| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

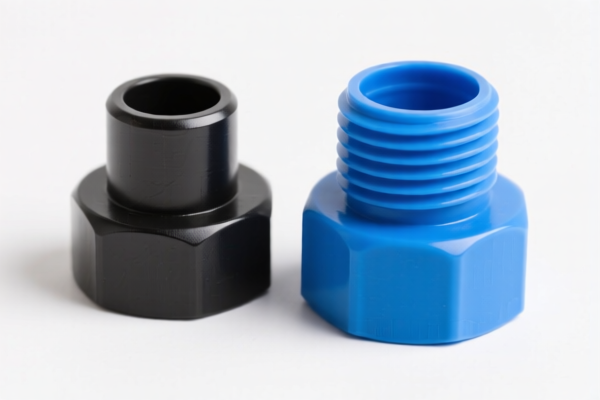

Product Classification: Plastic Tee Fittings

HS CODE: 3917400095 (or 3917400050, depending on specific product details)

🔍 Classification Overview

Plastic tee fittings fall under Chapter 3917 of the HS code, which covers plastic pipes, fittings, and other articles of plastic. Based on the provided data, the most likely HS code is 3917400095, which is for "other fittings" of plastic pipes and tubes.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

There is no indication of anti-dumping duties specific to plastic tee fittings in the provided data.

📌 Proactive Advice for Importers

- Verify Material: Confirm whether the tee fittings are made of polyethylene, PVC, or other plastics, as this may affect classification.

- Check Unit Price: The total tax rate is 60.3%, so the unit price and quantity will impact the total duty payable.

- Certifications Required: Ensure compliance with customs documentation, product standards, and import licenses if applicable.

- Consider Alternative HS Codes: If the fittings are non-pressure (e.g., for drainage), 3917400050 may be more appropriate.

📋 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3917400095 | Other fittings of plastic pipes/tubes | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | Non-pressure fittings (e.g., DWV) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917330000 | Unreinforced plastic pipes/fittings | 3.1% | 0.0% | 30.0% | 33.1% |

| 3917390050 | Other plastic pipes/fittings | 3.1% | 0.0% | 30.0% | 33.1% |

| 3925900000 | Other plastic building hardware | 5.3% | 25.0% | 30.0% | 60.3% |

✅ Next Steps for Importers

- Confirm the exact HS code based on material, pressure rating, and use.

- Review customs documentation and product specifications.

- Be prepared for increased tariffs after April 11, 2025.

- Consider tariff mitigation strategies if importing in large volumes.

Let me know if you need help with certification requirements or customs documentation.

Product Classification: Plastic Tee Fittings

HS CODE: 3917400095 (or 3917400050, depending on specific product details)

🔍 Classification Overview

Plastic tee fittings fall under Chapter 3917 of the HS code, which covers plastic pipes, fittings, and other articles of plastic. Based on the provided data, the most likely HS code is 3917400095, which is for "other fittings" of plastic pipes and tubes.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-Dumping Duties Mentioned:

There is no indication of anti-dumping duties specific to plastic tee fittings in the provided data.

📌 Proactive Advice for Importers

- Verify Material: Confirm whether the tee fittings are made of polyethylene, PVC, or other plastics, as this may affect classification.

- Check Unit Price: The total tax rate is 60.3%, so the unit price and quantity will impact the total duty payable.

- Certifications Required: Ensure compliance with customs documentation, product standards, and import licenses if applicable.

- Consider Alternative HS Codes: If the fittings are non-pressure (e.g., for drainage), 3917400050 may be more appropriate.

📋 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3917400095 | Other fittings of plastic pipes/tubes | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | Non-pressure fittings (e.g., DWV) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917330000 | Unreinforced plastic pipes/fittings | 3.1% | 0.0% | 30.0% | 33.1% |

| 3917390050 | Other plastic pipes/fittings | 3.1% | 0.0% | 30.0% | 33.1% |

| 3925900000 | Other plastic building hardware | 5.3% | 25.0% | 30.0% | 60.3% |

✅ Next Steps for Importers

- Confirm the exact HS code based on material, pressure rating, and use.

- Review customs documentation and product specifications.

- Be prepared for increased tariffs after April 11, 2025.

- Consider tariff mitigation strategies if importing in large volumes.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.