Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

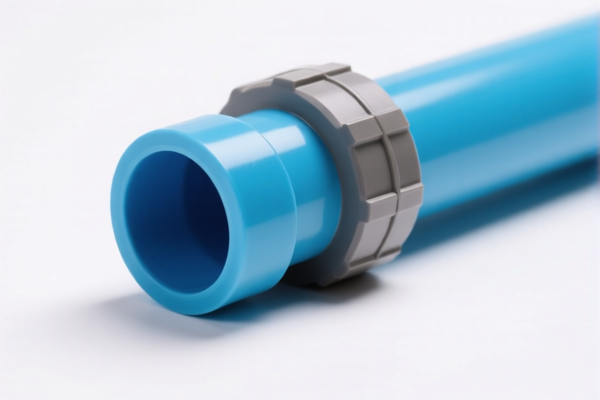

- Product Name: Plastic Water Pipe

- Classification: Based on the provided HS codes, the product falls under several possible classifications. Below is a detailed breakdown of the HS codes and associated tariffs:

🔍 HS Code 3917390050

- Description: Plastic water pipe (as per the classification description)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code appears twice in the list, but the classification and tax details are identical.

🔍 HS Code 3917400050

- Description: Plastic water pipe (as per the classification description)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a higher total tax rate due to the additional 25% tariff.

🔍 HS Code 3917320050

- Description: Plastic pipe (as per the classification description)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for a more general category of plastic pipes, not specifically water pipes.

🔍 HS Code 3917210000

- Description: Plastic pipe (as per the classification description)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for a general category of plastic pipes, possibly with different specifications or materials.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff after this date. This is a critical date to be aware of for cost planning and compliance.

- Material and Certification: Verify the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Some HS codes may require specific certifications (e.g., ISO, CE, etc.) for import.

- Classification Accuracy: Ensure the product is correctly classified under the most specific HS code. For example, "plastic water pipe" may have a different code than "plastic pipe" in general.

- Consult a Customs Expert: If the product has special features (e.g., reinforced, with fittings, or used in specific industries), a customs expert may be needed to confirm the correct classification.

✅ Proactive Actions for Importers:

- Double-check the product description and technical specifications.

- Confirm the HS code with customs authorities or a classification service.

- Plan for tariff increases after April 11, 2025.

- Ensure all required documentation and certifications are in place for customs clearance.

- Product Name: Plastic Water Pipe

- Classification: Based on the provided HS codes, the product falls under several possible classifications. Below is a detailed breakdown of the HS codes and associated tariffs:

🔍 HS Code 3917390050

- Description: Plastic water pipe (as per the classification description)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code appears twice in the list, but the classification and tax details are identical.

🔍 HS Code 3917400050

- Description: Plastic water pipe (as per the classification description)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a higher total tax rate due to the additional 25% tariff.

🔍 HS Code 3917320050

- Description: Plastic pipe (as per the classification description)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for a more general category of plastic pipes, not specifically water pipes.

🔍 HS Code 3917210000

- Description: Plastic pipe (as per the classification description)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for a general category of plastic pipes, possibly with different specifications or materials.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff after this date. This is a critical date to be aware of for cost planning and compliance.

- Material and Certification: Verify the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Some HS codes may require specific certifications (e.g., ISO, CE, etc.) for import.

- Classification Accuracy: Ensure the product is correctly classified under the most specific HS code. For example, "plastic water pipe" may have a different code than "plastic pipe" in general.

- Consult a Customs Expert: If the product has special features (e.g., reinforced, with fittings, or used in specific industries), a customs expert may be needed to confirm the correct classification.

✅ Proactive Actions for Importers:

- Double-check the product description and technical specifications.

- Confirm the HS code with customs authorities or a classification service.

- Plan for tariff increases after April 11, 2025.

- Ensure all required documentation and certifications are in place for customs clearance.

Customer Reviews

No reviews yet.