Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Plastic anti UV plates based on the provided HS codes and tax details:

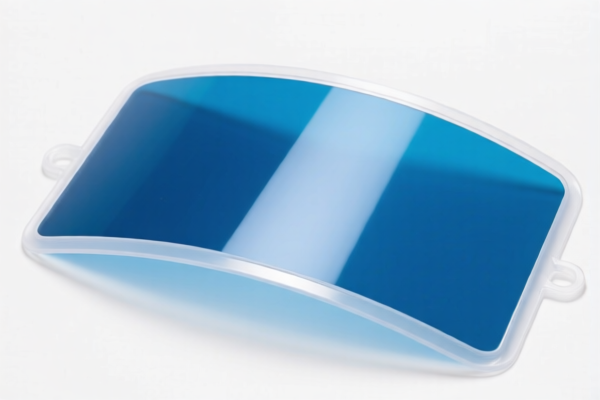

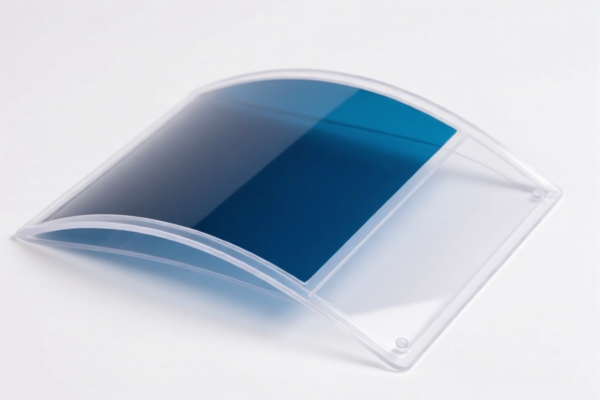

📦 Product Classification Overview: Plastic Anti UV Plates

✅ HS CODE: 3920995000

- Description: Plastic anti UV plates

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This is a general category for plastic anti UV plates not specified elsewhere.

✅ HS CODE: 3921905050

- Description: Plastic anti UV plates (specific type)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Lower base tariff compared to other codes, but still subject to the 30% special tariff after April 11, 2025.

✅ HS CODE: 3921902550

- Description: UV-resistant textile plastic plates

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Higher base tariff due to textile content or specific composition.

✅ HS CODE: 3920200055

- Description: Propylene plastic anti UV plates

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Specific to propylene-based materials, with a lower base tariff.

✅ HS CODE: 3921902900

- Description: UV-resistant textile plastic plates (another variant)

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Slightly higher than 3920200055 but lower than 3921902550.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the exact material composition (e.g., propylene, textile content) and certifications (e.g., UV resistance standards) to ensure correct HS code classification.

- Unit Price and Quantity: Tariff calculations depend on the unit price and quantity, so ensure accurate documentation for customs clearance.

📌 Proactive Advice:

- Double-check the material composition and intended use of the plastic anti UV plates to ensure the correct HS code is applied.

- If importing from countries with anti-dumping duties, verify if these apply to your product.

- Keep updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for your specific product. Here is the structured classification and tariff information for Plastic anti UV plates based on the provided HS codes and tax details:

📦 Product Classification Overview: Plastic Anti UV Plates

✅ HS CODE: 3920995000

- Description: Plastic anti UV plates

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This is a general category for plastic anti UV plates not specified elsewhere.

✅ HS CODE: 3921905050

- Description: Plastic anti UV plates (specific type)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Lower base tariff compared to other codes, but still subject to the 30% special tariff after April 11, 2025.

✅ HS CODE: 3921902550

- Description: UV-resistant textile plastic plates

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Higher base tariff due to textile content or specific composition.

✅ HS CODE: 3920200055

- Description: Propylene plastic anti UV plates

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Specific to propylene-based materials, with a lower base tariff.

✅ HS CODE: 3921902900

- Description: UV-resistant textile plastic plates (another variant)

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Slightly higher than 3920200055 but lower than 3921902550.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the exact material composition (e.g., propylene, textile content) and certifications (e.g., UV resistance standards) to ensure correct HS code classification.

- Unit Price and Quantity: Tariff calculations depend on the unit price and quantity, so ensure accurate documentation for customs clearance.

📌 Proactive Advice:

- Double-check the material composition and intended use of the plastic anti UV plates to ensure the correct HS code is applied.

- If importing from countries with anti-dumping duties, verify if these apply to your product.

- Keep updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for your specific product.

Customer Reviews

No reviews yet.