| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

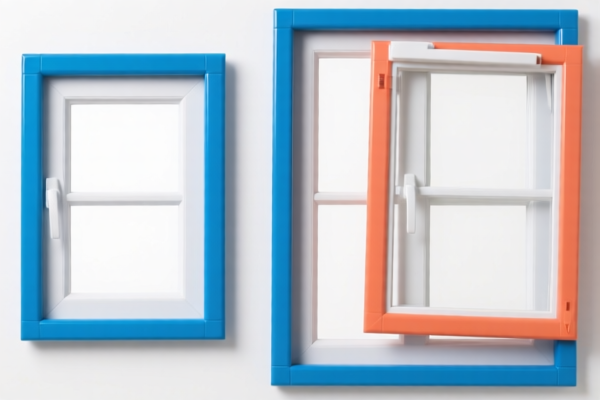

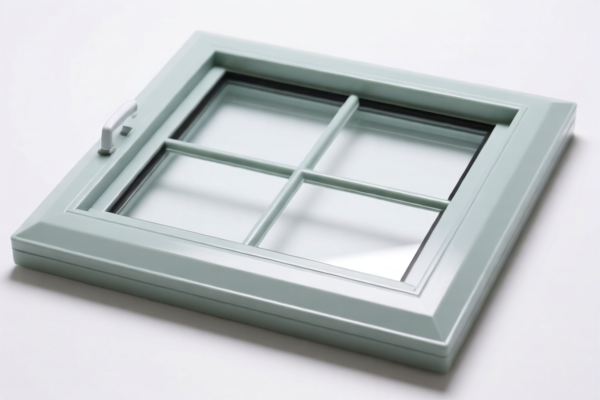

Product Classification: Plastic Window Frames

HS CODEs: 3925200020 and 3925200091

Classification Summary:

- Plastic window frames, including architectural, decorative, and bay window frames, are classified under HS CODE 3925200020 or 3925200091, depending on specific product details (e.g., design, use, or material composition).

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports of plastic window frames after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for plastic window frames. However, this may change depending on trade policies or investigations.

📌 Proactive Advice for Importers:

-

Verify Product Description:

Ensure the product is correctly classified under HS CODE 3925200020 or 3925200091 based on its specific use (e.g., architectural vs. decorative) and design. -

Check Material Composition:

Confirm that the product is made entirely of plastic (e.g., PVC) and not a composite or mixed material, which may affect classification. -

Review Certification Requirements:

Some countries may require product certifications (e.g., fire resistance, energy efficiency) for plastic window frames. Confirm if such certifications are needed for your destination market. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting pricing strategies or exploring alternative materials if cost-sensitive. -

Consult Customs Broker:

For accurate classification and compliance, it is recommended to consult a customs broker or trade compliance expert, especially for complex or high-value shipments.

📊 Summary Table:

| HS CODE | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3925200020 | Plastic architectural/window frames | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200091 | Plastic window frames (other) | 5.3% | 7.5% | 30.0% | 42.8% |

Let me know if you need help with customs documentation, tariff calculation tools, or classification guidance for similar products.

Product Classification: Plastic Window Frames

HS CODEs: 3925200020 and 3925200091

Classification Summary:

- Plastic window frames, including architectural, decorative, and bay window frames, are classified under HS CODE 3925200020 or 3925200091, depending on specific product details (e.g., design, use, or material composition).

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports of plastic window frames after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for plastic window frames. However, this may change depending on trade policies or investigations.

📌 Proactive Advice for Importers:

-

Verify Product Description:

Ensure the product is correctly classified under HS CODE 3925200020 or 3925200091 based on its specific use (e.g., architectural vs. decorative) and design. -

Check Material Composition:

Confirm that the product is made entirely of plastic (e.g., PVC) and not a composite or mixed material, which may affect classification. -

Review Certification Requirements:

Some countries may require product certifications (e.g., fire resistance, energy efficiency) for plastic window frames. Confirm if such certifications are needed for your destination market. -

Plan for Tariff Increases:

With the 30.0% additional tariff coming into effect after April 11, 2025, consider adjusting pricing strategies or exploring alternative materials if cost-sensitive. -

Consult Customs Broker:

For accurate classification and compliance, it is recommended to consult a customs broker or trade compliance expert, especially for complex or high-value shipments.

📊 Summary Table:

| HS CODE | Product Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3925200020 | Plastic architectural/window frames | 5.3% | 7.5% | 30.0% | 42.8% |

| 3925200091 | Plastic window frames (other) | 5.3% | 7.5% | 30.0% | 42.8% |

Let me know if you need help with customs documentation, tariff calculation tools, or classification guidance for similar products.

Customer Reviews

No reviews yet.