| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3922900000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 6910100020 | Doc | 35.8% | CN | US | 2025-05-12 |

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

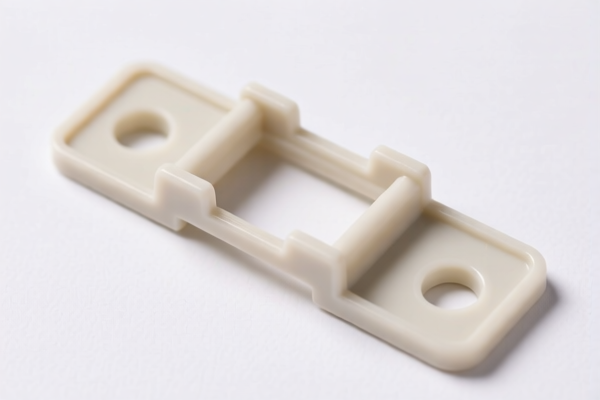

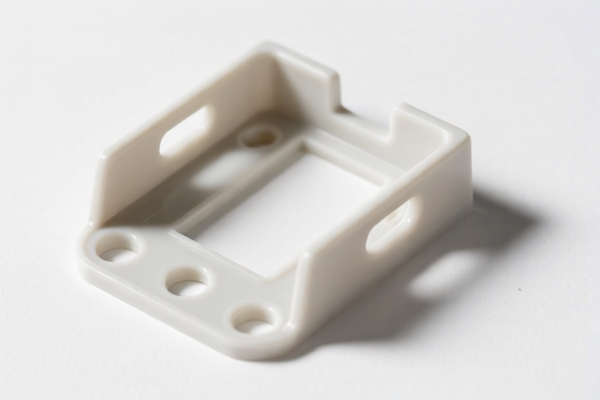

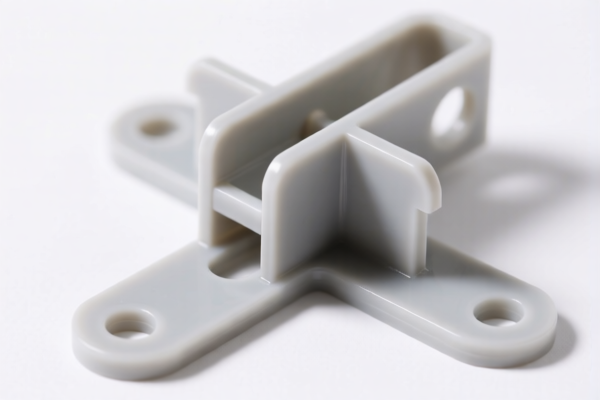

Product Classification and Customs Tariff Analysis for "Plastic Washbasin Bracket"

Below is the structured analysis of the HS codes and associated tariffs for the product "Plastic Washbasin Bracket" based on the provided data:

✅ HS CODE: 3922100000

Product Description: Plastic washbasin bracket (including洗脸盆支架, 洗手盆带支架, 洗脸池带支架)

Tariff Summary:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 43.8%

Key Notes:

- This HS code applies to plastic washbasin brackets of various types (e.g., for washbasin, sink, etc.).

- The 30.0% additional tariff is imposed after April 11, 2025, and is not related to anti-dumping duties.

- This is the most commonly applicable code for plastic washbasin brackets.

✅ HS CODE: 3922900000

Product Description: Plastic washbasin bracket made of polypropylene

Tariff Summary:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

Key Notes:

- This code is for polypropylene-based plastic washbasin brackets.

- The 25.0% additional tariff is higher than the general rate, likely due to specific material or product classification.

- The 30.0% special tariff applies after April 11, 2025.

✅ HS CODE: 6910100020

Product Description: Ceramic washbasin bracket

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.8%

Key Notes:

- This code applies to ceramic washbasin brackets.

- No general additional tariff is applied.

- The 30.0% special tariff is imposed after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of plastic (e.g., polypropylene) or ceramic, as this will determine the correct HS code and applicable tariffs.

- Check Unit Price: The total tax rate can significantly impact the final cost, especially for products with high import volumes.

- Certifications Required: Ensure compliance with any product safety or quality standards (e.g., CE, RoHS, etc.) depending on the destination market.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025 is a time-sensitive policy and should be factored into cost planning.

- Anti-Dumping Duty: Not applicable for this product, but always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin.

📅 Important Date Reminder:

- April 11, 2025: A 30.0% additional tariff will be applied to all products listed above.

- This is a non-negotiable policy and must be accounted for in import cost calculations.

If you have more details about the material, origin, or intended market, I can provide a more tailored analysis. Product Classification and Customs Tariff Analysis for "Plastic Washbasin Bracket"

Below is the structured analysis of the HS codes and associated tariffs for the product "Plastic Washbasin Bracket" based on the provided data:

✅ HS CODE: 3922100000

Product Description: Plastic washbasin bracket (including洗脸盆支架, 洗手盆带支架, 洗脸池带支架)

Tariff Summary:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 43.8%

Key Notes:

- This HS code applies to plastic washbasin brackets of various types (e.g., for washbasin, sink, etc.).

- The 30.0% additional tariff is imposed after April 11, 2025, and is not related to anti-dumping duties.

- This is the most commonly applicable code for plastic washbasin brackets.

✅ HS CODE: 3922900000

Product Description: Plastic washbasin bracket made of polypropylene

Tariff Summary:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

Key Notes:

- This code is for polypropylene-based plastic washbasin brackets.

- The 25.0% additional tariff is higher than the general rate, likely due to specific material or product classification.

- The 30.0% special tariff applies after April 11, 2025.

✅ HS CODE: 6910100020

Product Description: Ceramic washbasin bracket

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.8%

Key Notes:

- This code applies to ceramic washbasin brackets.

- No general additional tariff is applied.

- The 30.0% special tariff is imposed after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of plastic (e.g., polypropylene) or ceramic, as this will determine the correct HS code and applicable tariffs.

- Check Unit Price: The total tax rate can significantly impact the final cost, especially for products with high import volumes.

- Certifications Required: Ensure compliance with any product safety or quality standards (e.g., CE, RoHS, etc.) depending on the destination market.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025 is a time-sensitive policy and should be factored into cost planning.

- Anti-Dumping Duty: Not applicable for this product, but always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin.

📅 Important Date Reminder:

- April 11, 2025: A 30.0% additional tariff will be applied to all products listed above.

- This is a non-negotiable policy and must be accounted for in import cost calculations.

If you have more details about the material, origin, or intended market, I can provide a more tailored analysis.

Customer Reviews

No reviews yet.