| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3922200000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

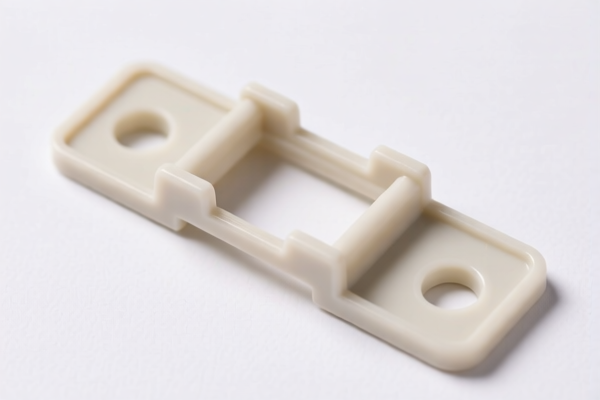

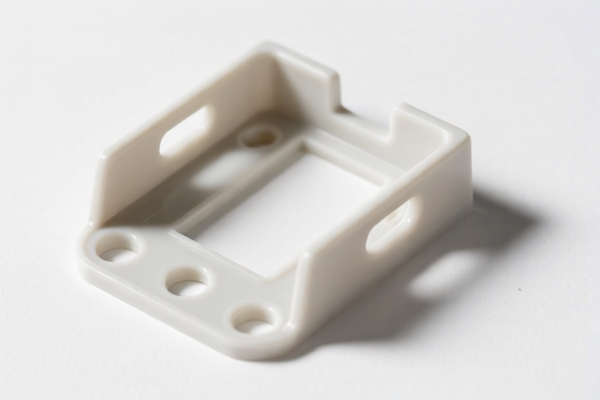

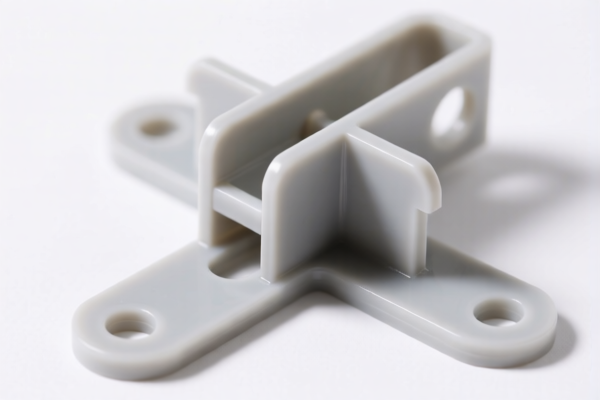

Product Name: Plastic Toilet Bracket

Classification Analysis and Tax Information:

- HS CODE: 3922200000

- Product Description: Plastic Toilet Bracket (plastic toilet cover support rod)

- Base Tariff Rate: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 43.8%

📌 Key Notes:

-

Classification Justification:

The product is classified under HS CODE 3922200000, which is specifically for "plastic toilet cover support rods." This is the most accurate and specific classification for a plastic toilet bracket. -

Tariff Changes:

- The base tariff is 6.3%, which is standard for plastic products.

- An additional 7.5% is applied as part of general trade policy.

- A special 30% tariff will be imposed after April 11, 2025, which is a time-sensitive policy.

- Total tax rate: 6.3% + 7.5% + 30.0% = 43.8% (after April 11, 2025).

⚠️ Important Alerts:

-

Time-sensitive Policy:

The 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed made of plastic and not a composite or metal product, which could change the classification.

- Check Unit Price: The tax rate is based on the product's classification and may vary depending on the declared value and origin.

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental standards) for import into the destination country.

- Consult Customs: For large or complex shipments, consider consulting a customs broker or compliance expert to ensure accurate classification and tax calculation.

Let me know if you need help with customs documentation or further classification details.

Product Name: Plastic Toilet Bracket

Classification Analysis and Tax Information:

- HS CODE: 3922200000

- Product Description: Plastic Toilet Bracket (plastic toilet cover support rod)

- Base Tariff Rate: 6.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 43.8%

📌 Key Notes:

-

Classification Justification:

The product is classified under HS CODE 3922200000, which is specifically for "plastic toilet cover support rods." This is the most accurate and specific classification for a plastic toilet bracket. -

Tariff Changes:

- The base tariff is 6.3%, which is standard for plastic products.

- An additional 7.5% is applied as part of general trade policy.

- A special 30% tariff will be imposed after April 11, 2025, which is a time-sensitive policy.

- Total tax rate: 6.3% + 7.5% + 30.0% = 43.8% (after April 11, 2025).

⚠️ Important Alerts:

-

Time-sensitive Policy:

The 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed made of plastic and not a composite or metal product, which could change the classification.

- Check Unit Price: The tax rate is based on the product's classification and may vary depending on the declared value and origin.

- Certifications Required: Ensure that the product meets any required certifications (e.g., safety, environmental standards) for import into the destination country.

- Consult Customs: For large or complex shipments, consider consulting a customs broker or compliance expert to ensure accurate classification and tax calculation.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.