| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923400010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 9620005000 | Doc | 60.3% | CN | US | 2025-05-12 |

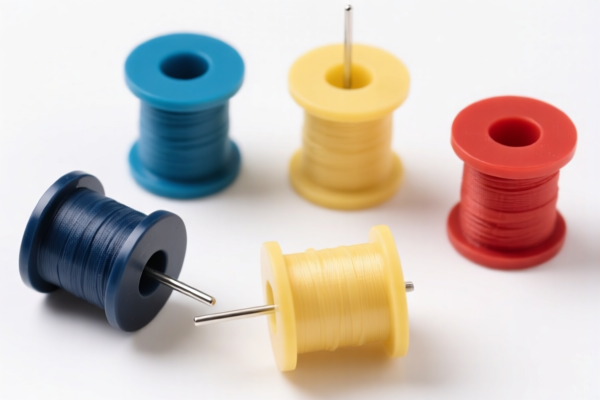

- HS CODE: 3923400010

- Product Name: Plastic Support Disks

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

-

Notes: This code is specifically for "plastic support disks" and may be more accurate if the product is a disk-shaped support.

-

HS CODE: 3923900080

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

-

Notes: This code is for general plastic support frames. Ensure the product description matches the term "support frame."

-

HS CODE: 3924905650

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

-

Notes: This code may apply to specific types of plastic support frames. Verify if the product falls under this category based on material and structure.

-

HS CODE: 9405920000

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

-

Notes: This code is for "other parts of furniture," which may include plastic support frames used in furniture. Confirm if the product is used in furniture.

-

HS CODE: 9620005000

- Product Name: Plastic Support Frame

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for "other articles of plastic," which is a broader category. It may be applicable if the product is not clearly classified under more specific codes.

Proactive Advice:

- Verify the product description and structure to ensure the most accurate HS code is selected.

- Check the material composition (e.g., is it 100% plastic, or a composite with metal parts?).

- Confirm the intended use (e.g., for furniture, industrial equipment, or general use).

- Review any required certifications (e.g., RoHS, REACH, or other compliance standards).

- Be aware of the April 11, 2025, tariff increase and plan accordingly for import costs.

- HS CODE: 3923400010

- Product Name: Plastic Support Disks

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

-

Notes: This code is specifically for "plastic support disks" and may be more accurate if the product is a disk-shaped support.

-

HS CODE: 3923900080

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

-

Notes: This code is for general plastic support frames. Ensure the product description matches the term "support frame."

-

HS CODE: 3924905650

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

-

Notes: This code may apply to specific types of plastic support frames. Verify if the product falls under this category based on material and structure.

-

HS CODE: 9405920000

- Product Name: Plastic Support Frame

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

-

Notes: This code is for "other parts of furniture," which may include plastic support frames used in furniture. Confirm if the product is used in furniture.

-

HS CODE: 9620005000

- Product Name: Plastic Support Frame

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for "other articles of plastic," which is a broader category. It may be applicable if the product is not clearly classified under more specific codes.

Proactive Advice:

- Verify the product description and structure to ensure the most accurate HS code is selected.

- Check the material composition (e.g., is it 100% plastic, or a composite with metal parts?).

- Confirm the intended use (e.g., for furniture, industrial equipment, or general use).

- Review any required certifications (e.g., RoHS, REACH, or other compliance standards).

- Be aware of the April 11, 2025, tariff increase and plan accordingly for import costs.

Customer Reviews

No reviews yet.