000 | Doc | 9.7¢/gross + 1.3%+30.0% | CN | US | 2025-05-12 |

| 3923210085 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300010 | Doc | 58.0% | CN | US | 2025-05-12 |

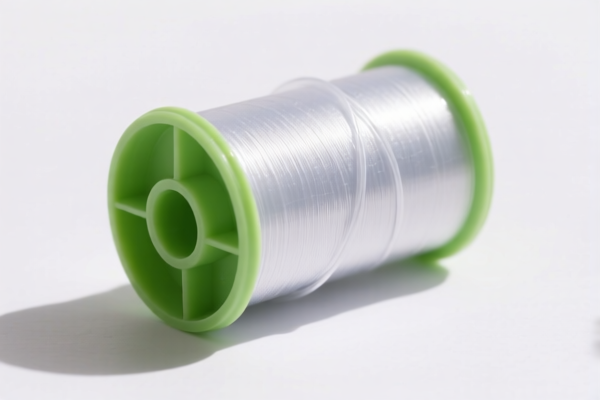

Here is the structured classification and tariff information for Plastic Spools (Transparent) based on the provided HS codes and tax details:

✅ HS CODE: 3923210085

Description: Plastic-made transportation or packaging items, applicable to transparent plastic bags or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also listed twice in the input, but it refers to the same classification.

✅ HS CODE: 3923300090

Description: Plastic-made goods transportation or packaging items, applicable to transparent plastic bottles or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3923300010

Description: Applicable to plastic bottles or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 9615192000

Description: Applicable to transparent plastic combs or similar items.

Total Tax Rate: 9.7¢/gross + 1.3% + 30.0%

Tax Breakdown:

- Base Tariff: 9.7¢/gross + 1.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to small plastic items like combs, which may not be relevant to "spools" unless the product is a comb-like spool.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

-

Material and Unit Price: Verify the material composition (e.g., polyethylene, polypropylene) and unit price to ensure correct classification and avoid misclassification penalties.

-

Certifications: Check if any certifications (e.g., REACH, RoHS, or import permits) are required for the product, especially if it's being imported into specific markets.

-

Product Clarification: If the product is a spool, ensure it is not misclassified as a bag or bottle. Clarify the function and design of the spool to match the correct HS code.

📌 Proactive Advice:

- Confirm the exact product description with your supplier or manufacturer.

- Use customs classification tools or consult a customs broker for confirmation.

- Keep updated on tariff changes, especially those tied to specific dates like April 11, 2025.

Let me know if you need help with a specific product description or further clarification on any of the HS codes. Here is the structured classification and tariff information for Plastic Spools (Transparent) based on the provided HS codes and tax details:

✅ HS CODE: 3923210085

Description: Plastic-made transportation or packaging items, applicable to transparent plastic bags or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also listed twice in the input, but it refers to the same classification.

✅ HS CODE: 3923300090

Description: Plastic-made goods transportation or packaging items, applicable to transparent plastic bottles or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 3923300010

Description: Applicable to plastic bottles or similar items.

Total Tax Rate: 58.0%

Tax Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 9615192000

Description: Applicable to transparent plastic combs or similar items.

Total Tax Rate: 9.7¢/gross + 1.3% + 30.0%

Tax Breakdown:

- Base Tariff: 9.7¢/gross + 1.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to small plastic items like combs, which may not be relevant to "spools" unless the product is a comb-like spool.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

-

Material and Unit Price: Verify the material composition (e.g., polyethylene, polypropylene) and unit price to ensure correct classification and avoid misclassification penalties.

-

Certifications: Check if any certifications (e.g., REACH, RoHS, or import permits) are required for the product, especially if it's being imported into specific markets.

-

Product Clarification: If the product is a spool, ensure it is not misclassified as a bag or bottle. Clarify the function and design of the spool to match the correct HS code.

📌 Proactive Advice:

- Confirm the exact product description with your supplier or manufacturer.

- Use customs classification tools or consult a customs broker for confirmation.

- Keep updated on tariff changes, especially those tied to specific dates like April 11, 2025.

Let me know if you need help with a specific product description or further clarification on any of the HS codes.

Customer Reviews

No reviews yet.